WSFS Financial Corp Reports Q1 2024 Earnings: Slight EPS Beat with Robust Loan Growth

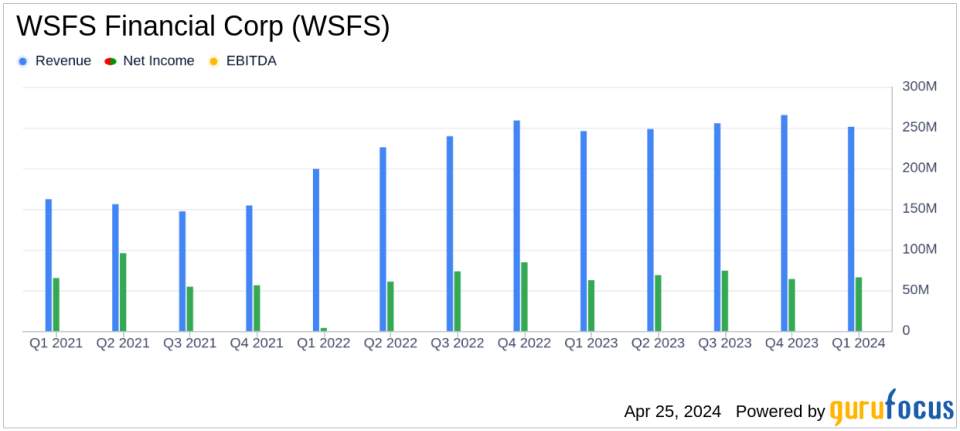

Earnings Per Share (EPS): Reported at $1.09, surpassing the estimated $1.07.

Net Income: Achieved $65.8 million, exceeding estimates of $64.55 million.

Revenue: Total net revenue reached $251.1 million, surpassing the estimated $171.99 million.

Annualized Loan Growth: Reported at 7%, reflecting a robust balance sheet and diverse business model.

Net Interest Income: Recorded at $175.3 million, showing a slight decrease from the previous quarter's $178.1 million.

Provision for Credit Losses: Lowered to $15.1 million from $24.8 million in the previous quarter, indicating improved credit quality.

Return on Average Assets (ROA): Stood at 1.28%, slightly up from 1.25% in the previous quarter.

On April 25, 2024, WSFS Financial Corp (NASDAQ:WSFS) announced its financial results for the first quarter of 2024, revealing a modest surpassing of analyst expectations for earnings per share while demonstrating significant strength in its loan portfolio. The detailed earnings report is available in their recent 8-K filing.

Company Overview

WSFS Financial Corp operates primarily through its subsidiary, WSFS Bank, offering a range of financial products and services. These include commercial lending, consumer banking, and wealth management. The majority of its revenue is generated from the WSFS Bank segment, which underscores the importance of its banking operations in its overall financial health.

Performance Highlights and Financial Metrics

For Q1 2024, WSFS reported a net income of $65.8 million, slightly above the estimated $64.55 million. Earnings per share (EPS) for the quarter stood at $1.09, surpassing the analyst estimate of $1.07. The company's return on average assets was 1.28%, and its net interest income was reported at $175.3 million, indicating a robust balance sheet but showing a slight decline from previous quarters.

Strategic Achievements and Operational Highlights

WSFS demonstrated solid annualized loan growth of 7%, driven by both commercial and consumer business lines. Despite a challenging operating environment, the bank has maintained stable asset quality and continued to build its allowance for credit losses, which now stands at 1.48% of total loans and leases. CEO Rodger Levenson highlighted the bank's strategic focus on strengthening the balance sheet and proactive credit risk management amidst uncertain economic conditions.

Challenges and Market Conditions

The bank faced headwinds from competitive market conditions, reflected in a net interest margin compression to 3.84%. Additionally, customer deposits saw a decrease, primarily due to a reduction in corporate trust deposits. These factors underscore the challenges WSFS faces in a fluctuating economic landscape.

Recognition and Future Outlook

WSFS was recognized as a recipient of the Gallup Exceptional Workplaces award and Forbes America's Best Banks 2024, affirming its operational excellence and strong corporate governance. Looking ahead, WSFS remains committed to its strategic initiatives aimed at fostering sustainable growth and enhancing shareholder value.

Financial Statements and Key Metrics

The balance sheet expansion with a notable increase in loan and lease balances underscores WSFS's growth trajectory. However, the decrease in total customer deposits highlights the need for a strategic review of deposit management. The efficiency ratio of 59.3% this quarter, compared to 54.0% in the same quarter last year, suggests increased operational costs, which could impact future profitability.

Conclusion

WSFS Financial Corp's first quarter results for 2024 reflect a resilient business model capable of navigating a complex economic environment. With a slight beat on EPS and a focus on strategic loan growth, WSFS is well-positioned to continue its trajectory of stable growth. Investors and stakeholders will likely watch closely how the bank manages market challenges and capitalizes on opportunities in upcoming quarters.

For more detailed information, you can access the full earnings report here.

Explore the complete 8-K earnings release (here) from WSFS Financial Corp for further details.

This article first appeared on GuruFocus.

Yahoo Finance

Yahoo Finance