Zhejiang Xiantong Rubber&PlasticLtd And Two More Growth Leaders With Significant Insider Stakes

As global markets navigate through a period of cautious optimism, with major indices showing mixed responses to economic signals and policy adjustments, investors continue to seek stable growth opportunities. In this context, companies like Zhejiang Xiantong Rubber & Plastic Ltd that boast high insider ownership can offer a compelling narrative of commitment and confidence in their future prospects.

Top 10 Growth Companies With High Insider Ownership

Name | Insider Ownership | Earnings Growth |

Medley (TSE:4480) | 34% | 28.7% |

Global Tax Free (KOSDAQ:A204620) | 18.1% | 72.4% |

Gaming Innovation Group (OB:GIG) | 26.7% | 36.9% |

KebNi (OM:KEBNI B) | 37.8% | 90.4% |

Credo Technology Group Holding (NasdaqGS:CRDO) | 14.7% | 60.9% |

Calliditas Therapeutics (OM:CALTX) | 11.6% | 52.9% |

HANA Micron (KOSDAQ:A067310) | 20% | 96.3% |

Vow (OB:VOW) | 31.8% | 97.6% |

Adocia (ENXTPA:ADOC) | 12.1% | 104.5% |

OSE Immunotherapeutics (ENXTPA:OSE) | 25.6% | 79.3% |

Let's uncover some gems from our specialized screener.

Zhejiang Xiantong Rubber&PlasticLtd

Simply Wall St Growth Rating: ★★★★★☆

Overview: Zhejiang Xiantong Rubber&Plastic Co., Ltd specializes in the R&D, design, production, and sales of automobile parts in China, with a market capitalization of approximately CN¥3.86 billion.

Operations: The company generates CN¥1.11 billion from its automotive parts segment.

Insider Ownership: 37.4%

Revenue Growth Forecast: 22.5% p.a.

Zhejiang Xiantong Rubber&PlasticLtd has demonstrated robust growth, with a 43.3% increase in earnings over the past year and forecasts indicating an annual profit rise of 28.8%. Revenue is also expected to grow significantly at 22.5% annually, outpacing the CN market's average. Despite these positives, the company's dividend sustainability is questionable as it's not well covered by cash flows. Additionally, while insider ownership suggests alignment with shareholder interests, there has been no substantial insider trading recently.

Shanghai Allist Pharmaceuticals

Simply Wall St Growth Rating: ★★★★★☆

Overview: Shanghai Allist Pharmaceuticals Co., Ltd. is a pharmaceutical company focused on the research, development, and commercialization of innovative drugs, with a market capitalization of CN¥28.90 billion.

Operations: The primary revenue segment for the company is its drug research and development, generating CN¥2.48 billion.

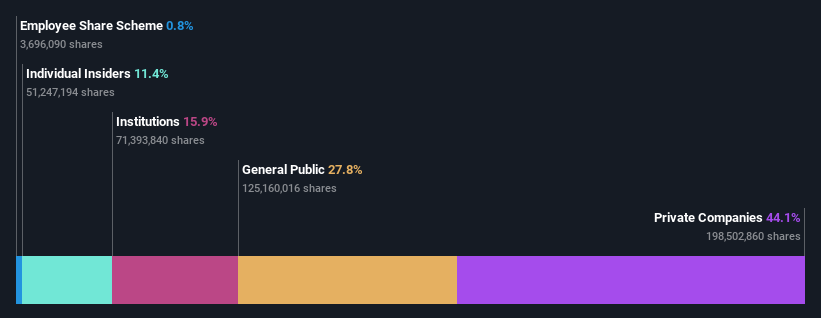

Insider Ownership: 11.4%

Revenue Growth Forecast: 20.6% p.a.

Shanghai Allist Pharmaceuticals has shown strong growth, with earnings increasing by 386.7% over the past year and projected to grow at 20.72% annually. Although this is slightly below the CN market's average growth rate of 22.2%, its revenue growth forecast at 20.6% per year exceeds the market average of 13.7%. The company's Return on Equity is expected to be high at 21.7%. Recently added as an index constituent, there has been no significant insider trading in the last three months.

Shenzhen Sunline Tech

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Shenzhen Sunline Tech Co., Ltd. specializes in providing banking software and technology services to global banking and finance clients, with a market capitalization of approximately CN¥5.02 billion.

Operations: The company generates its revenue primarily from the provision of banking software and technology services to its global finance sector clientele.

Insider Ownership: 24.9%

Revenue Growth Forecast: 16% p.a.

Shenzhen Sunline Tech has demonstrated resilience with a 28.2% earnings growth over the past year, and expectations are set for continued expansion at 33.79% annually, outpacing the broader CN market's 22.2%. Despite a recent net loss in Q1 2024, the company's annual revenue grew to CNY 1.92 billion, reflecting a steady upward trajectory. However, its Return on Equity is projected to remain low at around 10.4%, indicating potential challenges in maximizing shareholder value despite high insider ownership.

Make It Happen

Click here to access our complete index of 1453 Fast Growing Companies With High Insider Ownership.

Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Contemplating Other Strategies?

Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Companies discussed in this article include SHSE:603239 SHSE:688578 and SZSE:300348.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Yahoo Finance

Yahoo Finance