Zuora (NYSE:ZUO) Beats Q1 Sales Targets, Stock Jumps 12.6%

Subscription management platform Zuora (NYSE:ZUO) reported Q1 CY2024 results topping analysts' expectations , with revenue up 6.5% year on year to $109.8 million. The company expects next quarter's revenue to be around $112.5 million, in line with analysts' estimates. It made a non-GAAP profit of $0.11 per share, improving from its profit of $0.05 per share in the same quarter last year.

Is now the time to buy Zuora? Find out in our full research report.

Zuora (ZUO) Q1 CY2024 Highlights:

Revenue: $109.8 million vs analyst estimates of $108.8 million (small beat)

Operating profit (non-GAAP): $18.6 million vs analyst estimates of $14.9 million (24.8% beat)

EPS (non-GAAP): $0.11 vs analyst estimates of $0.07 ($0.04 beat)

Revenue Guidance for Q2 CY2024 is $112.5 million at the midpoint, roughly in line with what analysts were expecting (operating income guidance raised and slightly ahead)

The company reconfirmed its revenue guidance for the full year of $455 million at the midpoint (operating income guidance raised and slightly ahead)

Gross Margin (GAAP): 68.1%, up from 63.8% in the same quarter last year

Free Cash Flow of $31.4 million, up 127% from the previous quarter

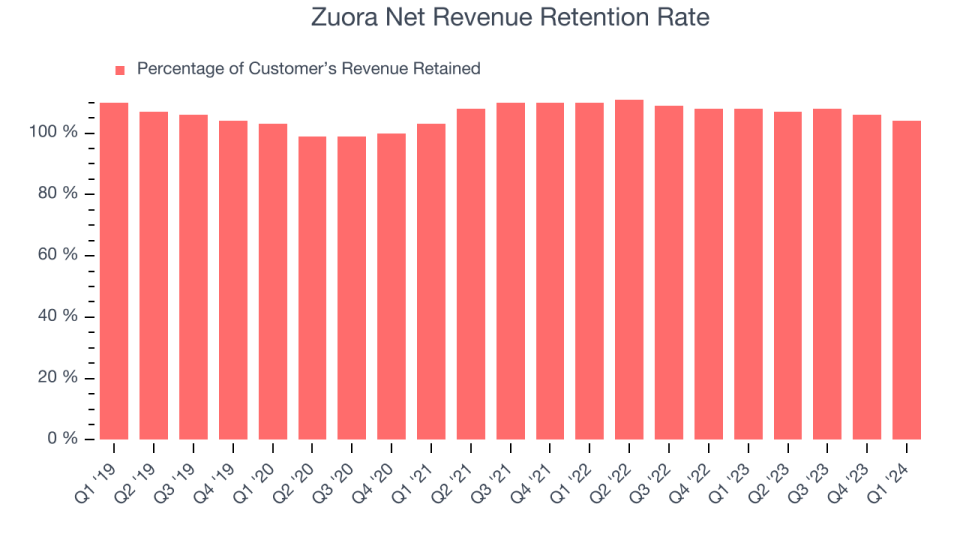

Net Revenue Retention Rate: 104%, in line with the previous quarter

Market Capitalization: $1.52 billion

“Our first quarter speaks to the quality of our install base and ability to drive strong expansion with innovations including the recent acquisition of Togai,” said Tien Tzuo, Founder and CEO at Zuora.

Founded in 2007, Zuora (NYSE:ZUO) offers software as a service platform that allows companies to bill and accept payments for recurring subscription products.

Payments Software

Consumers want the ability to make payments whenever and wherever they prefer – and to do so without having to worry about fraud or other security threats. However, building payments infrastructure from scratch is extremely resource-intensive for engineering teams. That drives demand for payments platforms that are easy to integrate into consumer applications and websites.

Sales Growth

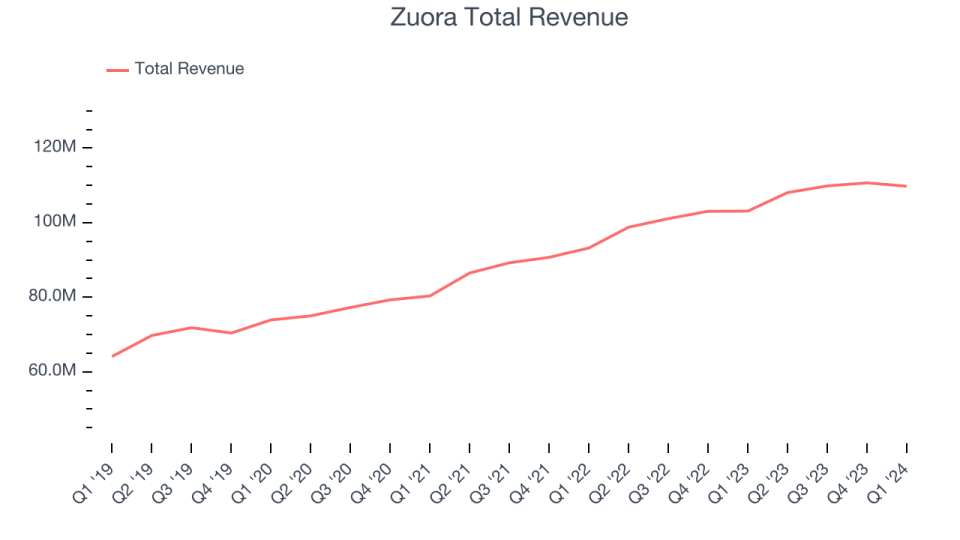

As you can see below, Zuora's revenue growth has been unremarkable over the last three years, growing from $80.33 million in Q1 2022 to $109.8 million this quarter.

Zuora's quarterly revenue was only up 6.5% year on year, which might disappoint some shareholders. On top of that, the company's revenue actually decreased by $900,000 in Q1 compared to the $820,000 increase in Q4 CY2023. While we'd like to see revenue increase each quarter, management is guiding for growth to rebound in the next quarter and a one-off fluctuation is usually not concerning.

Next quarter's guidance suggests that Zuora is expecting revenue to grow 4.1% year on year to $112.5 million, slowing down from the 9.4% year-on-year increase it recorded in the same quarter last year. Looking ahead, analysts covering the company were expecting sales to grow 6% over the next 12 months before the earnings results announcement.

Here at StockStory, we certainly understand the potential of thematic investing. Diverse winners from Microsoft (MSFT) to Alphabet (GOOG), Coca-Cola (KO) to Monster Beverage (MNST) could all have been identified as promising growth stories with a megatrend driving the growth. So, in that spirit, we’ve identified a relatively under-the-radar profitable growth stock benefitting from the rise of AI, available to you FREE via this link.

Product Success

One of the best parts about the software-as-a-service business model (and a reason why SaaS companies trade at such high valuation multiples) is that customers typically spend more on a company's products and services over time.

Zuora's net revenue retention rate, a key performance metric measuring how much money existing customers from a year ago are spending today, was 104% in Q1. This means that even if Zuora didn't win any new customers over the last 12 months, it would've grown its revenue by 4%.

Despite falling over the last year, Zuora still has an adequate net retention rate, showing us that it generally keeps customers but lags behind the best SaaS businesses, which routinely post net retention rates of 120%+.

Key Takeaways from Zuora's Q1 Results

Revenue in the quarter beat by a modest amount, but operating income beat by a convincing margin. While full year revenue guidance was maintained, the company raised its full year outlook for operating profit. Said differently, topline growth is in line with expectations, but it's more profitable and efficient growth. Overall, this was a solid quarter for Zuora. The stock is up 12.6% after reporting and currently trades at $11.1 per share.

So should you invest in Zuora right now? When making that decision, it's important to consider its valuation, business qualities, as well as what has happened in the latest quarter. We cover that in our actionable full research report which you can read here, it's free.

Yahoo Finance

Yahoo Finance