Ziff Davis (ZD) Q2 Earnings Beat Mark, Revenues Rise Y/Y

Ziff Davis ZD delivered adjusted earnings of $1.58 per share in second-quarter 2022, which beat the Zacks Consensus Estimate by 6.76% and improved 12.1% year over year.

Revenues totaled $337.4 million in the quarter, which missed the Zacks Consensus Estimate by 4.56%. The top line improved 2.2% from the year-ago quarter’s figure. Low growth in Ziff Davis’ total revenues is due to a loss in the advertising business segment.

Quarter in Detail

Advertising revenues of $189 million (56% of total revenues) declined 5% year over year. The current global supply-chain disruptions impacted Ziff Davis’ clients negatively and reduced their advertising budgets.

Net retention rate of 99.6% in the second quarter of 2022 declined from the year-ago quarter’s rate of 111.2%. Total number of advertisers improved 5.4% from the year-ago quarter’s level to 2,016 advertisers in the second quarter. Quarterly revenue per advertiser declined 9.5% year over year to $93.848 million.

Subscription revenues of $138 million (40.9% of total revenues) increased 10.4% year over year. Total number of subscribers improved 2.3% from the year-ago quarter’s number to 2,393 subscribers in the second quarter. Average quarterly revenue per subscriber improved 8.4% year over year to $57.64 million.

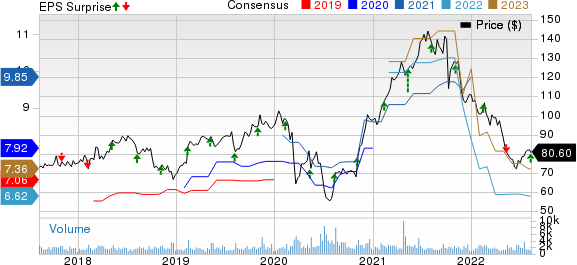

Ziff Davis, Inc. Price, Consensus and EPS Surprise

Ziff Davis, Inc. price-consensus-eps-surprise-chart | Ziff Davis, Inc. Quote

Digital Revenues of $258.4 million (76.6% of total revenues) increased 2.2% from the year-ago period’s number.

Cybersecurity and Martech revenues of $79 million (23.4% of total revenues) increased 3.7% from the year-ago period’s figure.

Adjusted non-GAAP sales and marketing, and general & administrative expenses contracted 50 bps and 90 bps each to 0.7% and 3.1%, respectively, from the corresponding year-ago quarter’s readings. Adjusted research, development & engineering expenses expanded 40 bps to 9.6% from the year-ago quarter’s number.

In the second quarter, adjusted EBITDA increased 5.3% to $118 million from the year-ago quarter’s level.

Balance Sheet and Cash Flow

As of Jun 30, 2022, cash, cash equivalents and investments were $849.3 million compared with $988.7 million as of Mar 31, 2022.

Cash flow from operations was $76 million in the second quarter compared with first-quarter 2022 cash flow of $116.5 million.

As of Jun 30, 2022, total gross debt was $1.11 billion compared with $1.13 billion as of Mar 31, 2022.

Guidance

For 2022, ZD expects total revenues of $1.41-$1435 billion. Adjusted EBITDA is expected between $507 million and $509 million.

For the full year, Ziff Davis expects adjusted EPS between $6.57 and $6.77.

Zacks Rank & Stocks to Consider

Ziff Davis currently has a Zacks Rank #4 (Sell).

ZD’s shares have returned 27.3% against the Zacks Computer and Technologysector’s decline of 23.6% in the year-to-date period.

Here are some better-ranked stocks in the broader sector.

Intuit INTU currently carries a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Intuit’s shares have slumped 28.2% in the year-to-date period compared with the Zacks Computer - Software industry’s decline of 18.6%. INTU is scheduled to report second-quarter 2022 results on Aug 23.

Keysight Technologies KEYS presently carries a Zacks Rank of 2.

KEY’s shares have dropped 21.3% in the year-to-date period compared with the Zacks Electronics - Measuring Instruments industry’s decline of 23%. KEYS is scheduled to report second-quarter 2022 results on Aug 17.

Arco Platform ARCE carries a Zacks Rank #3 (Hold) at present.

ARCE’s shares have plunged 27.5% in the year-to-date period compared with the Zacks Internet - Software industry’s decline of 46.3%. ARCE is scheduled to report second-quarter 2022 results on Aug 18.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Intuit Inc. (INTU) : Free Stock Analysis Report

Keysight Technologies Inc. (KEYS) : Free Stock Analysis Report

Arco Platform Limited (ARCE) : Free Stock Analysis Report

Ziff Davis, Inc. (ZD) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance