Zentalis Stock Up as FDA Lifts Partial Hold on Cancer Drug Studies

Shares of Zentalis Pharmaceuticals ZNTL gained 13.6% on Monday after it announced that the FDA has lifted the partial clinical hold previously imposed on three studies of the company’s lead product candidate, azenosertib, for three different cancer indications. The decision was based on the regulatory body’s review of Zentalis’ complete response package, which included a comprehensive safety assessment of the azenosertib program.

Zentalis’ azenosertib, a potentially first-in-class oral WEE1 inhibitor, is currently being studied as a monotherapy and in combination with other therapies for treating different types of cancer indications, including solid tumors and ovarian cancer.

Per Zentalis, the FDA has given the green light to resume enrollment in all ongoing azenosertib clinical studies with no changes in the clinical development plan. The company is gearing up to resume study activities across the azenosertib development program at the earliest.

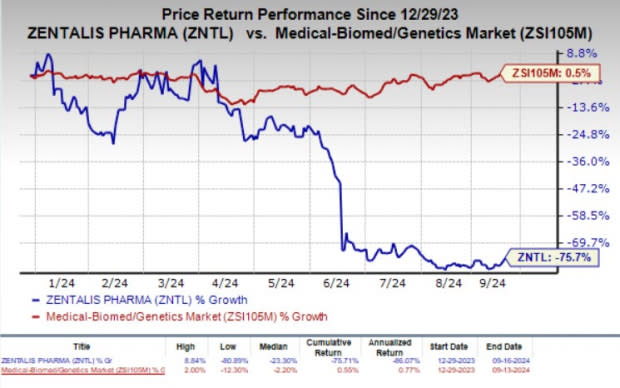

Year to date, shares of Zentalis have plunged 75.7% against the industry’s 0.5% growth.

Image Source: Zacks Investment Research

Developmental Setbacks Faced by ZNTL for Azenosertib

In June 2024, the FDA placed a partial clinical hold on the following azenosertib studies — the phase I ZN-c3-001 dose-escalation for solid tumors, the phase II ZN-c3-005 DENALI study for platinum-resistant ovarian cancer (PROC) and the phase II ZN-c3-004 TETON study for uterine serous carcinoma.

This action was taken by the regulatory body after two patients in the DENALI study died due to presumed sepsis. This resulted in a huge dip in Zentalis’ share price back then.

In its second-quarter earnings release, Zentalis announced that it has discontinued the development of the combination of its BCL-2 inhibitor, ZN-d5, with azenosertib due to unsatisfactory efficacy data. The combo therapy was evaluated in a phase I study for the treatment of relapsed or refractory acute myeloid leukemia.

ZNTL’s Future Clinical Development Plan for Azenosertib

ZNTL has already completed enrollment in cohort 1b of the DENALI study. Overall efficacy and safety data from the same is expected to be announced later in 2024. Zentalis also plans to present data from the ZN-c3-001 and the MAMMOTH studies later in the ongoing year.

The phase I/II MAMMOTH (ZN-c3-006) study is evaluating azenosertib in combination with GSK’s GSK PARP inhibitor Zejula (niraparib) and azenosertib as monotherapy for treating PROC.

The study is being conducted in partnership with GSK.

GSK’s Zejula is already approved for ovarian cancer and is currently being studied for additional ovarian cancer stages as well as non-small cell lung cancer and endometrial cancer.

Per the latest press release, Zentalis is scheduled to present azenosertib monotherapy data and provide additional updates on the azenosertib clinical development program and other data presentation timelines at an upcoming medical conference.

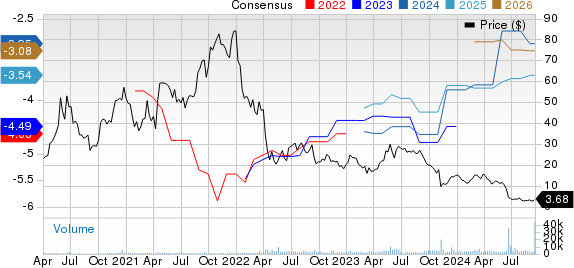

Zentalis Pharmaceuticals, Inc. Price and Consensus

Zentalis Pharmaceuticals, Inc. price-consensus-chart | Zentalis Pharmaceuticals, Inc. Quote

Zacks Rank & Stocks to Consider

Zentalis currently carries a Zacks Rank #3 (Hold).

Some better-ranked stocks in the biotech sector are Illumina, Inc. ILMN and Fulcrum Therapeutics, Inc. FULC, each sporting a Zacks Rank #1 (Strong Buy) at present. You can see the complete list of today’s Zacks #1 Rank stocks here.

In the past 60 days, estimates for Illumina’s 2024 earnings per share have moved up from $1.84 to $3.62. The consensus estimate for 2025 earnings has improved from $3.22 to $4.43. Year to date, shares of ILMN have lost 7%.

ILMN’s earnings beat estimates in each of the trailing four quarters, the average surprise being 463.46%.

In the past 60 days, estimates for Fulcrum Therapeutics’ 2024 loss per share have narrowed from $1.24 to 33 cents. The consensus estimate for 2025 loss per share has narrowed from $1.71 to $1.14. Year to date, shares of FULC have plunged 52.9%.

FULC’s earnings beat estimates in each of the trailing four quarters, the average surprise being 393.18%.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

GSK PLC Sponsored ADR (GSK) : Free Stock Analysis Report

Illumina, Inc. (ILMN) : Free Stock Analysis Report

Fulcrum Therapeutics, Inc. (FULC) : Free Stock Analysis Report

Zentalis Pharmaceuticals, Inc. (ZNTL) : Free Stock Analysis Report