Yuan still in breach mode as US labels China 'currency manipulator'

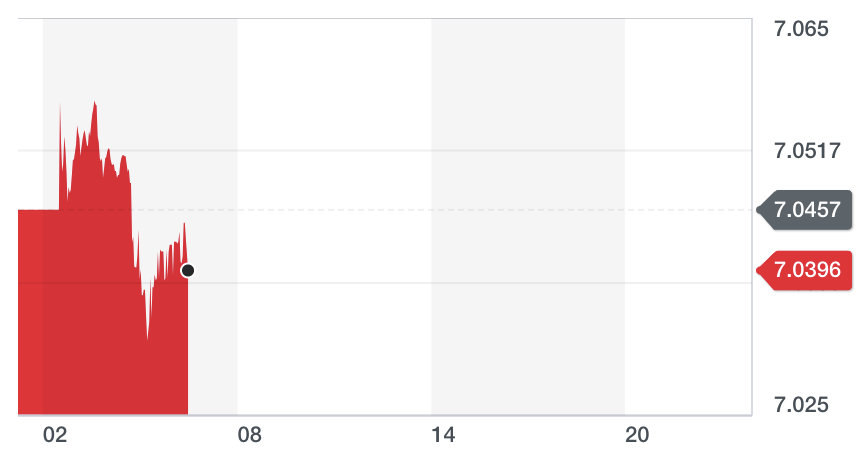

The Chinese yuan continued to stay within the breach zone of the key seven-per-dollar level against the US dollar (CNY=X) in early trading this morning after the US officially classed China as a “currency manipulator.”

After initially breaking through that key threshold for the first time since 2008 on Monday, the yuan on Tuesday continued to hover at 7.03, meaning 1 US dollar now buys more than 7 yuan.

The currency movement sent alarm bells throughout global stock markets. On Monday, the main indexes in the US recorded their worst trading day for 2019, while Asian and European markets roiled on the new development in the US-China trade war.

In early trading Tuesday, China’s Shanghai Composite (000001.SS) tumbled over over 1.5% while Japan’s Nikkei 225 (^N225) and Hong Kong’s Hang Seng Index (^HSI) all were down by just under 1%.

US president Donald Trump initially announced on Twitter that he would impose 10% tariffs on $300bn (£246bn) worth of Chinese goods, effective 1 September:

“Trade talks are continuing, and during the talks the US will start, on September 1st, putting a small additional Tariff of 10% on the remaining 300 Billion Dollars of goods and products coming from China into our Country...We look forward to continuing our positive dialogue with China on a comprehensive Trade Deal, and feel that the future between our two countries will be a very bright one!”

READ MORE: S&P 500 will plunge another 15% by the end of this year: strategist

China pledged to retaliate and on the first trading day since that threat, the yuan passed the seven-per-dollar level for the first time since 2008.

The US Treasury then classed China as a currency manipulator.

The US Treasury’s categorisation of China as a currency manipulator is defined as when "countries manipulate the rate of exchange between their currency and the United States dollar for purposes of preventing effective balance of payments adjustment or gaining unfair competitive advantage in international trade."

The designation also fulfils a campaign pledge by Trump who previously said that he’d name China a currency manipulator on his first day in office. Trump has since tweeted those comments:

Based on the historic currency manipulation by China, it is now even more obvious to everyone that Americans are not paying for the Tariffs – they are being paid for compliments of China, and the U.S. is taking in tens of Billions of Dollars! China has always....

— Donald J. Trump (@realDonaldTrump) August 5, 2019

Yahoo Finance

Yahoo Finance