Wyndham (WH) Expands Turkey Presence With Dolce Debut

Wyndham Hotels & Resorts, Inc. WH unveils its first Dolce hotel in Turkiye, Dolce by Wyndham Cesme Alacati, in partnership with DRD Hotels. This strategic partnership underscores WH's dedication to enhancing hotel travel accessibility and delivering exceptional guest experiences, supporting its leadership in this key travel market.

This marks the debut of the Dolce brand in Turkiye, alongside new openings of La Quinta by Wyndham Cesme and Wyndham Datca Perili Bay, further expanding WH's Turkiye portfolio to nearly 120 hotels. WH has a development pipeline that includes more than 25 additional hotels in the country.

The move signifies a significant milestone in WH's growth strategy. As the world's largest hotel franchising company with approximately 9,200 hotels globally, WH demonstrates its commitment to expanding upscale hospitality in Turkiye's Turkish Riviera and emerging urban areas through recent openings in Cesme and Datca in partnership with DRD Hotels.

Focus on Expansion

Wyndham is focused on expanding its geographic footprint and product offerings across all segments by leveraging its diversified brand portfolio. This accretive aim of the company is backed by its disciplined capital allocation strategy, which encompasses investments in high-return businesses accompanied by strategic collaborations and buyouts.

On May 14, 2024, it entered a partnership with Decameron All Inclusive Hotels & Resorts, significantly expanding its all-inclusive offerings to more than 50 resorts globally. This includes nine new resorts in Mexico, Panama and Jamaica, enhancing WH's product portfolio and global market presence while integrating these resorts into Wyndham Rewards for member benefits.

During first-quarter 2024, the company opened more than 13,000 rooms globally, showcasing 27% year-over-year growth. As of Mar 31, 2024, WY had 876,300 rooms globally, up 4% from 844,800 rooms at the prior-year quarter end. During the quarter, the company opened 50 new hotels across the United States, including key destinations Charlotte, Raleigh, Tucson and Jacksonville. The newly-opened hotels include 11 hotel conversions under the newly-created WaterWalk Extended Stay by Wyndham brand. The company is optimistic about its new ECHO Suites brand, which will offer new extended-stay products. The brand’s opening dates are expected in 2024.

As of the first quarter, WH’s global development pipeline consisted of nearly 2,000 hotels and approximately 243,000 rooms, showcasing an 8% year-over-year increase. Among the total pipeline, about 58% of it is international.

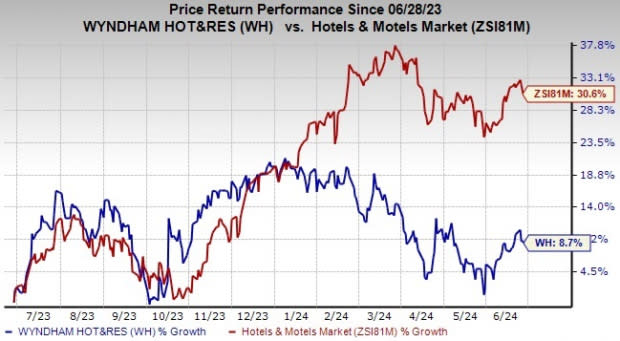

Image Source: Zacks Investment Research

Shares of this American hotel franchisor moved up 8.7% in the past year compared with the Zacks Hotels and Motels industry’s 30.6% growth. Although the stock has underperformed the industry, the ongoing expansion initiatives are likely to foster growth in the upcoming period.

Zacks Rank & Key Picks

Wyndham currently carries a Zacks Rank #3 (Hold).

Here are some better-ranked stocks from the Consumer Discretionary sector.

Royal Caribbean Cruises Ltd. RCL currently sports a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks Rank #1 stocks here.

RCL has a trailing four-quarter earnings surprise of 18.3%, on average. The stock has gained 56.4% in the past year. The Zacks Consensus Estimate for RCL’s 2024 sales and earnings per share (EPS) suggests growth of 16.8% and 64%, respectively, from year-ago levels.

PlayAGS, Inc. AGS presently sports a Zacks Rank of 1. AGS has a trailing four-quarter earnings surprise of 33.3%, on average. The stock has hiked 106.5% in the past year.

The consensus estimate for AGS’s 2024 sales and EPS implies growth of 6.5% and 3,000%, respectively, from year-ago levels.

Adtalem Global Education Inc. ATGE currently sports a Zacks Rank of 1. ATGE has a trailing four-quarter earnings surprise of 18.8%, on average. The stock has surged 96.3% in the past year.

The Zacks Consensus Estimate for ATGE’s fiscal 2025 sales and EPS indicates an increase of 5.3% and 16.6%, respectively, from year-ago levels.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Royal Caribbean Cruises Ltd. (RCL) : Free Stock Analysis Report

Adtalem Global Education Inc. (ATGE) : Free Stock Analysis Report

PlayAGS, Inc. (AGS) : Free Stock Analysis Report

Wyndham Hotels & Resorts (WH) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance