WW (NASDAQ:WW) Misses Q2 Revenue Estimates

Personal wellness company WW (NASDAQ:WW) fell short of analysts' expectations in Q2 CY2024, with revenue down 10.9% year on year to $202.1 million. The company's full-year revenue guidance of $770 million at the midpoint also came in 8.7% below analysts' estimates. It made a GAAP loss of $4.09 per share, down from its profit of $0.65 per share in the same quarter last year.

Is now the time to buy WW? Find out in our full research report.

WW (WW) Q2 CY2024 Highlights:

Revenue: $202.1 million vs analyst estimates of $208.9 million (3.3% miss)

EPS: -$4.09 vs analyst estimates of $0.03 (-$4.12 miss)

The company dropped its revenue guidance for the full year from $845 million to $770 million at the midpoint, a 8.9% decrease

Gross Margin (GAAP): 67.9%, up from 63.4% in the same quarter last year

Free Cash Flow was -$1.47 million compared to -$36.51 million in the previous quarter

Members: 3.8 million at quarter end

Market Capitalization: $84.82 million

"WeightWatchers has the right strategy to return the business to growth. With a rapidly changing landscape, we are taking decisive actions to navigate through this environment and completely reimagining how we operate," said Sima Sistani, the Company’s CEO.

Formerly known as Weight Watchers, WW (NASDAQ:WW) is a wellness company offering a range of products and services promoting weight loss and healthy habits.

Specialized Consumer Services

Some consumer discretionary companies don’t fall neatly into a category because their products or services are unique. Although their offerings may be niche, these companies have often found more efficient or technology-enabled ways of doing or selling something that has existed for a while. Technology can be a double-edged sword, though, as it may lower the barriers to entry for new competitors and allow them to do serve customers better.

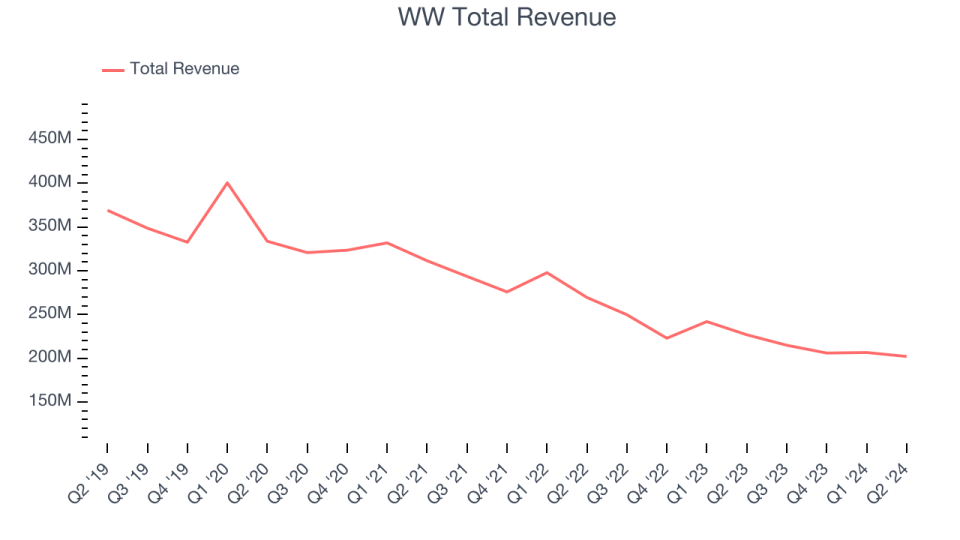

Sales Growth

A company’s long-term performance can indicate its business quality. Any business can put up a good quarter or two, but many enduring ones tend to grow for years. WW struggled to generate demand over the last five years as its sales dropped by 10.3% annually, a rough starting point for our analysis.

Long-term growth is the most important, but within consumer discretionary, product cycles are short and revenue can be hit-driven due to rapidly changing trends and consumer preferences. WW's recent history shows its demand has stayed suppressed as its revenue has declined by 14.6% annually over the last two years.

This quarter, WW missed Wall Street's estimates and reported a rather uninspiring 10.9% year-on-year revenue decline, generating $202.1 million of revenue. Looking ahead, Wall Street expects sales to grow 7% over the next 12 months, an acceleration from this quarter.

Today’s young investors likely haven’t read the timeless lessons in Gorilla Game: Picking Winners In High Technology because it was written more than 20 years ago when Microsoft and Apple were first establishing their supremacy. But if we apply the same principles, then enterprise software stocks leveraging their own generative AI capabilities may well be the Gorillas of the future. So, in that spirit, we are excited to present our Special Free Report on a profitable, fast-growing enterprise software stock that is already riding the automation wave and looking to catch the generative AI next.

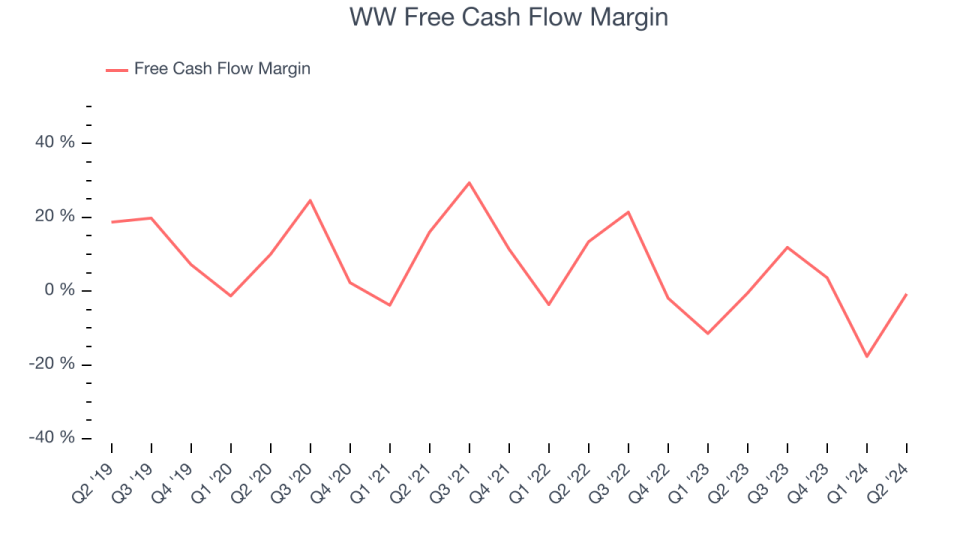

Cash Is King

Although earnings are undoubtedly valuable for assessing company performance, we believe cash is king because you can't use accounting profits to pay the bills.

WW broke even from a free cash flow perspective over the last two years, giving the company limited opportunities to return capital to shareholders.

WW broke even from a free cash flow perspective in Q2. This quarter's cash profitability was in line with the comparable period last year but below its two-year average. In a silo, this isn't a big deal because investment needs can be seasonal, but we'll be watching to see if the trend extrapolates into future quarters.

Over the next year, analysts predict WW's cash conversion will improve. Their consensus estimates imply its breakeven free cash flow margin for the last 12 months will increase to 3.6%, giving it more optionality.

Key Takeaways from WW's Q2 Results

We struggled to find many strong positives in these results. It lowered its full-year sales guidance, and its revenue and EPS fell short of Wall Street's estimates. Overall, this was a bad quarter for WW. The stock traded down 1.9% to $1.05 immediately after reporting.

WW may have had a tough quarter, but does that actually create an opportunity to invest right now? When making that decision, it's important to consider its valuation, business qualities, as well as what has happened in the latest quarter. We cover that in our actionable full research report which you can read here, it's free.