NIKKEI 225

38,471.20 -761.60 (-1.94%) HANG SENG

16,248.97 -351.49 (-2.12%) CRUDE OIL

85.31 -0.10 (-0.12%) GOLD FUTURES

2,403.10 +20.10 (+0.84%) DOW

37,803.99 +68.88 (+0.18%) Bitcoin GBP

50,286.65 -1,148.41 (-2.23%)

Crédit Agricole S.A. (XCA.DE)

| Previous close | 13.93 |

| Open | 13.57 |

| Bid | 13.52 x N/A |

| Ask | 13.57 x N/A |

| Day's range | 13.53 - 13.57 |

| 52-week range | 10.42 - 14.21 |

| Volume | |

| Avg. volume | 1,539 |

| Market cap | 40.976B |

| Beta (5Y monthly) | 1.53 |

| PE ratio (TTM) | 6.98 |

| EPS (TTM) | 1.94 |

| Earnings date | N/A |

| Forward dividend & yield | 1.05 (7.54%) |

| Ex-dividend date | 29 May 2024 |

| 1y target est | N/A |

Bloomberg

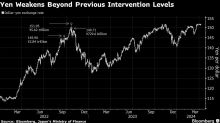

BloombergYen Drop Deepens After US Data, Raising Intervention Risk

(Bloomberg) -- The yen plunged through a level that Wall Street has warned could push Japanese authorities to step into the market to support the currency and then kept on going. Most Read from BloombergUS Sees Imminent Missile Strike on Israel by Iran, ProxiesUS Slams Strikes on Russia Oil Refineries as Risk to Oil MarketsChinese Cement Maker Halted After 99% Crash in 15 MinutesVietnam Tycoon Lan Sentenced to Death Over $12 Billion FraudUS Inflation Refuses to Bend, Fanning Fears It Will StickT

Globe Newswire

Globe NewswireRelease for availability of the 2023 Universal Registration Document of Crédit Agricole Assurances

Release Paris, April 8th 2024 Release for availability of the 2023 Universal Registration Document of Crédit Agricole Assurances Crédit Agricole Assurances would like to announce that its 2023 Universal Registration Document was filed with the AMF (French Securities Regulator) on April 8th, 2024, under number D.24-0260. The Universal Registration Document includes: the 2023 annual financial report,the report on corporate governance,the information concerning the fees paid to the Statutory Audito

Globe Newswire

Globe NewswireRelease of the 2023 Credit Agricole Assurances group’s SFCR

Release Paris, April 8th 2024 Release of the 2023 Credit Agricole Assurances group’s SFCR Crédit Agricole Assurances announced today the release of its group Solvency and Financial Condition Report (SFCR) for 2023. Since the implementation of Solvency 2 on January 1st, 2016 and more specifically within the Pillar 3 framework of the Directive concerning the public disclosure, the SFCR of Crédit Agricole Assurances group, wholly-owned subsidiary of the Crédit Agricole banking group, reports on the