Yacktman Focused Fund Adjusts Portfolio, Cuts Stake in Associated British Foods PLC

Insights from the Latest N-PORT Filing Reveal Key Investment Moves

Yacktman Focused Fund (Trades, Portfolio), known for its objective and patient investment approach, has disclosed its first-quarter portfolio for 2024. The Fund, part of Yacktman Asset Management (Trades, Portfolio), is committed to long-term capital appreciation and, to a lesser extent, current income. It is characterized by its non-diversified status, investing predominantly in common stocks across various domestic and international companies, including dividend-paying firms. The Yacktman team's investment decisions are based on individual security merits rather than market predictions, blending the principles of "growth" and "value" investing. They prioritize businesses that are fundamentally sound, managed with shareholder interests in mind, and available at attractive prices.

Summary of New Buy

Yacktman Focused Fund (Trades, Portfolio) initiated a position in one new stock during the quarter:

The most significant addition was Kellanova Co (NYSE:K), purchasing 300,000 shares, which now represents 0.49% of the portfolio with a total value of $17.19 million.

Key Position Increases

The Fund also increased its stake in one existing holding:

Notably, Kenvue Inc (NYSE:KVUE) saw an addition of 216,255 shares, bringing the total to 1,000,000 shares. This represents a 27.59% increase in share count, impacting the current portfolio by 0.13%, with a total value of $21.46 million.

Summary of Sold Out

Yacktman Focused Fund (Trades, Portfolio) exited its position in one holding during the first quarter of 2024:

Weatherford International PLC (NASDAQ:WFRD) was completely sold off, with 350,000 shares liquidated, resulting in a -1% impact on the portfolio.

Key Position Reduces

The Fund reduced its positions in 12 stocks, with significant changes in:

Associated British Foods PLC (LSE:ABF) saw a reduction of 1,261,157 shares, a -46.71% decrease, impacting the portfolio by -1.12%. The stock's average trading price was 23.14 during the quarter, with a 6.23% return over the past three months and 1.65% year-to-date.

Brenntag SE (XTER:BNR) was reduced by 393,222 shares, a -39.59% decrease, impacting the portfolio by -1.06%. The stock traded at an average price of 80.93 during the quarter, with a -6.92% return over the past three months and -8.17% year-to-date.

Portfolio Overview

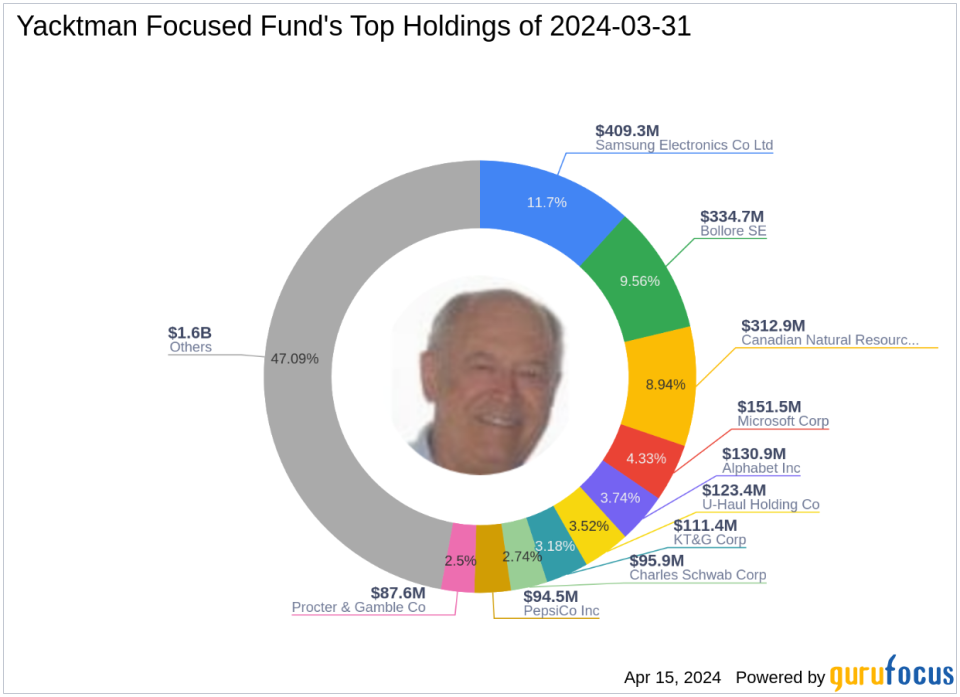

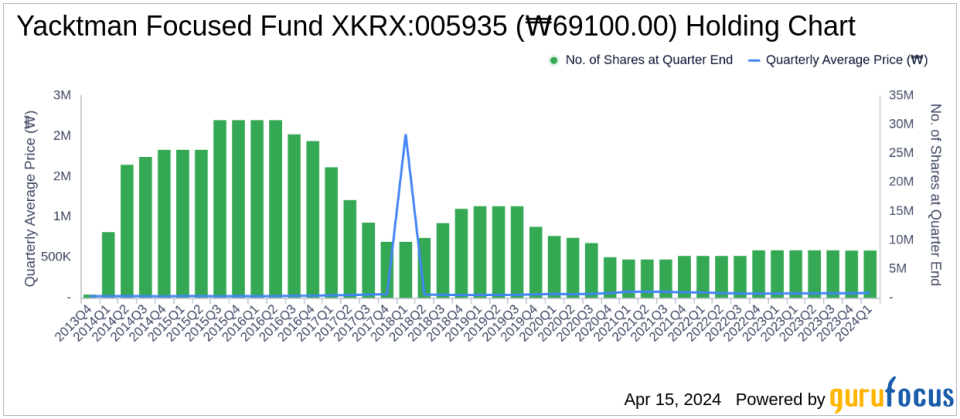

As of the first quarter of 2024, Yacktman Focused Fund (Trades, Portfolio)'s portfolio comprised 49 stocks. The top holdings included 11.7% in Samsung Electronics Co Ltd (XKRX:005935), 9.56% in Bollore SE (XPAR:BOL), 8.94% in Canadian Natural Resources Ltd (NYSE:CNQ), 4.33% in Microsoft Corp (NASDAQ:MSFT), and 3.74% in Alphabet Inc (NASDAQ:GOOG). The investments are primarily concentrated across nine industries: Communication Services, Technology, Consumer Defensive, Energy, Industrials, Consumer Cyclical, Financial Services, Basic Materials, and Healthcare.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

This article first appeared on GuruFocus.

Yahoo Finance

Yahoo Finance