One in three women keep their finances separate from their partner

One in three women currently keep their finances separate from their partner and young women are increasingly opting for the practice.

According to a new report by wealth management group Netwealth, which surveyed 4,000 British women in May and June this year, those aged between 16-34 are the least likely group to share their personal financial assets (31%) with their partners, compared with 26% of those aged above 55.

While the numbers look similar, Netwealth chief executive Charlotte Ransom said in a statement that “the traditional approach to managing finances jointly is being overturned by a new generation of financially more autonomous females.”

“With women increasingly entering marriage later in life, after years of earning their own income and controlling their own finances, it’s unsurprising that many are turning their back on a ‘what’s mine is yours’ approach,” she added.

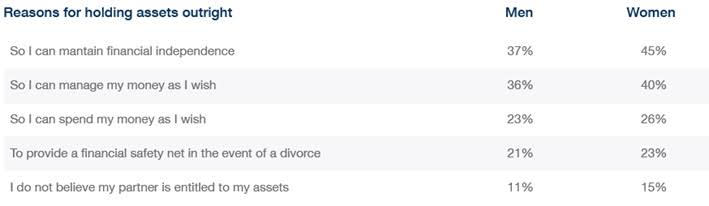

Almost half of the women surveyed said they kept their finance separate from their partners to maintain financial independence and 40% said they do it to “manage their money as they wish.” Meanwhile, only 15% of women do not believe their partner is entitled to their assets, though.

The report also showed that the wealthier women were, the more likely they would keep their money separate from their partners.

Almost one in three women earning £45,000 or more do not share their long-term savings with their partner (29%) in comparison with just 18% of those earning £45,000 or less, said the report.

“While growing levels of engagement and ownership among women is encouraging, a change in attitude alone will not enable women to catch up with the wealth of their male counterparts,” said Ransom.

“Investing is a crucial area of personal finance that is often still perceived to be a ‘man’s game’. By failing to participate, women are crucially missing out on the opportunity to grow their investments year on year to help close the wealth gap.

“The industry needs to work harder to recognise the financial power of women. Together we must develop improved services that enable female clients to retain a real sense of ownership and control over their wealth.”

Meanwhile, one of Britain’s most prominent personal finance experts warned that stripping individuals of financial independence is a warning sign of domestic abuse.

“Financial abuse is the hidden financial cousin of domestic abuse — it's all about dangerous, unfair control using finances. It can be subtle or brutal,” he said on his popular blog.

“It is defined as someone controlling another adult's access to their finances or ability to earn money, in order to reduce their independence and force reliance,” he added.

“Typical examples include someone forcing or coercing you to add them to your bank account, pressuring you to take out debt for them in your name, or emotionally blackmailing you to pay their bills (it's a subset of economic abuse, which also includes things like restriction to transport, clothes, food and other necessities).”

Contact Surviving Economic Abuse or Women's Aid for help and guidance for those directly facing domestic and financial abuse.

Yahoo Finance

Yahoo Finance