Yacktman Fund Trims Financial Empire in 4th Quarter

- By James Li

Stephen Yacktman and Jason Subotky, co-managers of the Yacktman Fund (Trades, Portfolio), seek long-term capital appreciation through equity investments in growth companies that trade at cheap prices. Such companies usually have a good business, which includes high cash returns on tangible assets and relatively low capital requirements. During fourth-quarter 2016, the fund trimmed over 10 positions, including five positions in the financial sector: Bank of New York Mellon Corp. (BK), U.S. Bancorp (USB), Bank of America Corp. (BAC), Goldman Sachs Group Inc. (GS) and Wells Fargo & Co. (WFC).

Warning! GuruFocus has detected 5 Warning Sign with BK. Click here to check it out.

The intrinsic value of BK

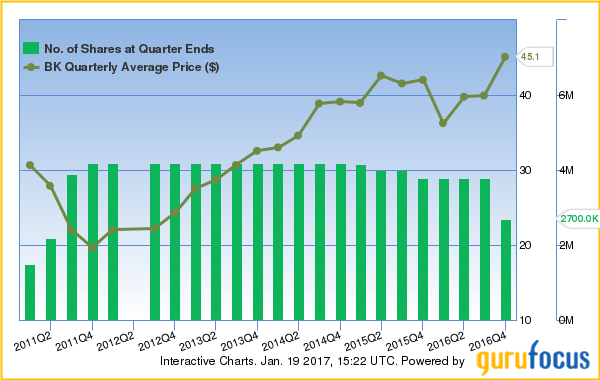

Bank of New York Mellon

The fund managers trimmed 28.95% of their position in Bank of New York Mellon, selling 1.1 million shares at an average price of $45.10.

BNY Mellon operates as two business segments: investment management and investment services. The global investment company has a satisfactory financial outlook: although the company has good cash-to-debt ratios and interest coverage, these financial metrics underperform over 60% of global asset management companies. Additionally, BNY Mellon's equity-to-asset ratio of 0.11 ranks lower than 94% of competitors, implying relatively high leverage.

Although BNY Mellon reported strong fourth-quarter 2016 earnings performance, the company's revenues and net income declined during the three-month period from October 2016 - December 2016. Fee and other revenue dropped about $200,000 while net income applicable to BNY Mellon's shareholders lost $110,000. The loss in company revenues primarily resulted from year-over-year revenue decreases in investment management and performance fees, reflecting unfavorable impacts from the stronger U.S. dollar versus the British pound.

While the company's profitability ranks 7 out of 10, BNY Mellon still has four medium warning signs, including a price near a 10-year high and increasing long-term debt. As the company has a mild debt burden and is slightly overvalued, Ken Fisher (Trades, Portfolio) also trimmed his position in BNY Mellon during fourth-quarter 2016.

U.S. Bancorp

The fund knocked off 23.81% of its stake in U.S. Bancorp, selling 1 million shares at an average price of $47.55.

Although the company has good financial strength and profitability, U.S. Bancorp has a Piotroski F-score of 3, suggesting a weak business operation. The company's cash-to-debt ratio of 0.44 implies potential financial distress.

U.S. Bancorp's fourth-quarter 2016 net income decreased 1.6% from third-quarter 2016 primarily due to a seasonal increase in noninterest expense of 2.5% and a provision for credit losses due to loan growth. The company's fourth-quarter 2016 earnings performance remained flat compared to the prior-year quarter, suggesting limited growth potential for 2017.

Like BNY Mellon, U.S. Bancorp has high valuations, including a price near a 10-year high and a price-sales ratio near a five-year high. As of Jan. 19, U.S. Bancorp's P/S ratio ranks lower than 66% of its competitors, and its price-book ratio underperforms 85% of regional U.S. banks. As the company also exhibits mild financial distress, Arnold Van Den Berg (Trades, Portfolio) eliminated U.S. Bancorp from his portfolio during fourth-quarter 2016.

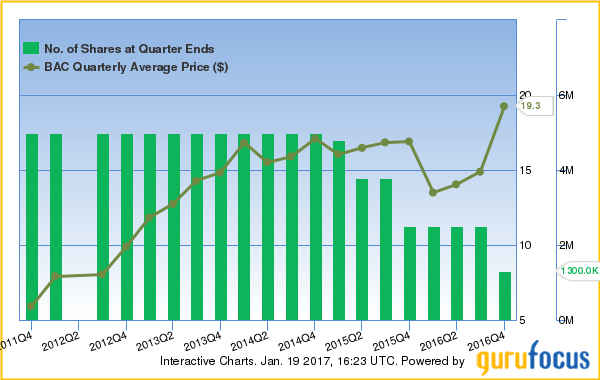

Bank of America

Yacktman and Subotky nearly halved their stake in Bank of America, selling 1.2 million of his 2.5 million-share stake at an average price of $19.26.

While Bank of America's financial strength ranks a good 6 out of 10, the company has moderate financial distress based on a cash-to-debt ratio of 0.66 and interest coverage of 2.31. The company's return on invested capital of 4.69% underperforms its WACC of 7.19%, suggesting that Bank of America will reduce value as it grows.

Although the company reported strong earnings performance during fourth-quarter 2016, Bank of America's profitability still ranks a poor 4 out of 10. The company's operating margin and return on equity underperform 60% of global banks, despite having profit margins near a 10-year high. Bank of America also has a dividend yield close to a 52-week low, and the bank's share price and P/S ratio are both near a five-year high.

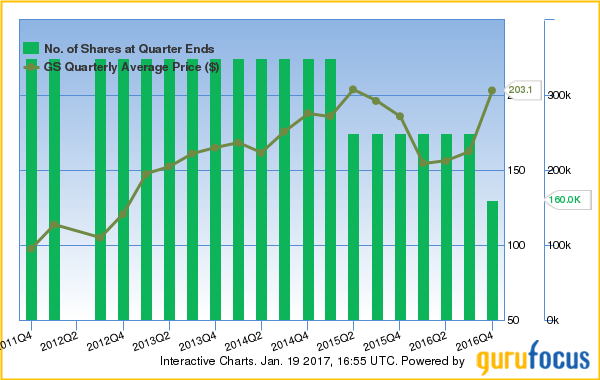

Goldman Sachs

The fund managers sold 90,000 of their 250,000-share stake in Goldman Sachs, a well-known financial exchange company based in New York. Goldman's share price averaged $203.76 during fourth-quarter 2016.

Goldman Sachs operates in four business segments: Investment Banking, Trading and Principal Investments, Asset Management and Securities Services. The financial holding company has moderately poor financial strength, with a cash-to-debt ratio of 0.39, an equity-to-asset ratio of 0.10 and interest coverage of 1.21. The above financial metrics underperform over 80% of global capital markets.

During 2016, Goldman Sachs reported net revenues of $30.61 billion and net earnings of $7.40 billion. Although the company's diluted earnings per common share increased from full-year 2015 to full-year 2016, net revenues in each of Goldman's business segments declined: Investment Banking lost 11% in sales while Institutional Client Services revenues dropped 5%. Investment Management revenues declined by 7% while Investing & Lending revenues took a 25% nosedive.

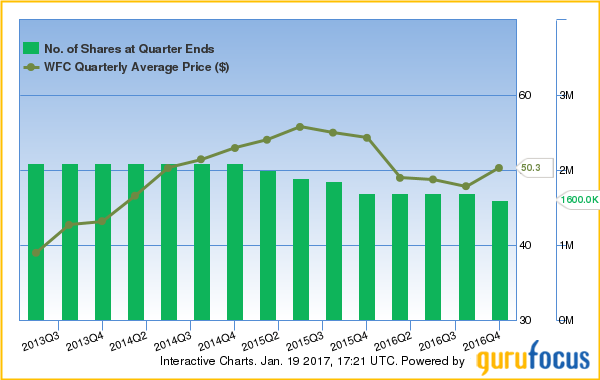

Wells Fargo

The fund sold 100,000 of its 1.7 million-share stake in Wells Fargo at an average price of $50.28.

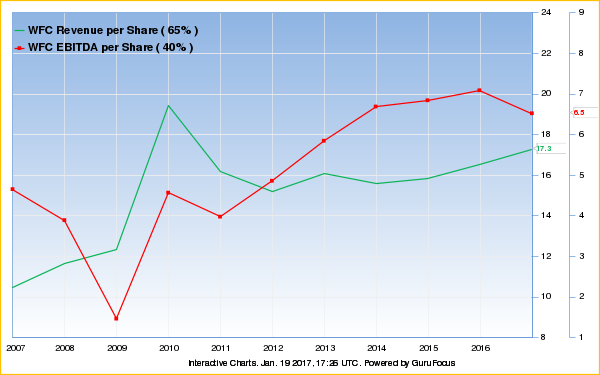

The diversified financial services company has a weak Piotroski F-score of 2, and its cash-to-debt ratio is a significantly low 0.06. The former suggests that Wells Fargo has a weak business operation while the latter implies moderate financial distress. Despite this, GuruFocus ranked Wells Fargo's business predictability 2.5 stars as of Jan. 19 based on the company's historical revenue per share and EBITDA per share trends for December 2006 - December 2016.

Although the bank has consistent per-share revenue growth, Wells Fargo's three-year revenue growth still underperforms 62% of global banks. Wells Fargo slightly missed its fourth-quarter 2016 expectations when the company lost $592 million in net hedging ineffectiveness. Additionally, the company has a three-year EBITDA growth of -0.80% and a three-year EPS growth of 0.80%, both near the industry median three-year average growth.

See also

Yacktman and Subotky also manage the Yacktman Focused Fund (Trades, Portfolio), a related fund. On a guru's stock picks page, you may see "Related:" and a list of other funds underneath "Last Update." You can click on the links to view the stock trades for the related gurus.

To view the latest guru picks, click on "Latest Guru Picks" underneath the "Gurus" tab.

Disclosure: The author has no position in the stocks mentioned.

Start a free 7-day trial of Premium Membership to GuruFocus.

This article first appeared on GuruFocus.

Warning! GuruFocus has detected 5 Warning Sign with BK. Click here to check it out.

The intrinsic value of BK

Yahoo Finance

Yahoo Finance