Worldwide Monoethylene Glycol Industry to 2028 - Featuring Reliance Industries, Saudi Basic Industries and BASF Among Others

Monoethylene Glycol Market

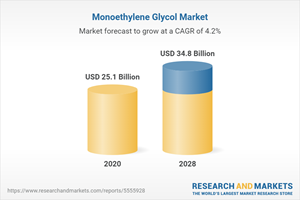

Dublin, June 16, 2022 (GLOBE NEWSWIRE) -- The "Monoethylene Glycol Market, by Production Process, by Application, by End-use Industry, and by Region - Size, Share, Outlook, and Opportunity Analysis, 2021 - 2028" report has been added to ResearchAndMarkets.com's offering.

Monoethylene glycol is also known as 1, 2-ethanediol and is soluble in a wide range of chemical compounds, alcohols, and water. Ethylene Oxide hydrolysis produces it primarily, with the emission of two co-products, Diethylene Glycol (DEG) and Triethylene Glycol (TEG).

Natural gas, coal, naphtha, and bioethanol are the feedstocks used to make monoethylene glycol, hence the market is divided into four types based on the sources from which it is made. Natural gas, followed by naphtha and coal, accounts for the majority of monoethylene glycol production. Due to mounting environmental concerns, most businesses are now focusing on producing biobased monoethylene glycol rather than petrochemical-based monoethylene glycol.

Monoethylene glycol is utilized in coolants and de-icing materials because of its chemical features, which include high viscosity, high boiling point, and low freezing point. PET and polyester resins are made primarily from monoethylene glycol. It is frequently utilized as a raw ingredient in the production of fabrics and polyester fibres.

Among other things, it's used as a coolant, anti-freeze, dewatering agent, chemical intermediate, humecant, and anti-corrosion agent. Monoethylene Glycol is also used in the making of tobacco, food and beverages, pharmaceuticals, and cosmetics, among other things.

Market Dynamics

The expansion of the monoethylene glycol market would be aided by rising demand for PET packaging in various commercial and industrial end-use applications. Clothing, industrial fabrics, and non-woven fabrics are just a few of the industries where fibers are used.

Some of the features of these fabrics, such as resistance to moisture, stains, oil, and water, have led to increased demand for them. It's abrasion-resistant and wrinkle-resistant. As a result of these characteristics, the use of fibre in textile sector and the monoethylene glycol market will grow in the forecast period.

On the other hand, MEG is extremely toxic to people; consumption has been shown to have a negative influence on the kidneys, the heart, and the central nervous system, which is limiting the market growth.

Key features of the study:

This report provides an in-depth analysis of the global monoethylene glycol market, market size (US$ Billion & Tons), and compound annual growth rate (%CAGR) for the forecast period (2022-2028), considering 2020 as the base year

It elucidates potential revenue opportunities across different segments and explains attractive investment proposition matrices for this market

This study also provides key insights about market drivers, restraints, opportunities, new product launches or approval, market trends, regional outlook, and competitive strategies adopted by key players

It profiles key players in the global monoethylene glycol market based on the following parameters - company highlights, products portfolio, key highlights, financial performance, and strategies

Key companies covered as a part of this study include Reliance Industries Limited, Saudi Basic Industries Corporation, BASF SE, India Glycols Limited, LyondellBasell Industries Holdings B.V., Chemtex Speciality Limited, Royal Dutch Shell PLC, Nouryon, Mitsubishi Chemical Corporation, and Eastman Chemical Company

Insights from this report would allow marketers and the management authorities of the companies to make informed decisions regarding their future product launches, type up-gradation, market expansion, and marketing tactics

The global monoethylene glycol market report caters to various stakeholders in this industry including investors, suppliers, product manufacturers, distributors, new entrants, and financial analysts

Stakeholders would have ease in decision-making through various strategy matrices used in analyzing the global monoethylene glycol market.

Key Topics Covered:

1. Research Objectives and Assumptions

2. Market Purview

Report Description

Market Definition and Scope

Executive Summary

Market Snippet, By Production Process

Market Snippet, By Application

Market Snippet, By End-use Industry

Market Snippet, By Region

Coherent Opportunity Map (COM)

3. Market Dynamics, Regulations, and Trends Analysis

Market Dynamics

Drivers

Supply Side Drivers

Demand Side Drivers

Economic Drivers

Restraints

Market Opportunities

Regulatory Scenario

Industry Trend

PEST Analysis

PORTER's Analysis

New Product Approvals/Launch

Promotion and Marketing Initiatives

4. Global Monoethylene Glycol Market- Impact of Coronavirus (COVID-19) Pandemic

Overview

Factors Affecting Global Monoethylene Glycol Market- COVID-19

Impact Analysis

5. Global Monoethylene Glycol Market, By Production Process, 2017 - 2028(US$ Billion & Tons)

Introduction

Market Share Analysis, 2017 and 2028 (%)

Y-o-Y Growth Analysis, 2021 - 2028

Segment Trends

Gas-based

Market Share Analysis, 2017 and 2028 (%)

Y-o-Y Growth Analysis, 2021 - 2028

Naphtha-based

Market Share Analysis, 2017 and 2028 (%)

Y-o-Y Growth Analysis, 2021 - 2028

Coal-based

Market Share Analysis, 2017 and 2028 (%)

Y-o-Y Growth Analysis, 2021 - 2028

Methane-to-Olefins

Market Share Analysis, 2017 and 2028 (%)

Y-o-Y Growth Analysis, 2021 - 2028

Bio-based

Market Share Analysis, 2017 and 2028 (%)

Y-o-Y Growth Analysis, 2021 - 2028

6. Global Monoethylene Glycol Market, By Application, 2017 - 2028(US$ Billion & Tons)

Introduction

Market Share Analysis, 2017 and 2028 (%)

Y-o-Y Growth Analysis, 2021 - 2028

Segment Trends

Polyester Fiber

Market Share Analysis, 2017 and 2028 (%)

Y-o-Y Growth Analysis, 2021 - 2028

Polyethylene Terephthalate (PET) Resins

Market Share Analysis, 2017 and 2028 (%)

Y-o-Y Growth Analysis, 2021 - 2028

Polyethylene Terephthalate (PET) Film

Market Share Analysis, 2017 and 2028 (%)

Y-o-Y Growth Analysis, 2021 - 2028

Antifreeze

Market Share Analysis, 2017 and 2028(%)

Y-o-Y Growth Analysis, 2021 - 2028

Others

Market Share Analysis, 2017 and 2028(%)

Y-o-Y Growth Analysis, 2021 - 2028

7. Global Monoethylene Glycol Market, By End-use Industry, 2017 - 2028(US$ Billion & Tons)

Introduction

Market Share Analysis, 2017 and 2028 (%)

Y-o-Y Growth Analysis, 2021 - 2028

Segment Trends

Textile

Market Share Analysis, 2017 and 2028 (%)

Y-o-Y Growth Analysis, 2021 - 2028

Plastic & Packaging

Market Share Analysis, 2017 and 2028 (%)

Y-o-Y Growth Analysis, 2021 - 2028

Automotive

Market Share Analysis, 2017 and 2028 (%)

Y-o-Y Growth Analysis, 2021 - 2028

Others

Market Share Analysis, 2017 and 2028 (%)

Y-o-Y Growth Analysis, 2021 - 2028

8. Global Monoethylene Glycol Market, By Region, 2017 - 2028(US$ Billion & Tons)

9. Competitive Landscape

Market Share Analysis

Company Profiles

Reliance Industries Limited

Product Portfolio

Financial Performance

Key Strategies

Recent Developments

Future Plans

Saudi Basic Industries Corporation

Product Portfolio

Financial Performance

Key Strategies

Recent Developments

Future Plans

BASF SE

Product Portfolio

Financial Performance

Key Strategies

Recent Developments

Future Plans

India Glycols Limited

Product Portfolio

Financial Performance

Key Strategies

Recent Developments

Future Plans

LyondellBasell Industries Holdings B.V.

Product Portfolio

Financial Performance

Key Strategies

Recent Developments

Future Plans

Chemtex Speciality Limited

Product Portfolio

Financial Performance

Key Strategies

Recent Developments

Future Plans

Royal Dutch Shell PLC

Product Portfolio

Financial Performance

Key Strategies

Recent Developments

Future Plans

Nouryon

Product Portfolio

Financial Performance

Key Strategies

Recent Developments

Future Plans

Mitsubishi Chemical Corporation

Product Portfolio

Financial Performance

Key Strategies

Recent Developments

Future Plans

Eastman Chemical Company

Product Portfolio

Financial Performance

Key Strategies

Recent Developments

Future Plans

10. Section

For more information about this report visit https://www.researchandmarkets.com/r/84m6xu

Attachment

CONTACT: CONTACT: ResearchAndMarkets.com Laura Wood, Senior Press Manager press@researchandmarkets.com For E.S.T Office Hours Call 1-917-300-0470 For U.S./CAN Toll Free Call 1-800-526-8630 For GMT Office Hours Call +353-1-416-8900

Yahoo Finance

Yahoo Finance