Zoetis (ZTS) to Report Q1 Earnings: What's in the Cards?

Zoetis, Inc. ZTS is slated to report its first-quarter 2024 results on May 2, before market open.

Zoetis has an encouraging surprise history so far. The bottom line surpassed estimates in three of the trailing four quarters and missed on the other occasion, delivering an average surprise of 0.99%.

Let's see how things might have shaped up in the to-be-reported quarter.

Factors to Consider

The veterinary drugmaker derives most of its revenues from a diversified product portfolio of medicines and vaccines used to treat and protect livestock and companion animals. Zoetis’ remaining revenues are derived from its non-pharmaceutical product categories, such as nutritional and agribusiness, and products and services in biodevices, genetic tests and precision animal health.

The company reports business results under two geographical operating segments — the United States and International.

First-quarter revenues in the United States segment are likely to have increased from the year-ago quarter, primarily driven by the rising sales of Zoetis’ companion animal products and livestock products. The Zacks Consensus Estimate for this segment is pegged at $1.12 billion, while our model estimate is pinned at $1.15 billion.

Revenues from the International segment are likely to have increased in the to-be-reported quarter due to higher companion animal and livestock product sales as well. The Zacks Consensus Estimate and our model estimate for total revenues generated from this segment are pinned at $1.01 billion and $0.99 billion, respectively.

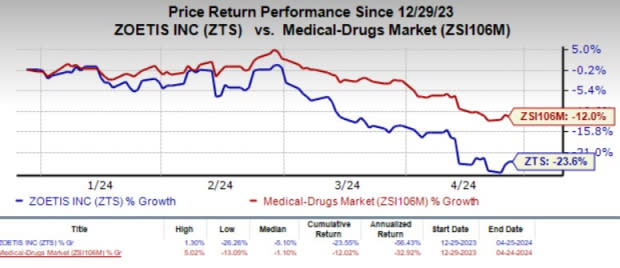

Year to date, shares of Zoetis have plunged 23.6% compared with the industry’s 12% decline.

Image Source: Zacks Investment Research

Companion animal products sales, particularly its monoclonal antibody products for osteoarthritis pain (Librela for dogs and Solensiafor cats), along with its flea, tick and heartworm combination product for dogs, Simparica Trio, are expected to have driven revenues in both the United States and International segments in the to-be-reported quarter. Zoestis’ Key dermatology products, including Apoquel and Cytopoint, are likely to have contributed to growth in these segments.

Last year, the FDA approved Apoquel Chewable tablets in the United States for controlling pruritus related to allergic dermatitis and control of atopic dermatitis in dogs at least 12 months of age. Apoquel chewable marks the first and only chewable treatment (an easier-to-use formulation) for the control of allergic itch and inflammation in dogs in the United States. This is expected to have increased sales of the product in the to-be-reported quarter.

Zoetis’ livestock product sales in the United States are likely to have improved in the soon-to-be-reported quarter, driven by a rise in cattle and swine product sales as a result of increased supply of vaccines. Higher revenues from poultry products are expected to have contributed to the uptick, driven by the sales growth of medicated feed additives and the expanded use of Zoamix.

In the International segment, total livestock product sales are likely to have increased in first-quarter 2024, primarily driven by growth in both the cattle and poultry portfolios, as a result of price increases across the broader international segment.

However, revenue growth potential in the international segment from livestock product sales is expected to have been impaired by decreased sales of Zoetis’ sheep and swine products due to unfavorable market conditions.

Zoetis Inc. Price and EPS Surprise

Zoetis Inc. price-eps-surprise | Zoetis Inc. Quote

Earnings Whispers

Our proven model does not conclusively predict an earnings beat for Zoetis this time around. The combination of a positive Earnings ESP and a Zacks Rank #1 (Strong Buy), 2 (Buy), or 3 (Hold) increases the odds of an earnings beat, which is not the case here, as you will see below. You can uncover the best stocks to buy or sell before they're reported with our Earnings ESP Filter.

Earnings ESP: Zoetis has an Earnings ESP of +1.03% as the Most Accurate Estimate currently exceeds the Zacks Consensus Estimate by 2 cents per share.

Zacks Rank: ZTS currently has a Zacks Rank #4 (Sell).

Stocks to Consider

Here are some stocks worth considering from the healthcare space, as our model shows that these have the right combination of elements to beat on earnings this reporting cycle.

Sarepta Therapeutics SRPT has an Earnings ESP of +108.99% and a Zacks Rank #2 at present. You can see the complete list of today’s Zacks #1 Rank stocks here.

Shares of Sarepta Therapeutics have gained 28.9% in the year-to-date period. SRPT’s earnings beat estimates in each of the last four quarters, delivering an average surprise of 464.56%.

Alnylam Pharmaceuticals ALNY has an Earnings ESP of +5.87% and a Zacks Rank #3 at present.

Shares of Alnylam have lost 24.9% year to date. ALNY beat earnings estimates in three of the last four quarters while missing the mark on one occasion, delivering an average surprise of 45.05%.

bluebird bio BLUE has an Earnings ESP of +4.93% and a Zacks Rank #3 at present.

Shares of bluebird have plunged 33.1% year to date. It beat earnings estimates in each of the last three reported quarters, delivering an average surprise of 50.06%.

Stay on top of upcoming earnings announcements with the Zacks Earnings Calendar.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Alnylam Pharmaceuticals, Inc. (ALNY) : Free Stock Analysis Report

Sarepta Therapeutics, Inc. (SRPT) : Free Stock Analysis Report

Zoetis Inc. (ZTS) : Free Stock Analysis Report

bluebird bio, Inc. (BLUE) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance