Xcel Brands (XELB) Q1 Loss Narrower Than Expected, Sales Dip Y/Y

Xcel Brands Inc. XELB delivered first-quarter 2024 results, with the bottom line faring better than the Zacks Consensus Estimate and the year-ago quarterly number. However, the year-over-year decline in revenues was a disappointment.

XELB has notably completed Project Fundamentals, which significantly reduced overhead and operating risk. This strategic step has returned to a working capital light business model. The company is now well-poised for strong growth in the core licensing business. Also, licensing revenues for the first quarter increased across all brands except for LOGO by Lori Goldstein, which resulted in flat royalties.

Considering the advancements and strategic realignment made through Project Fundamentals, management is optimistic about regaining profitability in 2024.

Xcel Brands, Inc Price, Consensus and EPS Surprise

Xcel Brands, Inc price-consensus-eps-surprise-chart | Xcel Brands, Inc Quote

Q1 Details

Xcel Brands, a media and consumer products company, posted adjusted loss of 9 cents per share in the quarter under review. The reported figure was narrower than the Zacks Consensus Estimate of a loss of 16 cents. Also, the bottom line improved significantly from adjusted loss of 18 cents reported in the year-earlier quarter.

Net sales of $2.2 million of this Zacks Rank #3 (Hold) company came in line with the consensus mark but slumped 44% from $6.1 million reported in the prior-year quarter. The decline was due to the company's strategic decision to exit all wholesale operating businesses as part of its Project Fundamentals plan.

Total direct operating costs and expenses decreased 43% year over year to $4 million. This was largely due to the termination of all wholesale and e-commerce activities in 2023, which led to staffing reductions and a decline in related overhead costs.

Adjusted EBITDA loss was $1.6 million, which came ahead of a loss of $3.2 million in the year-ago period. This improvement is largely attributed to the successful restructuring of business and the initiation of long-term license agreements for the company’s Halston, Judith Ripka, C Wonder and Longaberger brands.

Other Financial Aspects

XELB concluded the quarter with cash and cash equivalents of $1.6 million, long-term debt (less current portion) of $3.7 million and stockholders' equity of $43.9 million.

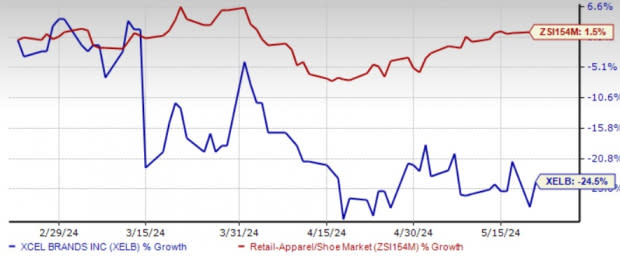

Shares of the company have declined 24.5% in the past three months against the industry’s growth of 1.5%.

Image Source: Zacks Investment Research

Outlook

Xcel Brands is set to introduce new core categories, including footwear and handbags, in the spring of 2025. Furthermore, the company anticipates announcing the launch of another celebrity designer brand on HSN before the year 2024 ends.

Management plans to collaborate with JTV to offer a broader product assortment, including Judith Ripka couture jewellery products, both on air and jtv.com. This partnership has the potential to attract over 50 million visitors to Judith Ripka e-commerce business. Looking ahead, the company foresees a strong sales momentum to continue through 2024 and 2025.

3 Picks You Can’t Miss

We have highlighted three better-ranked stocks, namely, The Gap, Inc. GPS, Abercrombie & Fitch Co. ANF and Gildan Activewear Inc. GIL.

Gap, a leading apparel retailer, currently sports a Zacks Rank #1 (Strong Buy) at present. GPS has a trailing four-quarter earnings surprise of 180.9%, on average. You can see the complete list of today’s Zacks #1 Rank stocks here.

The Zacks Consensus Estimate for GPS’ current financial-year sales and earnings suggests declines of 0.3% and 4.2%, respectively, from the year-ago reported figures.

Abercrombie & Fitch, a specialty retailer of premium, high-quality casual apparel, currently has a Zacks Rank #2 (Buy). ANF has a trailing four-quarter average earnings surprise of 715.6%.

The Zacks Consensus Estimate for Abercrombie & Fitch’s current fiscal-year sales and earnings indicates growth of 5.9% and 20.9%, respectively, from the prior-year levels.

Gildan Activewear, a distributer and manufacturer of activewear products, currently carries a Zacks Rank #2. GIL has a trailing four-quarter earnings surprise of 5.6%, on average.

The Zacks Consensus Estimate for Gildan Activewear current fiscal-year sales and earnings suggests an improvement of 2.1% and 14.4%, respectively, from the year-earlier levels.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Abercrombie & Fitch Company (ANF) : Free Stock Analysis Report

The Gap, Inc. (GPS) : Free Stock Analysis Report

Gildan Activewear, Inc. (GIL) : Free Stock Analysis Report

Xcel Brands, Inc (XELB) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance