Xcel Energy (XEL) Q2 Earnings Match Estimates, Revenues Beat

Xcel Energy Inc. XEL posted second-quarter 2022 operating earnings of 60 cents per share, on par with the Zacks Consensus Estimate. The bottom line improved by 3.4% from the year-ago earnings of 58 cents per share.

Total Revenues

Xcel Energy’s second-quarter revenues of $3,424 million beat the Zacks Consensus Estimate of $3,182 million by 7.6%. The same improved by 11.6% from the year-ago quarter’s figure of $3,068 million.

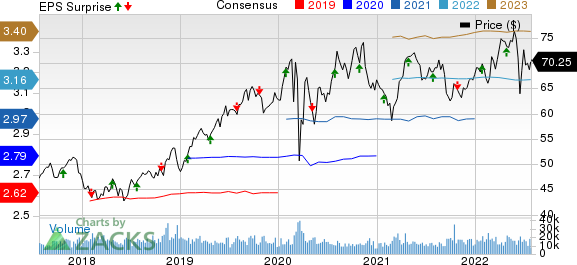

Xcel Energy Inc. Price, Consensus and EPS Surprise

Xcel Energy Inc. price-consensus-eps-surprise-chart | Xcel Energy Inc. Quote

Segmental Results

Electric: Revenues improved by 12.6% to $2,923 million from $2,597 million in the year-ago quarter.

Natural Gas: Revenues declined by 6% from the year-ago quarter’s $476 million to $449 million.

Other: Revenues in the segment increased 13.6% to $25 million from the year-ago quarter’s $22 million.

Highlights of the Release

Total operating expenses increased by 12.4% year over year to $2,955 million, primarily due to higher operating and maintenance expenses, higher electric fuel and purchased power costs along with the increased cost of natural gas sold and transported.

The operating income in the reported quarter improved by 0.6% from the prior-year quarter’s reading to $469 million.

Total interest charges and financing costs in the reported quarter rose 16.5% from the prior-year figure to $240 million.

In the second quarter, the Electric customer count increased 1% year over year, and the Natural Gas customer count increased 1.1% year over year.

Growth Prospects

Xcel Energy reaffirmed 2022 earnings per share (EPS) in the range of $3.10-$3.20. The Zacks Consensus Estimate for 2022 earnings of $3.16 per share is higher than $3.15, the midpoint of the guided range. XEL reiterated its plan to invest $26 billion during the 2022-2026 period. Out of the total, 30% of the planned expenditure will be directed toward strengthening electric distribution operations and 29% for fortifying electric transmission operations.

Zacks Rank

Xcel Energy currently carries a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Upcoming Releases

WEC Energy Group WEC is slated to report second-quarter 2022 earnings on Aug 2 before market open. The Zacks Consensus Estimate for the second-quarter EPS is pegged at 86 cents.

WEC Energy’ long-term earnings growth is currently pegged at 6.1%. The Zacks Consensus Estimate for WEC’s 2022 earnings implies year-over-year growth of 6.3%.

PNM Resources PNM is slated to report second-quarter 2022 earnings on Aug 4 before market open. The Zacks Consensus Estimate for the second-quarter EPS is pegged at 55 cents.

PNM Resources’ long-term earnings growth is currently pegged at 5%. The Zacks Consensus Estimate for PNM’s 2022 earnings implies year-over-year growth of 6.1%.

Alliant Energy Corp. LNT is slated to report second-quarter 2022 earnings on Aug 4 after market close. The Zacks Consensus Estimate for the second-quarter EPS is pegged at 58 cents.

Alliant Energy’s long-term earnings growth is currently pegged at 5.7%. The Zacks Consensus Estimate for LNT’s 2022 earnings implies year-over-year growth of 4.6%.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Xcel Energy Inc. (XEL) : Free Stock Analysis Report

WEC Energy Group, Inc. (WEC) : Free Stock Analysis Report

Alliant Energy Corporation (LNT) : Free Stock Analysis Report

PNM Resources, Inc. (PNM) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance