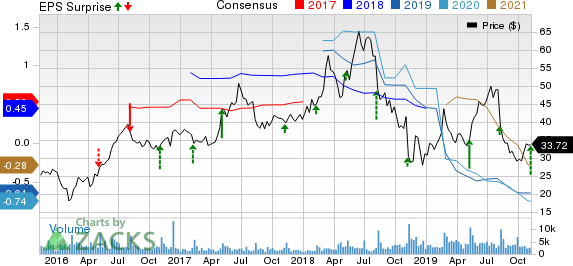

Zillow Group (ZG) Reports Q3 Loss, Beats Revenue Estimates

Guidance

Management expects fourth-quarter 2019 mortgage revenues of $17-$20 million. Homes segment revenues are anticipated to be in the range of $465-$490 million.

Total IMT segment revenues for the fourth quarter are expected to be in the range of $308-$315 million. Premier Agent revenues are anticipated in the range of $225-$229 million.

Total Adjusted EBITDA is anticipated to come in the range of ($43) to ($25) million.

The company plans to operate in around 26 markets by mid-2020. The company intends to commence operations in Los Angeles in the fourth quarter.

For 2019, management updated segmental revenue guidance for 2019. The company now anticipates Total IMT segment revenues and Premier Agent revenues in the range of $1.265-$1.272 billion (previously $1.250-$1.270 billion) and $915-$919 million (previously $900-$915 million), respectively.

Mortgage segment revenues for fiscal 2019 are now expected to be in the range of $97-$100 million (previously $90-$100 million).

Zacks Rank and Stocks to Consider

Zillow Group carries a Zacks Rank #3 (Hold).

Some better-ranked stocks in the broader technology sector worth considering are Alteryx, Inc. AYX, Instructure, Inc. INST and Fortinet, Inc. FTNT. All the three stocks flaunt a Zacks Rank #1 (Strong buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

Long-term earnings growth rate for Alteryx, Instructure and Fortinet is currently pegged at 39.85%, 30% and 14%, respectively.

Today's Best Stocks from Zacks

Would you like to see the updated picks from our best market-beating strategies? From 2017 through 2018, while the S&P 500 gained +15.8%, five of our screens returned +38.0%, +61.3%, +61.6%, +68.1%, and +98.3%.

This outperformance has not just been a recent phenomenon. From 2000 – 2018, while the S&P averaged +4.8% per year, our top strategies averaged up to +56.2% per year.

See their latest picks free >>

Click to get this free report Fortinet, Inc. (FTNT) : Free Stock Analysis Report Zillow Group, Inc. (ZG) : Free Stock Analysis Report Instructure, Inc. (INST) : Free Stock Analysis Report Alteryx, Inc. (AYX) : Free Stock Analysis Report To read this article on Zacks.com click here. Zacks Investment Research

Yahoo Finance

Yahoo Finance