Worldwide Indoor Farming Technology Industry to 2027 - Featuring AeroFarms, Bright Farms and Signify Holding Among Others

Global Indoor Farming Technology Market

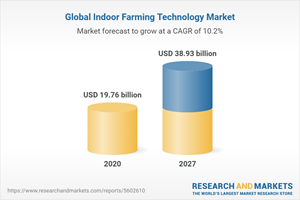

Dublin, July 19, 2022 (GLOBE NEWSWIRE) -- The "Indoor Farming Technology Market - Forecasts from 2022 to 2027" report has been added to ResearchAndMarkets.com's offering.

Indoor farming is a way of cultivating plants and crops exclusively indoors. It frequently uses hydroponics and artificial lighting, where growing conditions can be better controlled, to offer plants a sufficient amount of nutrients and light levels they require for growth. Plants of all kinds can be cultivated inside, although the most common are fruits, vegetables, and herbs. Rising awareness about the consumption of residue-free food has cleared the pathway for innovative techniques such as indoor farming.

Increasing agriculture production using less water and land resources

According to Forbes, By 2050, the world's population is expected to reach 9.7 billion, requiring a 70 percent increase in global food production in the next 30 years to feed everyone. Agriculture needs to adapt to use less water and pesticides, make crops less vulnerable to climate change, meanwhile provide more consistent yields. When compared to outside farming, indoor farms recirculate and reuse water, requiring 95 percent less water to cultivate the same crops.

The average production of standard lettuce farming doubled when cultivated vertically, according to the US Department of Agriculture. The transpiration process happens when plants or commodities are cultivated in vertical greenhouses, allowing farmers to reuse the water for irrigation. Greater production from less area is necessary, and indoor farming aids in a higher yield of various crops. As arable land becomes scarcer, the growing demand to maximize crop yields will drive the indoor farming business in the projected period.

The initial expense is high

Indoor farming is a costly enterprise, from locating suitable facilities to selecting the best-performing crops necessitates a significant investment. In addition, both greenhouses and vertical farms have a greater percentage of running expenditures due to the high use of electricity.

For an optimal indoor farm, controlling the ambient atmosphere with adequate temperature, lighting, and pollination as well as the plant arrangement is crucial. Land prices alone, which are typically highly expensive in urban areas, considerably boost the initial upfront costs. Equipment prices placed further strain on the budget of many vertical farming enterprises. Climate controls, LED lights, computers, shelving units, water lines, and other pricey equipment are required by most indoor farms.

Key Developments

In November 2021, NASA Research debuted a new phase of indoor farming. This new agricultural approach paved the way for the controlled environment agriculture (CEA) industry. Aerofarms formed a partnership with Hortifrut SA in April 2021. R&D of blueberry and cranberry production in fully controlled vertical farms and indoor environs will be the focus of the partnership.

BrightFarms established the newest indoor farm in Hendersonville in May 2021. The lettuce grown in the 6-acre greenhouse will yield 2 million pounds each year. Bright Farms also added three sustainable greenhouse farms to Massachusetts, North Carolina, and New York in 2019.

By growing systems, the global indoor farming technology market can be segmented into soil-based, aeroponics, hybrid, hydroponics, and aquaponics categories, respectively

Hydroponics is expected to account for a significant share in the market owing to advantages such as the low cost of water because the water remains in the system and maybe reused and the elimination of the need for soil. Aeroponics is expected to grow at a high CAGR in the projected period.

By component, the global indoor farming technology market can be segmented into software, hardware, and services

Over the estimation period, the hardware category is expected to have the biggest market share and develop quickly in the indoor farming technology market.

By facility type, the global indoor farming technology market can be segmented into indoor deep water culture systems, indoor vertical farms, container farms, and poly or glass greenhouses

The indoor vertical farm segment is expected to rise at a faster rate. Indoor vertical farms are enclosed, opaque chambers with artificial lighting and vertical growth methods, including hydroponics, aeroponics, and aquaponics.

By crop type, the global indoor farming technology market can be segmented into flowers and ornamentals, herbs and microgreens, fruits and vegetables, and others

The fruits and vegetable segment is expected to have a sizable market proportion. Fruit and vegetable consumption has increased by double digits over the last few decades, and this trend is anticipated to continue in the next years. One of the key factors that have accelerated the trend is the ever-increasing population. Herbs and microgreens segment is predicted to increase rapidly in the projected period.

By geography, the global indoor farming technology market can be segmented into the Asia Pacific, North America, the Middle East and Africa, South America, and Europe

Because of the increasing rise of greenhouses and vertical farms in the US and Canada, North America is one of the greatest indoor farming technology marketplaces. The greenhouse crop production sector currently dominates the indoor farming industry in the US. The Asia Pacific is expected to develop quickly, as demand for indoor farming technology has increased in the region owing to increasing international businesses investing in agricultural operations to fulfill the demands of crop growers for export-quality commodities exclusively.

COVID-19 Insights

The COVID-19 epidemic impacted the global indoor farming technology market significantly. The adoption rate of indoor farming systems, especially in urban areas worldwide, is expected to skyrocket due to the coronavirus epidemic. The agriculture industry was confronted with some difficulties. Some farmers missed their window of opportunity for harvesting seasonal crops, dropping agricultural product prices, and logistics disruption due to labor shortages. Many countries also realized that they were overly reliant on food imports and began focusing on domestic and internal production.

Key Topics Covered:

1. INTRODUCTION

2. RESEARCH METHODOLOGY

3. EXECUTIVE SUMMARY

4. MARKET DYNAMICS

4.1. Market Drivers

4.2. Market Restraints

4.3. Porter's Five Forces Analysis

4.3.1. Bargaining Power of Suppliers

4.3.2. Bargaining Powers of Buyers

4.3.3. Threat of Substitutes

4.3.4. Threat of New Entrants

4.3.5. Competitive Rivalry in Industry

4.4. Industry Value Chain Analysis

5. GLOBAL INDOOR FARMING TECHNOLOGY MARKET, BY GROWING SYSTEM

5.1. Introduction

5.2. Hydroponics

5.3. Aeroponics

5.4. Aquaponics

5.5. Soil-based

5.6. Hybrid

6. GLOBAL INDOOR FARMING TECHNOLOGY MARKET, BY COMPONENT

6.1. Introduction

6.2. Hardware

6.3. Software

6.4. Services

7. GLOBAL INDOOR FARMING TECHNOLOGY MARKET, BY FACILITY TYPE

7.1. Introduction

7.2. Glass or Poly Greenhouse

7.3. Indoor Vertical Farm

7.4. Container Farm

7.5. Indoor DWC System

8. GLOBAL INDOOR FARMING TECHNOLOGY MARKET, BY CROP TYPE

8.1. Introduction

8.2. Fruits & vegetables

8.3. Herbs & Microgreens

8.4. Flowers & Ornamentals

8.5. Others

9. GLOBAL INDOOR FARMING TECHNOLOGY MARKET, BY GEOGRAPHY

9.1. Introduction

9.2. North America

9.2.1. United States

9.2.2. Canada

9.2.3. Mexico

9.3. South America

9.3.1. Brazil

9.3.2. Argentina

9.3.3. Others

9.4. Europe

9.4.1. United Kingdom

9.4.2. Germany

9.4.3. France

9.4.4. Italy

9.4.5. Others

9.5. Middle East and Africa

9.5.1. Saudi Arabia

9.5.2. Israel

9.5.3. Others

9.6. Asia Pacific

9.6.1. China

9.6.2. Japan

9.6.3. India

9.6.4. South Korea

9.6.5. Indonesia

9.6.6. Thailand

9.6.7. Taiwan

9.6.8. Others

10. COMPETITIVE ENVIRONMENT AND ANALYSIS

10.1. Major Players and Strategy Analysis

10.2. Emerging Players and Market Lucrativeness

10.3. Mergers, Acquisition, Agreements, and Collaborations

10.4. Vendor Competitiveness Matrix

11. COMPANY PROFILES

11.1. AeroFarms

11.2. Bright Farms Inc.

11.3. Bowery Inc.

11.4. FreshBox Farms

11.5. Signify Holding

11.6. Argus Control Systems

11.7. Netafim

11.8. Logiqs

11.9. Richel Group

11.10. Vertical Farm Systems

11.11. General Hydroponics

11.12. Square roots

11.13. Gotham Greens

For more information about this report visit https://www.researchandmarkets.com/r/2d5e3b

Attachment

CONTACT: CONTACT: ResearchAndMarkets.com Laura Wood, Senior Press Manager press@researchandmarkets.com For E.S.T Office Hours Call 1-917-300-0470 For U.S./CAN Toll Free Call 1-800-526-8630 For GMT Office Hours Call +353-1-416-8900

Yahoo Finance

Yahoo Finance