Is it worth going to university anymore?

Going to university is often seen as the path to future success but with the prospect of a five-figure debt and no guarantee of a decent job at the end of it, many people are now wondering if it’s worth getting a degree at all.

In 2016/17, there were 1.87 million British students studying at higher education institutions. And, according to the Institute of Fiscal Studies (IFS), they will leave with a debt of around £50,000 ($63,646) each, with students from the poorest backgrounds ending up with debts of £57,000 (including interest) from a three-year degree. In fact, the IFS puts the total outstanding UK debt at £100.5bn.

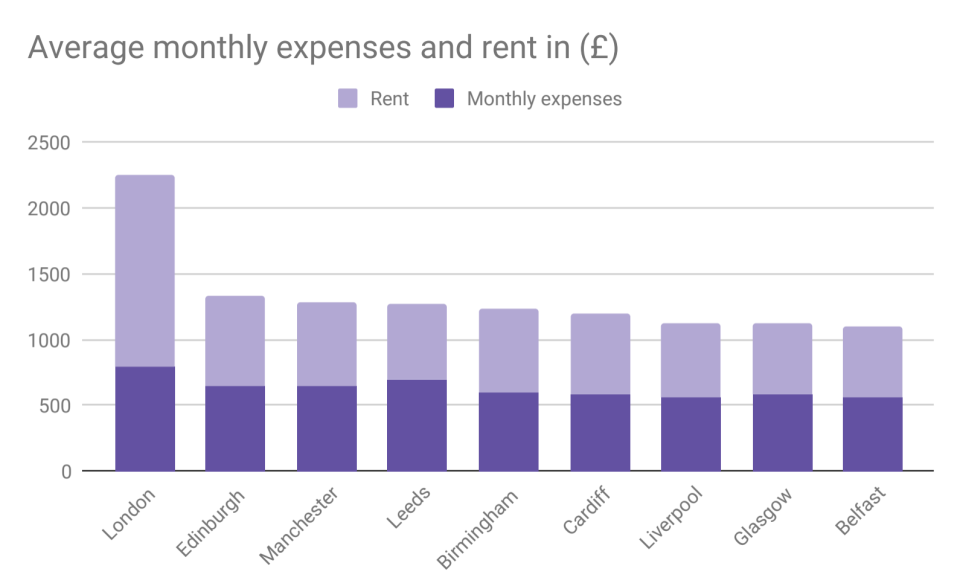

For many students, the actual cost of a degree is unsustainable and there are many hidden costs that people don’t think about such as the day-to-day spending.

Amelia Miller, 23, who graduated from the University of Nottingham in 2017 with a degree in German and Spanish said: “I have a huge debt and I don’t know how I’m going to pay it off. Universities have to be more truthful about the fact that you may have to wait a while until you get your first job. Everyone told me I’ll be alright because I have a degree and I believed them.”

Not all degrees are equal

The value of a degree varies wildly — depending on where you go and what you study.

Overall, the most profitable degrees are generally ones from Oxford, Cambridge, London-based institutions, or those from the Russell Group which is a self-selected association of 24 public research universities.

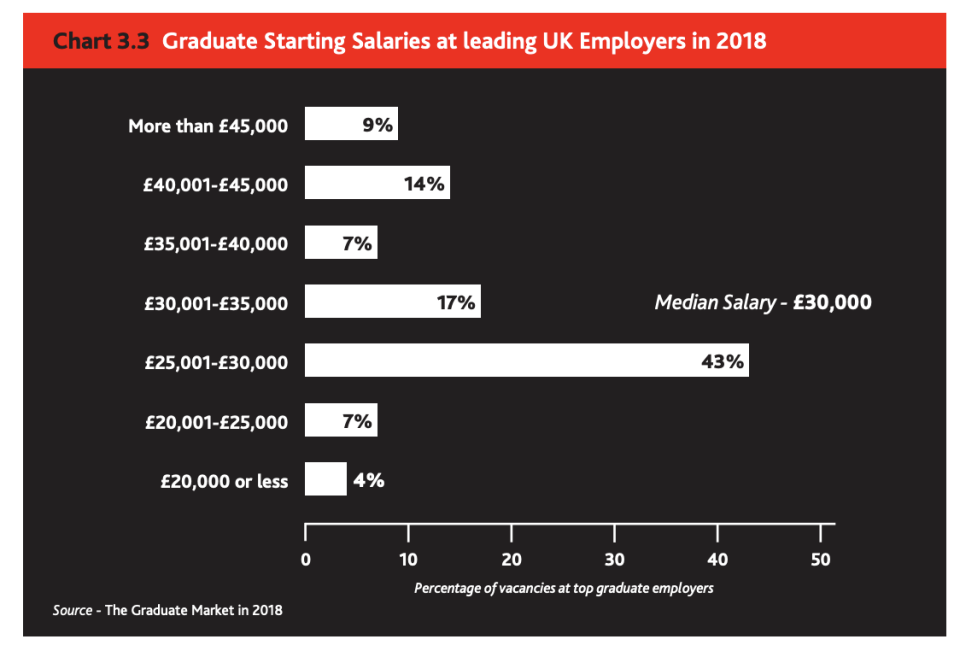

Unsurprisingly, the STEM (science, technology, engineering and mathematics) subjects seem to deliver the greatest return on investment. The top five individual courses — Medicine and Dentistry, Veterinary Science, Economics, Engineering and Technology, and Mathematical Sciences — all garnered an average of £40,000 for a starting salary after someone graduates.

To put this into perspective, the average salary in the UK is £27,600, according to the Annual Survey of Hours and Earnings (ASHE). Meanwhile, a report from an independent research agency High Fliers Fliers said average graduate starting salaries were around £30,000.

Some even have a starting salary that blows the average wage in Britain out of the water:

Not everyone can or wants to be a doctor, engineer, accountant or a coder. But studying humanities subjects, such as literature, languages, and history, does not always give a clear career path and this can lead to job that is low-paid, not in the area the person would necessarily choose, or one with few transferrable office skills.

Miller currently works at a financial consultancy firm as an associate consultant, but despite working with clients like Deutsche Bank she says she has no opportunity to use the languages she studied at university.

“I never had a clear idea of what I wanted to do even after university. To be honest I am not completely content with my current job and only took it out of desperation,” she told Yahoo Finance UK.

“I’ve only been working here for two and a half months and already I’m quite bored and fed up. Though the people are nice, there is no flexibility and it’s all admin. It pays me well, around £24,000, but it’s getting me down. I also think universities should do some practical classes, because I had no idea how to use Excel until I started this job.”

So what is the alternative?

Degrees are of course essential for certain fields but shouldn’t be the be all and end all of the start of a career. In fact, over the years, companies — ranging from small businesses to large global firms — have been working on ways to encourage people to look beyond the university lecture room and take up apprenticeships.

Apprenticeships allow people to combine working with studying to gather skills and knowledge in a specific job.

Advertising and media services giant Publicis Media UK is one of the many big firms investing in apprenticeships for young workers. It started with a small group of apprenticeships in 2017, which rose to 19 positions in 2018. In 2019, the group is expecting to take on 44 in total.

“We are constantly expanding,” said Sue Frogley, CEO of media services group Publicis Media UK to Yahoo Finance UK. “We bring in people regardless of their social, economic background, we take in absolutely everyone.

“I am constantly impressed with how much the apprentices grow. Just the other week there was a 20-year-old who was speaking in front of the board of directors. I’m sure he was incredibly nervous but he got a huge round of applause at the end.”

“Although the apprentices are paid a little less when they first start, by the time they are the same age as graduates, they are paid the same. Plus they have extra years of practical experience and don’t have a student debt, of which the current amounts are unbelievable.”

However, she did highlight that apprenticeships are a “big investment” on behalf of the company and can take up a lot of management time. “You have to take care of them and for some companies this may take up too many resources,” she added.

“As the apprentices we take on are 18 years old, obviously there are maturity differences between them and the graduates and they are less confident in public speaking, but we help them with communication. The scheme runs for two years, they are paid during it and at the end they have a job immediately afterwards.”

It is for this reason the UK government has been listening to the corporate world and have been finding ways to support businesses taking on apprentices. In 2017 the government launched an apprenticeship levy to fulfil their promise of three million apprentices by 2020. They introduced incentives for companies who provide apprenticeships, helping fund some of the training costs and unveiled a new range measures to help boost these roles in 2018.

The long-term benefits of an apprenticeship

Apprenticeships have grown beyond manual labour-related roles, such as carpentry and car mechanics.

Now, a huge number of corporations have lucrative apprenticeships schemes in the world of finance, technology, and pharmaceuticals that pay up to £25,000 while learning on the job. This is especially lucrative since this is near the average UK wage without the incurrence of university debt.

Alongside major groups like National Grid (NG.L), GlaxoSmithKline (GSK.L), and Unilever (ULVR.L), one of the world’s largest professional groups Deloitte also has a higher apprenticeship programme called BrightStart.

Kirstie Wilkins, 21, was on the Deloitte BrightStart five-year apprenticeship scheme but managed to finish it in three years. She is now working full-time as a consultant.

“It was incredibly hard work and not everyone is ready for that commitment at 18, but if you’re up for a challenge and getting a head start to your career, I can’t recommend it enough. I had training and learned skills directly related to my work,” she told Yahoo Finance UK.

“Looking back I would say don’t always follow the status quo. If you’re not 100% committed to a uni degree, keep your options open. Don’t let the word ‘apprenticeship’ put you off.”

Mark Di-Toro, a careers expert from Glassdoor, echoed her sentiment that whether you choose university or an apprenticeship, hard work and dedication are the same.

“Whether you’re involved in an apprenticeship programme or a recent university graduate, prospective employers will be looking for similar traits when hiring. Young job seekers should always display a passion for the company and its mission, the potential to grow as individuals and a keen willingness to learn,” he said to Yahoo Finance UK.

“One of the key benefits of hiring both graduates and apprentices should be the fact that they are prepared to adapt for the employer. They will be open to new opportunities and be happy to help other teams in as many ways as possible. As it quite often is their first job, employers have a blank canvas in which to build on. Grads and apprentices alike are far more mouldable than experienced employees, who, at times, aren’t as willing to adapt.”

But Wilkins highlighted also how there is still more that needs to be done, in order to grow awareness around apprenticeships to remove the stigma.

“I went to an all girls’ state school in Surrey, and apprenticeships were not something that was discussed. Out of 120 girls, only three didn’t go to university,” she said. “There is so much stigma attached to the word ‘apprentice’ because the images of manual and low-skilled labour come to mind. But that is not true.”

To listen to Yahoo Finance UK’s latest podcast on work and management, download it on Apple Podcasts, ACast, or Google podcasts to listen while on the go.

Yahoo Finance

Yahoo Finance