Xerox Holdings Corp (XRX) Faces Challenges in Q1 2024, Misses Analyst Forecasts

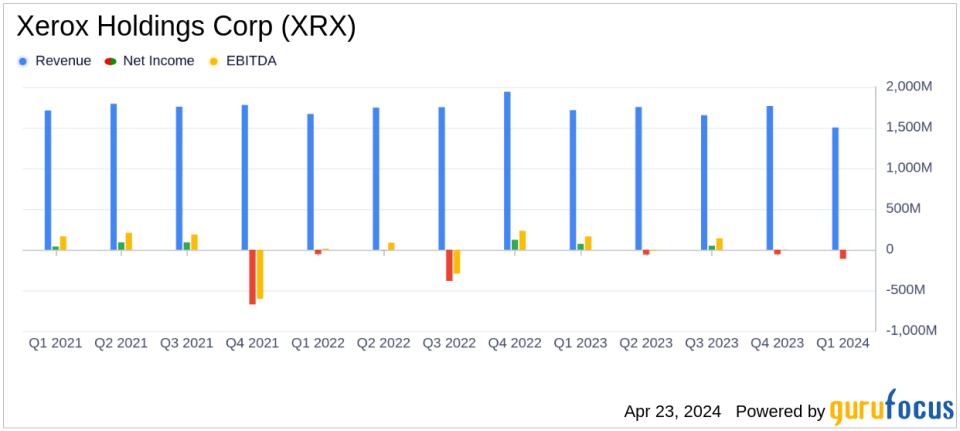

Revenue: Reported at $1.50 billion, a decrease of 12.4% year-over-year, falling short of estimates of $1.534 billion.

Net Loss: Recorded a GAAP net loss of $113 million, significantly below the estimated net income of $49.50 million.

Earnings Per Share (EPS): GAAP loss per share stood at $0.94, drastically underperforming against the estimated earnings of $0.35 per share.

Adjusted Net Income: Achieved $11 million, showing a sharp decline from the previous year and not meeting the quarterly net income estimate.

Free Cash Flow: Reported a negative $89 million, indicating a substantial decrease from the previous year.

Operating Margin: Adjusted operating margin was 2.2%, a decrease of 470 basis points from the previous year.

Guidance: Expects a revenue decline of 3% to 5% in constant currency for the full year and an adjusted operating margin of at least 7.5%.

Xerox Holdings Corp (NASDAQ:XRX) released its 8-K filing on April 23, 2024, unveiling its financial results for the first quarter of the year. The company reported a significant downturn, with revenue dropping to $1.50 billion, a 12.4% decrease from the previous year, and a stark contrast to the estimated $1.534 billion. Adjusted earnings per share also fell short of expectations at $0.06, compared to the anticipated $0.35.

Company Overview

Xerox, a renowned OEM in multifunction printers and a provider of software and services, operates primarily in one segment focusing on large enterprise markets. Approximately 60% of its revenue is generated in the U.S., with the remaining 40% coming from international operations. The company is also expanding into digital print packaging solutions and printed electronics, aiming to diversify its revenue streams and reduce dependency on traditional printing technologies.

Financial Performance Breakdown

The first quarter saw Xerox grappling with several challenges, including a $113 million GAAP net loss, a significant decline from a net income of $71 million in the previous year. This downturn reflects a decrease of $184 million or $1.37 per share year-over-year. The company's adjusted operating margin also suffered, dropping by 470 basis points to 2.2%.

Xerox's cash flow positions reflected these challenges, with operating cash flow and free cash flow registering at $(79) million and $(89) million, respectively, both showing declines from the prior year. This financial strain was attributed to comprehensive changes in the company's operating model and charges related to its Project Reinvention, which incurred $100 million in after-tax charges.

Strategic Initiatives and Market Adaptation

Despite the disappointing results, CEO Steve Bandrowczak remains optimistic about the company's restructuring strategy, which aims to align Xerox more closely with market demands and improve operational efficiency. The company's "Reinvention" plan includes exiting certain manufacturing operations and simplifying geographic presence, which are expected to streamline operations and reduce costs in the long term.

Xerox's guidance for 2024 anticipates a revenue decline of 3% to 5% in constant currency but expects improvements in adjusted operating income margin by more than 190 basis points, reflecting the potential benefits from its ongoing strategic adjustments.

Investor and Market Implications

The first quarter results and the ongoing strategic shifts underscore a period of transition for Xerox. Investors and stakeholders are likely to watch closely how these initiatives will translate into financial performance in a challenging and rapidly evolving digital and print market. The company's ability to navigate these changes while fostering growth in new business areas will be critical in determining its long-term success.

For detailed financial figures and future projections, please refer to the full 8-K filing by Xerox Holdings Corp.

Explore the complete 8-K earnings release (here) from Xerox Holdings Corp for further details.

This article first appeared on GuruFocus.

Yahoo Finance

Yahoo Finance