Zinc Media Group plc's (LON:ZIN) Shares Not Telling The Full Story

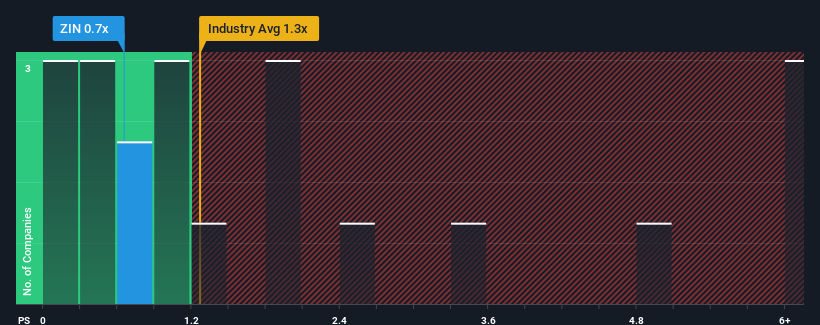

When close to half the companies operating in the Entertainment industry in the United Kingdom have price-to-sales ratios (or "P/S") above 1.3x, you may consider Zinc Media Group plc (LON:ZIN) as an attractive investment with its 0.7x P/S ratio. However, the P/S might be low for a reason and it requires further investigation to determine if it's justified.

View our latest analysis for Zinc Media Group

How Has Zinc Media Group Performed Recently?

Zinc Media Group certainly has been doing a good job lately as it's been growing revenue more than most other companies. Perhaps the market is expecting future revenue performance to dive, which has kept the P/S suppressed. If the company manages to stay the course, then investors should be rewarded with a share price that matches its revenue figures.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on Zinc Media Group.

How Is Zinc Media Group's Revenue Growth Trending?

In order to justify its P/S ratio, Zinc Media Group would need to produce sluggish growth that's trailing the industry.

Taking a look back first, we see that the company grew revenue by an impressive 72% last year. However, the latest three year period hasn't been as great in aggregate as it didn't manage to provide any growth at all. Accordingly, shareholders probably wouldn't have been overly satisfied with the unstable medium-term growth rates.

Shifting to the future, estimates from the one analyst covering the company suggest revenue should grow by 19% over the next year. Meanwhile, the rest of the industry is forecast to only expand by 0.9%, which is noticeably less attractive.

In light of this, it's peculiar that Zinc Media Group's P/S sits below the majority of other companies. Apparently some shareholders are doubtful of the forecasts and have been accepting significantly lower selling prices.

The Key Takeaway

Using the price-to-sales ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

Zinc Media Group's analyst forecasts revealed that its superior revenue outlook isn't contributing to its P/S anywhere near as much as we would have predicted. The reason for this depressed P/S could potentially be found in the risks the market is pricing in. At least price risks look to be very low, but investors seem to think future revenues could see a lot of volatility.

Don't forget that there may be other risks. For instance, we've identified 5 warning signs for Zinc Media Group (1 can't be ignored) you should be aware of.

It's important to make sure you look for a great company, not just the first idea you come across. So if growing profitability aligns with your idea of a great company, take a peek at this free list of interesting companies with strong recent earnings growth (and a low P/E).

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Join A Paid User Research Session

You’ll receive a US$30 Amazon Gift card for 1 hour of your time while helping us build better investing tools for the individual investors like yourself. Sign up here

Yahoo Finance

Yahoo Finance