Should You Be Worried About Insider Transactions At J D Wetherspoon plc (LON:JDW)?

We've lost count of how many times insiders have accumulated shares in a company that goes on to improve markedly. The flip side of that is that there are more than a few examples of insiders dumping stock prior to a period of weak performance. So we'll take a look at whether insiders have been buying or selling shares in J D Wetherspoon plc (LON:JDW).

What Is Insider Buying?

It is perfectly legal for company insiders, including board members, to buy and sell stock in a company. However, most countries require that the company discloses such transactions to the market.

Insider transactions are not the most important thing when it comes to long-term investing. But equally, we would consider it foolish to ignore insider transactions altogether. As Peter Lynch said, 'insiders might sell their shares for any number of reasons, but they buy them for only one: they think the price will rise.'

See our latest analysis for J D Wetherspoon

The Last 12 Months Of Insider Transactions At J D Wetherspoon

In the last twelve months, the biggest single sale by an insider was when the CEO, Director & Member of Management Board, John Hutson, sold UK£67k worth of shares at a price of UK£13.33 per share. So we know that an insider sold shares at around the present share price of UK£13.23. While we don't usually like to see insider selling, it's more concerning if the sales take price at a lower price. We note that this sale took place at around the current price, so it isn't a major concern, though it's hardly a good sign.

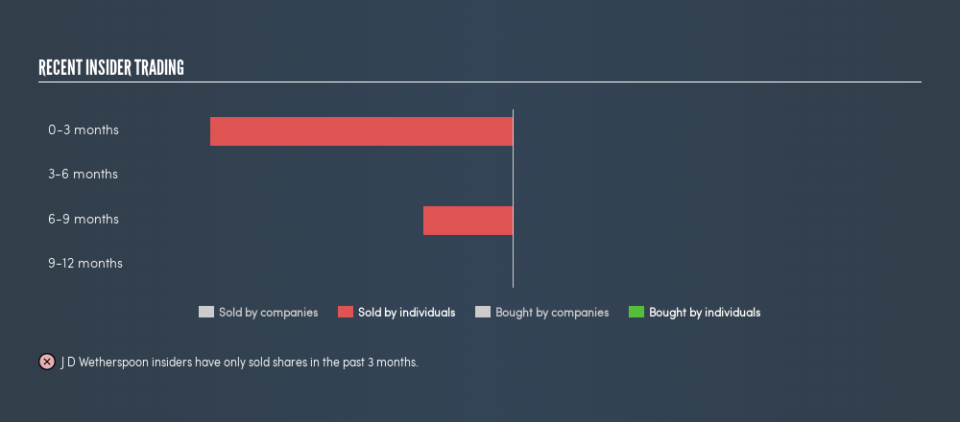

In the last twelve months insiders netted UK£198k for 15061 shares sold. J D Wetherspoon insiders didn't buy any shares over the last year. You can see a visual depiction of insider transactions (by individuals) over the last 12 months, below. If you want to know exactly who sold, for how much, and when, simply click on the graph below!

If you are like me, then you will not want to miss this free list of growing companies that insiders are buying.

Insiders at J D Wetherspoon Have Sold Stock Recently

Over the last three months, we've seen significant insider selling at J D Wetherspoon. In total, insiders sold UK£153k worth of shares in that time, and we didn't record any purchases whatsoever. This may suggest that some insiders think that the shares are not cheap.

Insider Ownership of J D Wetherspoon

For a common shareholder, it is worth checking how many shares are held by company insiders. Usually, the higher the insider ownership, the more likely it is that insiders will be incentivised to build the company for the long term. It's great to see that J D Wetherspoon insiders own 32% of the company, worth about UK£439m. I like to see this level of insider ownership, because it increases the chances that management are thinking about the best interests of shareholders.

So What Does This Data Suggest About J D Wetherspoon Insiders?

Insiders sold J D Wetherspoon shares recently, but they didn't buy any. And even if we look to the last year, we didn't see any purchases. It is good to see high insider ownership, but the insider selling leaves us cautious. If you are like me, you may want to think about whether this company will grow or shrink. Luckily, you can check this free report showing analyst forecasts for its future.

But note: J D Wetherspoon may not be the best stock to buy. So take a peek at this free list of interesting companies with high ROE and low debt.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.

Yahoo Finance

Yahoo Finance