Yum! Brands' (YUM) Pizza Hut Announces Latest Menu Offering

Pizza Hut, a reportable brand of Yum! Brands, Inc. YUM, announced its new take on menu offerings by introducing the Cheeseburger Melt.

The management highlights the innovation behind the Cheeseburger Melt, which combines the elements of a cheeseburger into Pizza Hut's signature crust to create a unique and irresistible dining experience.

The new Cheeseburger Melt comes with a Burger Sauce and features beef, applewood-smoked bacon, onions, mozzarella and cheddar. The folded parmesan-crusted thin crust Melt comes in an additional four varieties including Pepperoni Lover's, Buffalo Chicken, Chicken Bacon Parmesan and Meat Lover's, accompanied by respective condiments.

The pizza maker also announced the inclusion of this new menu item on its My Hut Box offer, thus offering customers a chance to choose between Melts or a two-topping Personal Pan Pizza along with a side of fries or four boneless wings, and a 20-ounce drink for a starting price of $6.99.

The company is leveraging menu innovation as a key growth strategy, alongside other initiatives aimed at catering to diverse customer preferences and driving growth. As part of its marketing approach, Pizza Hut is deploying delivery drivers at select fast-food burger chain drive-thrus, thereby offering customers the chance to scan a QR code for a free Cheeseburger Melt and PEPSI drink while supplies last.

Going forward, the company is optimistic and anticipates the new addition to drive sales in the upcoming periods.

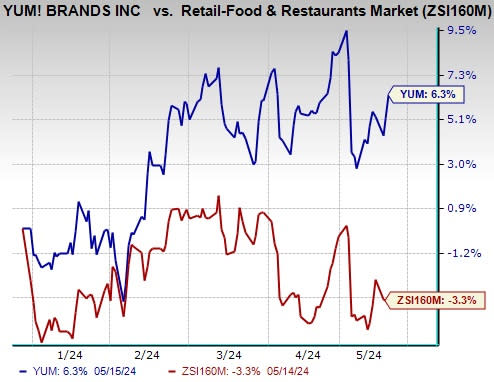

Price Performance

Shares of YUM grew 6.3% in the year-to-date period against the Zacks Retail - Restaurants industry’s 3.3% decline. The uptick in the performance of the company can be attributable to the increased digital sales and its expansion initiatives. During the first quarter of 2024, the digital mix improved 5 basis points, reaching a record of more than 50% of system sales. This was attributable to continued kiosk deployment, greater adoption of click-and-collect and stable third-party aggregator sales. Going forward, the company intends to focus on engaging in strategic investments for diversifying its menu offerings across all brands and expanding its geographic reach to foster its growth prospects.

Image Source: Zacks Investment Research

Earnings estimates for this Zacks Rank #3 (Hold) company for 2024 are pegged at $5.65 per share, indicating 9.3% growth from the year-ago period’s reported levels. The growth prospect is further solidified by a trailing four-quarter earnings surprise of 3.9%, on average.

Key Picks

Here are some better-ranked stocks from the Zacks Retail-Wholesale sector.

Wingstop Inc. WING currently sports a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks Rank #1 stocks here.

WING has a trailing four-quarter earnings surprise of 21.4%, on average. The stock has hiked 93.2% in the past year. The Zacks Consensus Estimate for WING’s 2024 sales and earnings per share (EPS) suggests growth of 27.5% and 36.7%, respectively, from the year-ago period’s levels.

The Gap, Inc. GPS presently flaunts sports a Zacks Rank of 1. GPS has a trailing four-quarter earnings surprise of 180.9%, on average. The stock has surged 192.1% in the past year.

The Zacks Consensus Estimate for GPS’ fiscal 2024 sales and EPS suggests a decline of 0.3% and 4.9%, respectively, from the year-ago period’s levels.

Brinker International, Inc. EAT currently carries a Zacks Rank #2 (Buy). EAT has a trailing four-quarter earnings surprise of 213.4%, on average. The stock has risen 65.1% in the past year.

The Zacks Consensus Estimate for EAT’s fiscal 2024 sales and EPS indicates a 5% and a 39.2% rise, respectively, from the year-ago period’s levels.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Yum! Brands, Inc. (YUM) : Free Stock Analysis Report

Brinker International, Inc. (EAT) : Free Stock Analysis Report

The Gap, Inc. (GPS) : Free Stock Analysis Report

Wingstop Inc. (WING) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance