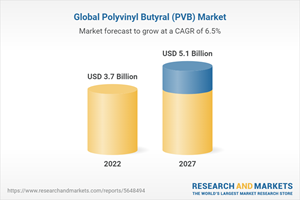

The Worldwide Polyvinyl Butyral Industry is Expected to Reach $5.1 Billion by 2027

Global Polyvinyl Butyral (PVB) Market

Dublin, Sept. 20, 2022 (GLOBE NEWSWIRE) -- The "Global Polyvinyl Butyral (PVB) Market by Application (Films & Sheets, Paints & Coatings, Adhesives), End-use (Automotive, Construction, Electrical & Electronics) and Region (North America, Asia Pacific, Europe, South America, Middle East & Africa) - Forecast to 2027" report has been added to ResearchAndMarkets.com's offering.

The global polyvinyl butyral (PVB) market is projected to grow from USD 3.7 billion in 2022 to USD 5.1 billion by 2027, at a CAGR of 6.5% between 2022 and 2027.

PVB are witnessing increased adoption in vehicles sunroof, aircraft windows for noise suppression, and interlayers in glass for enhanced safety. PVB films & sheets applications in construction industry are driven by the growth in residential housing, favorable demographics, and rising affordability which support the growth of PVB market during the forecast period. PVB films are also used in photovoltaic industry as the encapsulation material which enhance the life span of solar panels. However, availability of substitute materials such as ethylene-vinyl acetate (EVA) restricts the growth of the PVB market.

In terms of value, adhesives is the third fastest-growing segment in PVB market, by application, during the forecast period

PVB adhesives have strong adhesion characteristics and suitable for bonding metal, glass, leather, wood, and paper. PVB resins are used to develop variety of adhesives such as PCB and hot-melt adhesives. PCB adhesives possesses high strength and resistance ideal for electrical applications. PVB adhesives have high tensile strength due to which it is used to bind glass splinters and panels in various end-use industries.

In terms of value, construction is estimated to be second fastest-growing segment in PVB market, by end-use industry, during the forecast period

The growth of polyvinyl butyral (PVB) market is mainly contributed to the rapid developments in the construction industry. PVB laminating glass is utilized in commercial shops, government buildings, and banks for safety &security. PVB films have consumption in residential construction for protection of indoor furniture and plastic products from ultraviolet radiation and fading. Additionally, consumption of low thickness PVB sheets such as 0.38 millimeters, 0.76 millimeters, and 1.04 millimeters in architectural applications will boost the growth of the market.

Europe region accounted for the second-largest share in the PVB market by value

The region has stringent regulations to achieve energy efficiency in construction projects. Safety standards such as use of laminated glass in cars, LCVs, trucks, and buses and established automotive industry supports the growth of the market. Focus on clean energy generation by using renewable sources of energy such as solar power produced by photovoltaics is also expected to propel the demand of PVB in the region. Europe is considered an automotive hub, owing to the presence of established automobile manufacturers, such as Volkswagen, BMW, and Daimler. Moreover, technological advancements, new reformed policies, and rising investments in the region is expected to increase the consumption of PVB during the forecast period.

Key Topics Covered:

1 Introduction

2 Research Methodology

3 Executive Summary

4 Premium Insights

4.1 Attractive Opportunities in PVB Market

4.2 Asia-Pacific: PVB Market, by End-use Industry and Country

4.3 PVB Market, by Application

4.4 PVB Market, by End-use Industry

4.5 PVB Market, by Country

5 Market Overview

5.1 Introduction

5.2 Market Dynamics

5.2.1 Drivers

5.2.1.1 Growth in End-use Industries Driving Demand in Asia-Pacific

5.2.1.2 Large-Scale Demand for PVB Films for Window and Sunroof Application in Automotive Industry

5.2.1.3 Growth in Construction Industry

5.2.2 Restraints

5.2.2.1 High Recycling Activities of PVB

5.2.3 Opportunities

5.2.3.1 Increasing Demand from Photovoltaics Industry

5.2.4 Challenges

5.2.4.1 Stringent Environmental Regulations

5.3 Porter's Five Forces Analysis

5.4 Value Chain Analysis

5.4.1 Raw Material Suppliers

5.4.2 PVB Manufacturers

5.4.3 End-users

5.5 Ecosystem Mapping

5.6 Pricing Analysis

5.7 Technology Analysis

5.8 Trends/Disruptions Impacting Customers' Businesses

5.9 Patent Analysis

5.9.1 Introduction

5.9.2 Methodology

5.9.3 Document Type

5.9.4 Publication Trends, 2011-2021

5.9.5 Insights

5.9.6 Legal Status of Patents

5.9.7 Jurisdiction Analysis

5.9.8 Top Companies/Applicants

5.9.8.1 Patents by Saint-Gobain

5.9.8.2 Patents by Solutia Inc.

5.9.8.3 Patents by Kuraray Co. Ltd.

5.9.9 Top 10 Patent Owners (US) in Last 10 Years

5.10 Key Conferences & Events in 2022-2023

5.11 Key Factors Affecting Buying Decision

5.12 Tariffs & Regulations

5.13 Trade Analysis

5.14 Case Study Analysis

5.14.1 PVB Interlayer for Dome-Shaped Glass Rooftop Provided by Eastman Chemical Company

5.15 Comparison of PVB vs Substitutes

5.16 Customer Analysis

5.17 Material Analysis

5.18 Macroeconomic Data

6 PVB Market, by Application

6.1 Introduction

6.2 Films & Sheets

6.2.1 Automotive and Construction Industries to Drive Films & Sheets Segment

6.3 Paints & Coatings

6.3.1 High Adhesive Strength and Corrosion Resistance to Drive Market in Paints & Coatings Application

6.4 Adhesives

6.4.1 PVB Offers Good Mechanical Properties to Adhesives

6.5 Others

7 PVB Market, by End-use Industry

7.1 Introduction

7.2 Automotive

7.2.1 Continuous Innovation in Production of Laminated Glass to Drive Market

7.3 Construction

7.3.1 Rapid Development of Construction Industry to Fuel Market

7.4 Electrical & Electronics

7.4.1 Electrical & Electronics Sector Increasingly Using PVB Films in Photovoltaics Application

7.5 Others

8 PVB Market, by Region

9 Competitive Landscape

9.1 Overview

9.2 Strategies Adopted by Key Players

9.3 Market Evaluation Matrix

9.4 Market Ranking Analysis

9.5 Revenue Analysis of Top Players

9.6 Market Share Analysis

9.7 Company Evaluation Matrix

9.7.1 Stars

9.7.2 Emerging Leaders

9.7.3 Pervasive Players

9.7.4 Participants

9.8 Start-Ups and Small and Medium-Sized Enterprises (SMEs) Evaluation Matrix

9.8.1 Progressive Companies

9.8.2 Responsive Companies

9.8.3 Starting Blocks

9.8.4 Dynamic Companies

9.9 Competitive Benchmarking

9.9.1 Company Footprint

9.9.2 Company Application Footprint

9.9.3 Company End-use Industry Footprint

9.9.4 Company Region Footprint

9.10 Strength of Product Portfolio

9.11 Business Strategy Excellence

9.12 Competitive Scenario

9.12.1 Expansions, Collaborations, and Investments

9.12.2 Acquisitions & Agreements

10 Company Profiles

10.1 Key Players

10.1.1 Kuraray Co. Ltd.

10.1.2 Eastman Chemical Company

10.1.3 Sekisui Chemical Co. Ltd.

10.1.4 Hubergroup

10.1.5 Chang Chun Group

10.1.6 Anhui Wanwei Bisheng New Material Co. Ltd.

10.1.7 Kingboard (Fo Gang) Specialty Resins Limited

10.1.8 Qingdao Jinuo New Materials Co. Ltd.

10.1.9 Huakai Plastic Co. Ltd.

10.1.10 Tridev Resins Pvt. Ltd.

10.2 Other Players

10.2.1 Qingdao Jiahua Plastics Co. Ltd.

10.2.2 Siva Chemical Industries

10.2.3 Tanyun Junrong (Liaoning) Chemical Research Institute New Materials Incubator Co. Ltd.

10.2.4 Synpol Products Private Limited

10.2.5 Uniform Synthetics Private Limited

10.2.6 D.R. Coats Ink & Resins Pvt. Ltd.

10.2.7 Huzhou Xinfu New Materials Co. Ltd.

10.2.8 Qingdao Haocheng Industrial Company Limited

10.2.9 Zhejiang Pulijin Plastic Co. Ltd.

10.2.10 Tiantai Kanglai Industrial Co. Ltd.

10.2.11 Hefei TNJ Chemical Industry Co. Ltd.

10.2.12 Guangzhou Aojisi New Material Co. Ltd.

10.2.13 Dulite Co. Ltd.

10.2.14 Sinoever International Co. Ltd.

10.2.15 Jinhe Enterprise Co. Limited

11 Appendix

For more information about this report visit https://www.researchandmarkets.com/r/p9qvde

Attachment

CONTACT: CONTACT: ResearchAndMarkets.com Laura Wood,Senior Press Manager press@researchandmarkets.com For E.S.T Office Hours Call 1-917-300-0470 For U.S./ CAN Toll Free Call 1-800-526-8630 For GMT Office Hours Call +353-1-416-8900

Yahoo Finance

Yahoo Finance