Yen Strength May be Challenged Short Term

But speculators may be tempted to look for weakness in the short term and buy the U.S Dollar against the Japanese currency.

Yen’s Strength Remains Intact

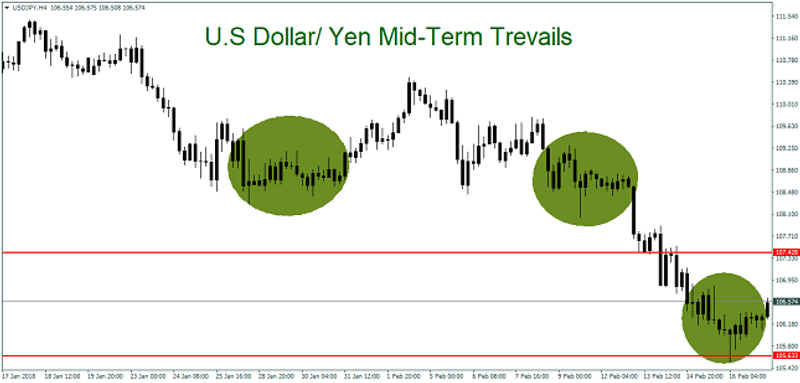

The Yen has weakened from the strongest part of its short-term range. The Japanese currency remains among the most valuable ratios versus the U.S Dollar and is near 106.50 as of this morning. Friday and early trading today have seen the U.S Dollar bought against the Yen and resistance look to be about 107.50, with support near 106.00.

The Nikkei Index gained nearly 2% today via its equities. The Yen is certainly still testing highs not seen for 15-month highs, and it may continue to do so – but short-term opportunities exist for range traders.

Range Trading Tempting for Yen

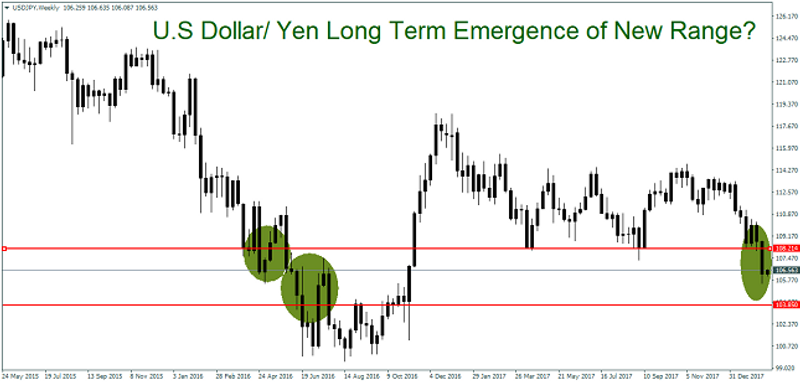

The Yen’s recent strength should be looked at closely with a long-term weekly chart, like the one provided here. The Yen could be entering a new range which it has not traversed since June of 2016 before getting stronger, and then eventually weakening after the U.S Presidential election of Donald Trump.

The Yen could be facing a change of outlook via investors who think the Bank of Japan will have to tighten monetary policy eventually. However, near-term a test of the range is likely still in the cards.

In the short term, we believe Yen may be negative. The mid-term and Long term we are unbiased.

Yaron Mazor is a senior analyst at SuperTraderTV.

SuperTraderTV Academy is a leader in investing and stock trading education. Sign up for a class today to learn proven strategies on how to trade smarter.

This article was originally posted on FX Empire

Yahoo Finance

Yahoo Finance