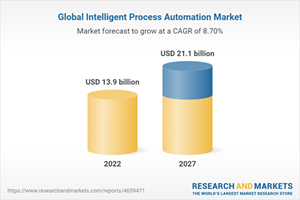

The Worldwide Intelligent Process Automation Industry is Expected to Reach $21.1 Billion by 2027

Global Intelligent Process Automation Market

Dublin, Nov. 07, 2022 (GLOBE NEWSWIRE) -- The "Intelligent Process Automation Market with Covid-19 Impact Analysis by Component, Technology, Application, Business Function (IT, Finance & Accounts, and Human Resource), Deployment Mode, Organisation Size, Vertical and Region - Global Forecast to 2027" report has been added to ResearchAndMarkets.com's offering.

The publisher forecasts the global Intelligent Process Automation Market size is expected to grow USD 13.9 billion in 2022 to USD 21.1 billion by 2027, at a Compound Annual Growth Rate (CAGR) of 8.7% during the forecast period.

By Application, the Contact Center Management segment to grow at the highest market share during the forecast period

Contact center management is a tool that organizations use to manage the daily operations of the workforce across multiple touchpoints and channels to assist omnichannel customer journeys. Contact center management includes workforce forecasting, agent scheduling, time management, employee empowerment and enrichment, reporting, and customer interactions.

There is an increase in customer expectations; customers call for a change in pattern from customer service management to customer experience management. Contact centers are moving toward building a digital workforce in place of their automation strategy by integrating RPA, AI, NLP, ML, and analytics elements to automate their business processes.

Developments are being done to automate processes that were earlier seen as non-automatable due to their input in unstructured formats, such as free flow text documents and scanned images. This is why newer technologies are developed to assist and help agents interact with customers and drive more satisfaction.

By Organization Size, the Large Enterprises segment to hold the larger market size during the forecast period

Organizations with more than 1,000 employees are considered large enterprises. The adoption of the IPA solution among large enterprises is expected to increase in the coming years. The large enterprises are expected to have adopted the IPA solution for reducing operational costs, improving business functioning, enhancing operational efficiency, and sustaining the intense competition.

With the increasing amount of data, processes, and tasks, large enterprises have started investing in IT infrastructure and technical expertise to automate their various tasks. The IPA solution helps save infrastructure costs, improve business functioning, and enhance agility.

Large enterprises possess a huge amount of data across business functions, which they need to analyze for entity extraction, text classification, summarization, and sentiment analysis. Large organizations in BFSI, retail, healthcare, and telecommunications verticals need AI technology for identifying patterns in data. AI helps data management teams realize which practices are ineffective and what all are working best.

Several organizational departments have been utilizing data to enhance their operations. For instance, sales departments that study consumer trends can get useful insights. AI makes sure that data reaches the right user without getting intercepted by cybercriminals who may employ man-in-the-middle, spear phishing, ransomware, spyware, or any other cyberattacks.

By Region, North America to grow at the highest market share during the forecast period

In terms of market size, North America is expected to be the major contributor to the IPA market during the forecast period. The US and Canada are expected to be the major contributors to the North American market. Enterprises in this region are the early adopters of technologies, such as machine learning, AI, NLP, and virtual bots adoption. Most of the North American industry verticals have already gone through digital transformation.

This rapid adoption of technologies has led to the generation of massive data by North American companies and presented positive opportunities for the deployment of IPA software to maintain and manage such data. The automation of business processes results in less need for manpower and saves a lot of time and cost, enabling companies to focus on business-critical decisions.

Key Topics Covered:

1 Introduction

2 Research Methodology

3 Executive Summary

4 Premium Insights

4.1 Attractive Opportunities in Market

4.2 Market, by Deployment Mode, 2022

4.3 North American Intelligent Process Automation Market, 2022

4.4 Asia-Pacific Market, 2022

4.5 Market, by Country

5 Market Overview and Industry Trends

5.1 Introduction

5.2 Market Dynamics

5.2.1 Drivers

5.2.1.1 Rising Adoption of Rpa

5.2.1.2 Increasing Inheritance of Ml and Advanced Analytics

5.2.1.3 Faster Decision-Making Across Organizations

5.2.1.4 Rising Demand for Automated Solutions for Business Continuity Planning

5.2.2 Restraints

5.2.2.1 Massive Data Handling and Cost Computation

5.2.2.2 Absence of Highly Sophisticated and Skilled Manpower

5.2.2.3 High Cost of Investment

5.2.3 Opportunities

5.2.3.1 Effective Monitoring of Data and Fraud Detection

5.2.3.2 Increasing Investment in Ipa Market

5.2.4 Challenges

5.2.4.1 Hike in Cybersecurity Threats

5.2.4.2 Difficulties in Rising in Maturity Chain

5.2.4.3 Poor Communication Infrastructure to Restrict Growth

5.3 Industry Trends

5.3.1 Supply/Value Chain Analysis

5.3.2 Ecosystem/Market Map

5.3.3 Porter's Five Forces Analysis

5.3.4 Key Stakeholders and Buying Criteria

5.3.4.1 Key Stakeholders in Buying Process

5.3.4.2 Buying Criteria

5.3.5 Technology Analysis

5.3.6 Trends and Disruptions Impacting Buyers

5.3.7 Patent Analysis

5.3.8 Pricing Analysis

5.3.9 Market Assessment by Data Type

5.3.10 Use Cases

5.3.10.1 Contact Center Management

5.3.10.1.1 Use Case 1: Ke Holdings Inherited Laiye's Rpa Deployment to Accelerate Data Transmission

5.3.10.1.2 Use Case 2: E.On Chose Cognigy.Ai as a Solution for Its High Modularity and Custom Integration Capabilities

5.3.10.2 Business Process Automation

5.3.10.2.1 Use Case 3: Flowforma Managed Multi-Cloud Infrastructure of Global Pharma Organization

5.3.10.2.2 Use Case 4: Bizagi Automation Platform Automated Audi Japan Kk's Finance Processes

5.3.10.3 Application Management

5.3.10.3.1 Use Case 5: Laiye Built Ai-Powered Conversational Robot for Astrazeneca

5.3.10.4 Content Management

5.3.10.4.1 Use Case 6: Deutsche Bank Selected Workfusion to Streamline Processes

5.3.10.4.2 Use Case 7: Kofax Selected Cognigy.Ai to Enhance Its Search Engine for Its Knowledge Base

5.3.10.5 Security Management

5.3.10.5.1 Use Case 8: Future-Proofing a Captive Auto Finance Organization with Pegasystems

5.3.11 Tariff & Regulatory Impact

5.3.11.1 Regulatory Bodies, Government Agencies, and Other Organizations

5.3.12 Key Conferences & Events in 2022

5.4 COVID-19 Market Outlook for Market

6 Intelligent Process Automation Market, by Component

6.1 Introduction

6.1.1 Component: COVID-19 Impact

6.2 Platform

6.2.1 Platform: on Market Drivers

6.3 Solution

6.3.1 Solution: Intelligent Process Automation Market Drivers

6.4 Services

6.4.1 Services: Market Drivers

6.4.2 Professional Services

6.4.2.1 Advisory/Consulting

6.4.2.2 Design & Implementation

6.4.2.3 Training

6.4.2.4 Support & Maintenance

6.4.3 Managed Services

7 Intelligent Process Automation Market, by Technology

7.1 Introduction

7.2 Technology: Market Drivers

7.3 Technology: COVID-19 Impact

7.4 Natural Language Processing

7.5 Machine and Deep Learning

7.6 Neural Networks

7.7 Virtual Agents

7.8 Mini Bots

7.9 Computer Vision

7.10 Other Technologies

8 Intelligent Process Automation Market, by Application

8.1 Introduction

8.1.1 Application: COVID-19 Impact

8.2.1 Contact Center Management: Market Drivers

8.3 Business Process Automation

8.3.1 Business Process Automation: Market Drivers

8.4 Application Management

8.4.1 Application Management: Intelligent Process Automation Market Drivers

8.5 Content Management

8.5.1 Content Management: Market Drivers

8.6 Security Management

8.6.1 Security Management: Market Drivers

8.7 Other Applications

9 Intelligent Process Automation Market, by Business Function

9.1 Introduction

9.1.1 Business Functions: COVID-19 Impact

9.2 Information Technology

9.2.1 Information Technology: Market Drivers

9.3 Finance & Accounts

9.3.1 Finance & Accounts: Intelligent Process Automation Market Drivers

9.4 Human Resources

9.4.1 Human Resources: Market Drivers

9.5 Operations & Supply Chain

9.5.1 Operations & Supply Chain: Market Drivers

10 Intelligent Process Automation Market, by Deployment Mode

10.1 Introduction

10.1.1 Deployment Mode: COVID-19 Impact

10.2 On-Premises

10.2.1 On-Premises: Market Drivers

10.3 Cloud

10.3.1 Cloud: Market Drivers

11 Intelligent Process Automation Market, by Organization Size

11.1 Introduction

11.1.1 Organization Size: COVID-19 Impact

11.2 Large Enterprises

11.2.1 Large Enterprises: Market Drivers

11.3 Small and Medium-Sized Enterprises

11.3.1 Small and Medium-Sized Enterprises: Market Drivers

12 Intelligent Process Automation Market, by Vertical

12.1 Introduction

12.1.1 Vertical: COVID-19 Impact

12.2 Banking, Financial Services, and Insurance

12.2.1 Banking, Financial Services and Insurance: Market Drivers

12.3 Telecommunications & It

12.3.1 Telecommunications & It: Intelligent Process Automation Market Drivers

12.4 Manufacturing & Logistics

12.4.1 Manufacturing & Logistics: Market Drivers

12.5 Media & Entertainment

12.5.1 Media & Entertainment: Market Drivers

12.6 Retail & Ecommerce

12.6.1 Retail & Ecommerce: Intelligent Process Automation Market Drivers

12.7 Healthcare & Life Sciences

12.7.1 Healthcare & Life Sciences: Market Drivers

12.8 Other Verticals

13 Intelligent Process Automation Market, by Region

14 Competitive Landscape

14.1 Overview

14.2 Market Evaluation Framework

14.3 Key Player Strategies/Right to Win

14.4 Competitive Scenario and Trends

14.4.1 Product Launches

14.4.2 Deals

14.4.3 Others

14.5 Market Share Analysis of Top Players

14.6 Historical Revenue Analysis

14.7 Company Evaluation Matrix Overview

14.8 Company Evaluation Matrix Methodology and Definitions

14.8.1 Star

14.8.2 Emerging Leaders

14.8.3 Pervasive

14.8.4 Participants

14.9 Company Product Footprint Analysis

14.10 Company Market Ranking Analysis

14.11 Startup/Sme Evaluation Matrix Methodology and Definitions

14.11.1 Progressive Companies

14.11.2 Responsive Companies

14.11.3 Dynamic Companies

14.11.4 Starting Blocks

14.12 Competitive Benchmarking for Sme/Startup

15 Company Profiles

15.1 Key Players

15.1.1 Atos

15.1.2 Ibm

15.1.3 Genpact

15.1.4 Hcl Technologies

15.1.5 Pegasystems

15.1.6 Blue Prism

15.1.7 Capgemini

15.1.8 Cgi

15.1.9 Nice

15.1.10 Cognizant

15.1.11 Accenture

15.1.12 Infobip

15.1.13 Infosys

15.1.14 Tcs

15.1.15 Tech Mahindra

15.1.16 Uipath

15.1.17 Wipro

15.1.18 Xerox Corporation

15.1.19 Happiest Minds

15.1.20 Workfusion

15.1.21 Automation Anywhere

15.2 Smes/ Startups

15.2.1 Virtual Operations

15.2.2 Hive

15.2.3 Hyperscience

15.2.4 Laiye

15.2.5 Cognigy

15.2.6 Jiffy.Ai

15.2.7 InfinitUS

15.2.8 Electroneek

15.2.9 Snorkel Ai

15.2.10 Vianai

15.2.11 Kryon

15.2.12 Rossum

15.2.13 Autologyx

15.2.14 Automation Edge

16 Adjacent/Related Market

17 Appendix

For more information about this report visit https://www.researchandmarkets.com/r/yu2xmw

Attachment

CONTACT: CONTACT: ResearchAndMarkets.com Laura Wood,Senior Press Manager press@researchandmarkets.com For E.S.T Office Hours Call 1-917-300-0470 For U.S./ CAN Toll Free Call 1-800-526-8630 For GMT Office Hours Call +353-1-416-8900

Yahoo Finance

Yahoo Finance