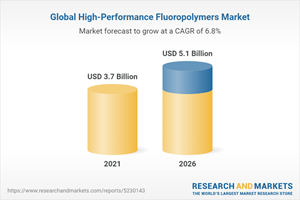

The Worldwide High-Performance Fluoropolymers Industry is Expected to Reach $5.1 Billion by 2026

Global High-Performance Fluoropolymers Market

Dublin, May 02, 2022 (GLOBE NEWSWIRE) -- The "Global High-Performance Fluoropolymers Market by Type(PTFE, FEP, PFA/MFA, ETFE), Form(Granular, Fine Powder & Dispersion), Application, End-use Industry(Industrial Processing, Transportation, Electrical & Electronics, Medical) & Region - Forecast to 2026" report has been added to ResearchAndMarkets.com's offering.

The global high-performance fluoropolymers (HPF) market size is estimated to be USD 3.7 billion in 2021 and is projected to reach USD 5.1 billion by 2026, at a CAGR of 6.8%.

This growth is attributed to HPF's growing number of applications in various industries. Also, expansion across end-use industries is further driving the industry for HPF globally. Rapid adoption of 5G Connectivity, advancements in the designing of electronic components, and rising need of hybrid and compact engines for automobiles are also among the major drivers of the HPF consumption.

PTFE accounted for the largest share in total HPF market

PTFE is the most widely used type of HPF and accounted for the largest market share. There is an increase in the use of dispersion and fine powder PTFE, for various applications, especially in North America and APAC. It is used in a wide range of applications such as semiconductor, automotive components, electrical appliances, and non-stick cookware. The growing applications in the electrical & electronics industry are expected to trigger the demand for PTFE, especially in advanced batteries and fuel cells.

Granular form accounted for the largest market share

HPF market is segmented into various forms such as suspension/granules, Fine powder & dispersion, and micropowder. HPF in the form of suspension/granules dominate the market. HPF exhibit excellent properties, such as good insulation, low surface energies, and high resistance to oils, UV radiation, chemicals, water, and corrosion. Granular fluoropolymers are processed by compression and sintering to make parts directly or to make billets suitable for machining. HPF in the form of granules are ideal for manufacturing high-performance mechanical/electrical products requiring excellent end-use performance such as skived tapes, films, sheets, machined gaskets, expansion joints, bellows, piston rings, and diaphragms. Suitability of granular form of HPF in the manufacturing of various components is a major reason for the large market size.

Coatings & liners accounted for the largest market share

HPF market is segmented on the basis of applications as coatings & liners, components, films, and additives. The market in coatings & liners is estimated to account for the largest share during the forecast period. HPF coatings and liners are used to overcome the challenges of protecting large and complex containment vessels and related piping systems. Coatings & liners offer corrosion, abrasion, and wear resistance while maintaining non-stick and high purity characteristics.

Electronic & Electricals segment accounted for the largest market share

HPF market is segmented on the basis of end-use industry as industrial processing, transportation, medical, electrical & electronics, and others. The increased usage of HPF in wire coatings, cable coatings, fiber optics, and electrical systems in aircraft, computers, and other applications.

Asia Pacific is the largest HPF market globally

In 2020, Asia Pacific accounted for the largest share in the global HPF market. Leading manufacturers and exporters of medical & pharmaceutical, electronics, automotive, and chemical products. The availability of cheap raw materials, low-cost labor, and presence of established end-use industries, such as chemical, oil & gas, transportation, and medical.

China and India, have benefited the HPFs market, owing to increasing demand for high-quality medical, automotive, consumer, and electronic products. China, India, Japan, and South Korea are among the largest automobile producers globally, which creates demand on a regular basis for fluoropolymer products in the transportation industry. Presence of full-fledged end-use industries is the major demand driver for HPF in Asia Pacific.

Key Topics Covered:

1 Introduction

2 Research Methodology

3 Executive Summary

4 Premium Insights

4.1 Attractive Opportunities in High Performance Fluoropolymers Market

4.2 High Performance Fluoropolymers Market, by Type

4.3 High Performance Fluoropolymers Market, by Form

4.4 High Performance Fluoropolymers Market, by End-Use Industry

4.5 High Performance Fluoropolymers Market, by Major Countries

4.6 Asia-Pacific High Performance Fluoropolymers Market, by Type and End-Use Industry, 2020

5 Market Overview

5.1 Introduction

5.2 Market Dynamics

5.2.1 Drivers

5.2.1.1 High Growth in End-Use Industries

5.2.1.2 Robust Growth in Pv Installation

5.2.1.3 Emergence of Manufacturing Sector in Asia-Pacific

5.2.2 Restraints

5.2.2.1 Higher Cost of High Performance Fluoropolymers Than Conventional Materials

5.2.2.2 Environmental Sustainability

5.2.3 Opportunities

5.2.3.1 Emerging Market for Melt-Processible Fluoropolymers

5.2.4 Challenges

5.2.4.1 Difficulty in Processing High Performance Fluoropolymers

5.2.4.2 Intense Price Competition from Chinese Manufacturers

5.2.4.3 Use of Reprocessed Ptfe

5.3 Porter's Five Forces Analysis

5.4 Value Chain of High Performance Fluoropolymers

5.4.1 Raw Material Suppliers

5.4.2 High Performance Fluoropolymer Manufacturers

5.4.3 Compounders

5.4.4 Producers of Semi-Finished Goods

5.4.5 Oems

5.4.6 End-Users

5.5 Patent Analysis

5.5.1 Introduction

5.5.2 Methodology

5.5.3 Document Type

5.5.4 Publication Trends, Last 10 Years (2011-2021)

5.5.5 Insights

5.5.6 Legal Status of Patents

5.5.7 Jurisdiction Analysis

5.5.8 Top Companies/Applicants

5.5.8.1 Patents by Daikin Industries, Ltd.

5.5.8.2 Patents by W.L. Gore & Associates, Inc.

5.5.8.3 Patents by Nitto Denko Corporation

5.5.9 Top 10 Patent Owners (Us) in Last 10 Years

5.6 Raw Material/Component Analysis

5.6.1 Fluorspar

5.6.2 Ethylene

5.6.3 Tertrafluoroethylene (Tfe)

5.7 Regulations Related to High Performance Fluoropolymers Market

5.7.1 Regulations in Medical Devices Market

5.7.2 Regulations in Water Treatment Market

5.7.2.1 North America

5.7.2.1.1 Clean Water Act

5.7.2.1.2 Safe Drinking Water Act (Sdwa)

5.8 Trade Analysis

5.9 Ecosystem Mapping

5.10 Technology Analysis

5.10.1 5G Connectivity and High Performance Fluoropolymers

5.10.2 Electric Vehicle and High Performance Fluoropolymers

5.10.3 Advancements in Electronic Designs and High Performance Fluoropolymers

5.10.4 Energy Transition and High Performance Fluoropolymers

5.11 Trends/Disruptions Impacting Customers' Businesses

5.12 Macroeconomic Indicators

5.13 Pricing Trend Analysis

5.14 Impact of COVID-19 on High Performance Fluoropolymers Market

5.15 Key Conferences & Events in 2022-2023

5.16 Case Study Analysis

5.16.1 Air Frohlich Using Teflon Film for Heat Exchangers

5.16.2 Ptfe Coatings for Aerospace Components

6 High Performance Fluoropolymers Market, by Type

6.1 Introduction

6.2 Ptfe

6.2.1 Growing Applications in Various End-Use Industries to Drive Ptfe Market

6.3 Fep

6.3.1 Melt-Processability and Anti-Corrosion Properties to Drive Market

6.4 Pfa/Mfa

6.5 Etfe

6.6 Others

7 High Performance Fluoropolymers Market, by Form

7.1 Introduction

7.1.1 Granular/Suspension

7.1.2 Fine Powder & Dispersion

7.1.3 Fine Powder/Coagulated Dispersions (Cd)

7.1.4 Aqueous Dispersions (Ad)

8 High Performance Fluoropolymers Market, by End-Use Industry

8.1 Introduction

8.2 Electrical & Electronics

8.2.1 Telecommunication

8.2.1.1 Growth in Consumption of Wire & Cable in Telecommunication Sector Fuels Demand for Hpf

8.2.2 Semiconductors

8.2.2.1 Hpf Films Have Increased Demand in Semiconductor Coatings

8.2.3 Electronic Components

8.2.3.1 Increasing Use of Hpf Coatings in Electronic Components

8.2.4 Defense Electronics

8.2.4.1 Growing Spending on Defense Projects Bolster Demand for Hpf

8.3 Industrial Processing

8.3.1 Chemical Processing

8.3.1.1 Excellent Resistance to Aggressive Chemicals Drive Demand for Hpf

8.3.2 Oil & Gas

8.3.2.1 High Consumption of Seals, Gaskets, Encapsulation, Power Cables, and Tubing Propel Market

8.3.3 Power Plants

8.3.3.1 High Growth Opportunities in Renewable Energy to Drive the Market

8.3.4 Water Treatment

8.3.4.1 Expansion in Emerging Markets to Propel Demand

8.3.5 Food Processing

8.3.5.1 High Chemical and Heat Resistance of Hpf Suitable for Use in Food Processing Industry

8.4 Transportation

8.4.1 Automotive

8.4.1.1 Growth in Production of Automobiles and Rising Demand for Evs to Drive Market

8.4.2 Aerospace

8.4.2.1 Growing Production of Aircraft in Europe and North America to Drive Demand for Hpf

8.5 Medical

8.5.1 Medical Devices

8.5.1.1 Increased Consumption of Prosthesis to Boost Consumption

8.5.2 Pharmaceutical & Biotechnology

8.5.2.1 Hpf is Used in Pharmaceutical Products due to Its Chemical Inertness

8.6 Others

8.6.1 Building & Construction

8.6.2 Consumer Household

9 High Performance Fluoropolymers Market, by Application

9.1 Introduction

9.1.1 Coatings & Liners

9.1.1.1 Growing Demand from Various End-Use Industries to Drive Market for Hpf Coatings & Liners

9.1.2 Components

9.1.2.1 Melt-Processability and High Chemical Inertness Properties to Drive Market

9.1.3 Films

9.1.3.1 Increasing Demand from Building & Construction Industry is Driving Market for Hpf Films

9.1.4 Additives

9.1.4.1 Increasing Demand from Asia-Pacific, Europe, and North America is Driving Demand for Hpv Additives

9.1.5 Others

10 High Performance Fluoropolymers Market, by Region

11 Competitive Landscape

11.1 Revenue Analysis

11.1.1 High Performance Fluoropolymers Market

11.2 Market Ranking

11.2.1 Agc, Inc.

11.2.2 Daikin Industries

11.2.3 The Chemours Company

11.2.4 Gujarat Fluorochemicals Limited

11.2.5 3M

11.3 Competitive Evaluation Quadrant (Tier 1)

11.3.1 Terminology/Nomenclature

11.3.1.1 Star

11.3.1.2 Pervasive

11.3.1.3 Emerging Leader

11.3.2 Strength of Product Portfolio

11.3.3 Business Strategy Excellence

11.4 Market Evaluation Matrix

11.5 Competitive Evaluation Quadrant (Small and Medium Enterprises)

11.5.1 Terminology/Nomenclature

11.5.1.1 Progressive Companies

11.5.1.2 Responsive Companies

11.5.1.3 Dynamic Companies

11.5.2 Strength of Product Portfolio (Sme's)

11.5.3 Business Strategy Excellence (Sme's)

11.5.4 Company Footprint

11.5.5 Company Type Footprint

11.5.6 Company End-Use Footprint

11.5.7 Company Region Footprint

11.6 Competitive Scenario and Trends

11.6.1 High Performance Fluoropolymers Market

11.6.1.1 Product Launches

11.6.1.2 Deals

11.6.1.3 Others

12 Company Profiles

12.1 Major Players

12.1.1 Agc, Inc.

12.1.2 Daikin Industries

12.1.3 The Chemours Company

12.1.4 Gfl Limited

12.1.5 3M

12.1.6 Dongyue Group

12.1.7 Fluoroseals Spa

12.1.8 Hubei Everflon Polymer

12.1.9 Halopolymer

12.1.10 Solvay

12.2 Other Players

12.2.1 Bitrez

12.2.2 Chenguang Research Institute of Chemical Industry

12.2.3 Fluorocarbon

12.2.4 Guangzhou Fluoroplastics Co., Ltd

12.2.5 Hindustan Fluorocarbons Limited

12.2.6 In2Plastics

12.2.7 Jiangsu Meilan Chemical Co. Ltd.

12.2.8 Juhua Group Corporation

12.2.9 Polyflon Technology Limited

12.2.10 Rochling Group

12.2.11 Rtp Company

12.2.12 Shandong Hengyi New Material Technology Co., Ltd.

12.2.13 Shamrock Technologies

12.2.14 Techmer Pm

12.2.15 Zibo Bainaisi Chemical Co., Ltd.

13 Appendix

For more information about this report visit https://www.researchandmarkets.com/r/ta2ppk

Attachment

CONTACT: CONTACT: ResearchAndMarkets.com Laura Wood, Senior Press Manager press@researchandmarkets.com For E.S.T Office Hours Call 1-917-300-0470 For U.S./CAN Toll Free Call 1-800-526-8630 For GMT Office Hours Call +353-1-416-8900

Yahoo Finance

Yahoo Finance