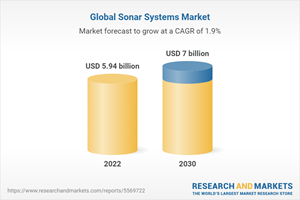

The Worldwide Sonar Systems Industry is Expected to Reach $7 Billion by 2030

Global Sonar Systems Market

Dublin, May 20, 2022 (GLOBE NEWSWIRE) -- The "Sonar Systems Market Share, Size, Trends, Industry Analysis Report, By Application; By Ports; By Installation, By Region; Segment Forecast, 2022 - 2030" report has been added to ResearchAndMarkets.com's offering.

The global sonar systems market size is expected to reach USD 7.0 billion by 2030, according to a new study. This report gives a detailed insight into current market dynamics and provides analysis on future market growth.

Key factors driving the market's growth include stable growth in the deliveries of military vessels. The market will be driven by the steady increase in military vessel deliveries. Military vessels use a handful of the most modern systems for maximum precision. These are employed on military ships for various purposes, including mine detection, seabed terrain analysis, anti-submarine warfare, diver detection, and port security.

Submarines utilize active sonar to navigate enemy seas undetected, but aircraft carriers and corvettes employ multi-static sonar to identify enemy ships. The growing number of such military ships on the water will help the industry in the coming years. Furthermore, un-manned Underwater Vehicles (UUVs) are remotely operated underwater vehicles that are utilized for various functions in the marine environment, including mine detection, seabed terrain exploration, fish behavioral observation, and so on.

These uncrewed aerial vehicles (UUVs) are evolving as more militaries and other organizations show interest in them. Due to the small size of UUVs, the systems employed in them must likewise be small, and the systems must be modern enough to work efficiently on the remote control. This allows the industry to both change and flourish simultaneously.

Based on the platform, the airborne segment accounted for the leading share in the industry. During the predicted period, the airborne category will see significant expansion. Early detection of opponents' submarines to prevent attacks and loss of resources is a crucial usage of sonobuoys and dipping port in the airborne segment, generating demand for sonobuoys.

Market players such as Atlas Elektronik, Lockheed Martin, Furuno Electric Co., Japan Radio Company, Kongsberg Gruppen ASA, L3 Technologies, Raytheon Company, Sonardyne, Teledyne Technologies Inc., Navico, FLIR Systems, Thales Group, and Ultra Electronics are some key players operating in the global market.

In October 2021, Kraken Robotics signed a service contract with the Canadian government, enabling the Royal Canadian Navy to test their ultra-high-resolution survey equipment (RCN). Kraken will deploy its KATFISH towed SAS sonar system. Thus, the agreements among significant players for the robotics services boost market growth during the forecast period.

Key Topics Covered:

1. Introduction

2. Executive Summary

3. Research Methodology

4. Global Sonar Systems Market Insights

4.1. Sonar Systems - Industry Snapshot

4.2. Sonar Systems Market Dynamics

4.2.1. Drivers and Opportunities

4.2.1.1. Stable Growth in the Deliveries of Military Vessels

4.2.1.2. Increasing Adoption rate of Unmanned Underwater Vehicles (UUVs)

4.2.2. Restraints and Challenges

4.2.2.1. Shift from 2D sonar processing to 3D sonar processing for seabed imaging and charting

4.3. Porter's Five Forces Analysis

4.3.1. Bargaining Power of Suppliers (Moderate)

4.3.2. Threats of New Entrants: (Low)

4.3.3. Bargaining Power of Buyers (Moderate)

4.3.4. Threat of Substitute (Moderate)

4.3.5. Rivalry among existing firms (High)

4.4. PESTLE Analysis

4.5. Sonar Systems Industry Trends

4.6. Value Chain Analysis

4.7. COVID-19 Impact Analysis

5. Global Sonar Systems Market, by Application

5.1. Key Findings

5.2. Introduction

5.2.1. Global Sonar Systems Market, by Application, 2018 - 2030 (USD Billion)

5.3. Anti-submarine Warfare

5.3.1. Global Sonar Systems Market, by Anti-submarine Warfare, by Region, 2018 - 2030 (USD Billion)

5.4. Port Security

5.4.1. Global Sonar Systems Market, by Port Security, by Region, 2018 - 2030 (USD Billion)

5.5. Mine Detection & Countermeasure Systems

5.5.1. Global Sonar Systems Market, by Mine Detection & Countermeasure Systems, by Region, 2018 - 2030 (USD Billion)

5.6. Radiation Detection & Monitoring

5.6.1. Global Sonar Systems Market, by Radiation Detection & Monitoring, by Region, 2018 - 2030 (USD Billion)

5.7. Search & Rescue

5.7.1. Global Sonar Systems Market, by Search & Rescue, by Region, 2018 - 2030 (USD Billion)

5.8. Navigation

5.8.1. Global Sonar Systems Market, by Navigation, by Region, 2018 - 2030 (USD Billion)

5.9. Diver Detection

5.9.1. Global Sonar Systems Market, by Diver Detection, by Region, 2018 - 2030 (USD Billion)

5.10. Seabed Terrain Investigation

5.10.1. Global Sonar Systems Market, by Seabed Terrain Investigation, by Region, 2018 - 2030 (USD Billion)

5.11. Scientific

5.11.1. Global Sonar Systems Market, by Scientific, by Region, 2018 - 2030 (USD Billion)

5.12. Others

5.12.1. Global Sonar Systems Market, by Others, by Region, 2018 - 2030 (USD Billion)

6. Global Sonar Systems Market, by Platform

6.1. Key Findings

6.2. Introduction

6.2.1. Global Sonar Systems Market, by Platform, 2018 - 2030 (USD Billion)

6.3. Commercial Vessels

6.3.1. Global Sonar Systems Market, by Commercial Vessels, by Region, 2018 - 2030 (USD Billion)

6.4. Defense Vessels

6.4.1. Global Sonar Systems Market, by Red, Defense Vessels, by Region, 2018 - 2030 (USD Billion)

6.5. Unmanned Underwater Vehicles (UUVs)

6.5.1. Global Sonar Systems Market, by Unmanned Underwater Vehicles (UUVs), by Region, 2018 - 2030 (USD Billion)

6.6. Aircraft

6.6.1. Global Sonar Systems Market, by Aircraft, by Region, 2018 - 2030 (USD Billion)

6.7. Ports

6.7.1. Global Sonar Systems Market, by Ports, by Region, 2018 - 2030 (USD Billion)

7. Global Sonar Systems Market, by Ports

7.1. Key Findings

7.2. Introduction

7.2.1. Global Sonar Systems Market, by Ports, 2018 - 2030 (USD Billion)

7.3. Hull-mounted

7.3.1. Global Sonar Systems Market, by Hull-mounted, by Region, 2018 - 2030 (USD Billion)

7.4. Stern-mounted

7.4.1. Global Sonar Systems Market, by Stern-mounted, by Region, 2018 - 2030 (USD Billion)

7.5. Dipping

7.5.1. Global Sonar Systems Market, by Dipping, by Region, 2018 - 2030 (USD Billion)

7.6. Sonobuoy

7.6.1. Global Sonar Systems Market, by Sonobuoy, by Region, 2018 - 2030 (USD Billion)

8. Global Sonar Systems Market, by Installation

8.1. Key Findings

8.2. Introduction

8.2.1. Global Sonar Systems Market, by Installation, 2018 - 2030 (USD Billion)

8.3. Fixed

8.3.1. Global Sonar Systems Market, by Fixed, by Region, 2018 - 2030 (USD Billion)

8.4. Deployable

8.4.1. Global Sonar Systems Market, by Deployable, by Region, 2018 - 2030 (USD Billion)

9. Global Sonar Systems Market, by Geography

10. Competitive Landscape

10.1. Expansion and Acquisition Analysis

10.1.1. Expansion

10.1.2. Acquisitions

10.2. Partnerships/Collaborations/Agreements/Exhibitions

11. Company Profiles

11.1. Atlas Elektronik

11.1.1. Company Overview

11.1.2. Financial Performance

11.1.3. Product Benchmarking

11.1.4. Recent Development

11.2. FLIR Systems

11.2.1. Company Overview

11.2.2. Financial Performance

11.2.3. Product Benchmarking

11.2.4. Recent Development

11.3. Furuno Electric Co.

11.3.1. Company Overview

11.3.2. Financial Performance

11.3.3. Product Benchmarking

11.3.4. Recent Development

11.4. Japan Radio Company

11.4.1. Company Overview

11.4.2. Financial Performance

11.4.3. Product Benchmarking

11.4.4. Recent Development

11.5. Kongsberg Gruppen ASA

11.5.1. Company Overview

11.5.2. Financial Performance

11.5.3. Product Benchmarking

11.5.4. Recent Development

11.6. L3 Technologies

11.6.1. Company Overview

11.6.2. Financial Performance

11.6.3. Product Benchmarking

11.6.4. Recent Development

11.7. Lockheed Martin

11.7.1. Company Overview

11.7.2. Financial Performance

11.7.3. Product Benchmarking

11.7.4. Recent Development

11.8. Navico

11.8.1. Company Overview

11.8.2. Financial Performance

11.8.3. Product Benchmarking

11.8.4. Recent Development

11.9. Raytheon Company

11.9.1. Company Overview

11.9.2. Financial Performance

11.9.3. Product Benchmarking

11.9.4. Recent Development

11.10. Sonardyne

11.10.1. Company Overview

11.10.2. Financial Performance

11.10.3. Product Benchmarking

11.10.4. Recent Development

11.11. Teledyne Technologies Inc.

11.11.1. Company Overview

11.11.2. Financial Performance

11.11.3. Product Benchmarking

11.11.4. Recent Development

11.12. Thales Group

11.12.1. Company Overview

11.12.2. Financial Performance

11.12.3. Product Benchmarking

11.12.4. Recent Development

11.13. Ultra Electronics

11.13.1. Company Overview

11.13.2. Financial Performance

11.13.3. Product Benchmarking

11.13.4. Recent Development

For more information about this report visit https://www.researchandmarkets.com/r/72um1a

Attachment

CONTACT: CONTACT: ResearchAndMarkets.com Laura Wood, Senior Press Manager press@researchandmarkets.com For E.S.T Office Hours Call 1-917-300-0470 For U.S./CAN Toll Free Call 1-800-526-8630 For GMT Office Hours Call +353-1-416-8900

Yahoo Finance

Yahoo Finance