Wyndham Hotels (WH) Sets Foot in Barbados With New Property

Wyndham Hotels & Resorts, Inc. WH recently announced the addition of Wyndham Grand Barbados, Sam Lord's Castle Resort & Spa in Barbados. The move is in line with the company’s expansion momentum in the Caribbean, joining the likes of Wyndham Alltra Samana (in the Dominican Republic) and TRS Coral Costa Mujeres (Mexico).

Nestled on the southeastern side of the island of Barbados, the 422-room resort features ocean views and lanai-style private balconies. It also provides guests with amenities like a fitness center, dining spaces, a spa, lounge and event spaces (of 15,000 square feet) and a pool area.

Wyndham Hotels is optimistic concerning the hotel’s opening. Attributes such as refined accommodations, attentive service and relaxed surroundings are likely to aid WH in the upcoming period. The company anticipates opening the property in mid-October 2023.

Emphasis on Expansion

WH is consistently trying to expand its presence worldwide and capitalize on the demand for hotels in international markets.

During the second quarter of 2023, its development pipeline grew 1% on a sequential basis and 10% year over year. It awarded more than 175 contracts (for approximately 24,000 room additions), reflecting a rise of 6% year-over-year and 7% from 2019 levels. Wyndham Hotels reported strength in its conversion pipeline, particularly in international markets, including Europe, the Middle East and Latin America.

Moving ahead, WH anticipates the momentum in unit additions to persist for some time. Attributes of improvement in franchise retention rate and no slowdown in new construction projects are likely to aid the company in the upcoming periods. For 2023, Wyndham Hotels anticipates its net room growth to rise by 2-4% on a year-over-year basis.

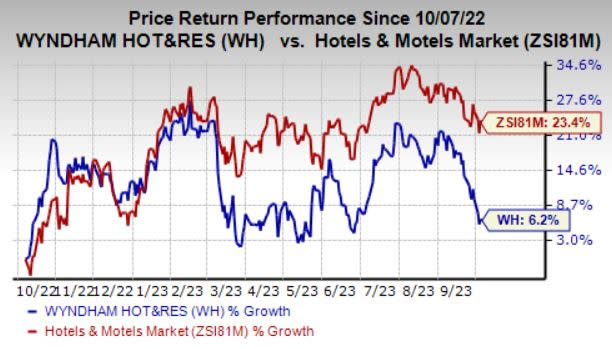

Price Performance

Image Source: Zacks Investment Research

Coming to price performance, shares of Wyndham Hotels have gained 6.2% in the past year compared with the industry’s 23.4% growth. The downside can be attributed to challenging macroeconomic factors, including inflation and instability in the banking system.

Financing conditions in certain regions have been challenging due to rising interest rates. The company is cautious in this regard, as further challenges pave a path for inability to access cash and the threat of new financing arrangements. The company intends to monitor the situation to gauge the impacts. Meanwhile, earnings estimates for 2023 have declined in the past 60 days, depicting analysts’ concern regarding the stock’s growth potential.

Zacks Rank & Key Picks

Wyndham Hotels currently carries a Zacks Rank #3 (Hold).

Some better-ranked stocks in the Zacks Consumer Discretionary sector include:

Live Nation Entertainment, Inc. LYV sports a Zacks Rank #1 (Strong Buy). The company has a trailing four-quarter earnings surprise of 34.6% on average. Shares of LYV have increased by 6.7% in the past year. You can see the complete list of today’s Zacks #1 Rank stocks here.

The Zacks Consensus Estimate for LYV’s 2023 sales and EPS indicates a rise of 21.3% and 57.8%, respectively, from the year-ago period’s levels.

Hilton Worldwide Holdings Inc. HLT carries a Zacks Rank #2 (Buy). HLT has a trailing four-quarter earnings surprise of 12.5% on average. Shares of the company have gained 21.5% in the past year.

The Zacks Consensus Estimate for HLT’s 2023 sales and EPS indicates a rise of 14.8% and 23.7%, respectively, from the year-ago period’s levels.

OneSpaWorld Holdings Limited OSW currently carries a Zacks Rank #2. OSW has a trailing four-quarter earnings surprise of 42.6% on average. Shares of OSW have increased by 33.6% in the past year.

The Zacks Consensus Estimate for OSW’s 2023 sales and EPS indicates a rise of 44.5% and 117.9%, respectively, from the year-ago period’s levels.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Live Nation Entertainment, Inc. (LYV) : Free Stock Analysis Report

Hilton Worldwide Holdings Inc. (HLT) : Free Stock Analysis Report

Wyndham Hotels & Resorts (WH) : Free Stock Analysis Report

OneSpaWorld Holdings Limited (OSW) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance