Zimmer Biomet (ZBH) Q3 Earnings Beat, Gross Margin Contracts

Zimmer Biomet Holdings, Inc. ZBH posted third-quarter 2020 adjusted earnings per share (EPS) of $1.81, beating the Zacks Consensus Estimate by 72.4%. The figure increased 2.3% year over year.

The quarter’s adjustments include certain amortization, restructuring, acquisition, integration and relatedcosts among others.

On a reported basis, the company registered earnings of $1.16 per share compared with the year-ago earnings of $2.08 per share.

Revenue Details

Third-quarter net sales of $1.93 billion improved 2% (up 1.1% at constant exchange rate or CER) year over year. The figure also exceeded the Zacks Consensus Estimate by 12.5%. The company noted that there was stronger-than-expected recovery of elective procedures in the third quarter. However, the pace of procedure volume and patient returns slowed toward the end of the quarter with overall performance still negatively impacted by the pandemic.

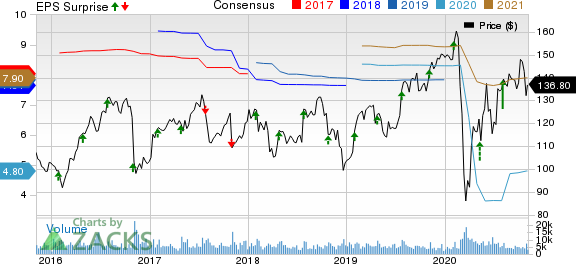

Zimmer Biomet Holdings, Inc. Price, Consensus and EPS Surprise

Zimmer Biomet Holdings, Inc. price-consensus-eps-surprise-chart | Zimmer Biomet Holdings, Inc. Quote

During the third quarter, sales generated in the Americas totaled $1.22 billion (up 3.3% year over year at CER) while the same in EMEA (Europe, the Middle East and Africa) grossed $366.2 million (down 5.7% year over year at CER). Asia-Pacific registered 0.7% rise at CER to $346.6 million.

Segments

Sales in the Knees unit declined 1.4% year over year at CER to $648.7 million. Hips recorded a 4.4% rise at CER to $484.1 million. Revenues in the S.E.T. (Sports Medicine, Extremities and Trauma) unit increased 2.5% year over year to $359.9 million.

Among other segments, Dental, Spine & CMFT (Craniomaxillofacial and Thoracic) rose 6.5% at CER to $295.5 million. Other revenues were down 11.1% to $141.1 million.

Margins

Gross margin, after excluding intangible asset amortization, came in at 70.5%, reflecting a contraction of 121 basis points (bps) in the third quarter. Selling, general and administrative expenses declined 4.4% to $790 million. Research and development expenses declined 24.9% to $85.9 million. Adjusted operating margin expanded 311 bps to 25.1% during the quarter.

Cash Position

Zimmer Biomet exited the third quarter with cash and cash equivalents of $967.3 million compared with $713.4 million at second-quarter end. Long-term debt at the end of the quarter totaled $7.84 billion, reflecting a decline from $8.21 billion at the end of the second quarter.

Cumulative net cash provided by operating activities at the end of the third quarter was $779.4 million compared with $1.16 billion in the year-ago period.

2020 Guidance

According to Zimmer Biomet, although it has seen encouraging recovery in elective procedures in the third quarter, there continues to be uncertainty around the scope and duration of COVID-19 and its ongoing impact.Accordingly, it did not provide any guidance for the fourth quarter.

Our Take

Zimmer Biomet ended the third quarter on a better-than-expected note with improving sales performances across most of its operating segments and geographies. Stronger recovery was seen in the Americas and Asia Pacific while there was a slower return in regions within Europe, the Middle East and Africa (EMEA). However, the pace of procedure volume and patient returns slowed toward the end of the quarter.

Zacks Rank and Key Picks

Zimmer Biomet currently carries a Zacks Rank #3 (Hold).

Some better-ranked stocks in the broader medical space are West Pharmaceutical Services WST, Thermo Fisher Scientific TMO and Align Technology ALGN.

West Pharmaceutical reported third-quarter 2020 adjusted EPS of $1.15, beating the Zacks Consensus Estimate by 13.9%. Net revenues of $548 million outpaced the consensus estimate by 7.2%. It currently carries a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Thermo Fisher, a Zacks Rank #2 company, reported third-quarter 2020 adjusted EPS of $5.63, beating the Zacks Consensus Estimate by 28.8%. Revenues of $8.52 billion outpaced the consensus mark by 10%.

Align Technology reported third-quarter 2020 adjusted EPS of $2.25, surpassing the Zacks Consensus Estimate by a stupendous 281.4%. Net revenues of $734.1 million exceeded the Zacks Consensus Estimate by 38%. It currently carries a Zacks Rank #2.

5 Stocks Set to Double

Each was hand-picked by a Zacks expert as the #1 favorite stock to gain +100% or more in 2020. Each comes from a different sector and has unique qualities and catalysts that could fuel exceptional growth.

Most of the stocks in this report are flying under Wall Street radar, which provides a great opportunity to get in on the ground floor.

Today, See These 5 Potential Home Runs >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Align Technology, Inc. (ALGN) : Free Stock Analysis Report

Thermo Fisher Scientific Inc. (TMO) : Free Stock Analysis Report

West Pharmaceutical Services, Inc. (WST) : Free Stock Analysis Report

Zimmer Biomet Holdings, Inc. (ZBH) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance