Intesa Sanpaolo S.p.A. (0HBC.IL)

| Previous close | 3.7385 |

| Open | 3.6495 |

| Bid | 3.5365 x 0 |

| Ask | 3.6810 x 0 |

| Day's range | 3.5795 - 3.6590 |

| 52-week range | 2.1330 - 3.7570 |

| Volume | |

| Avg. volume | 4,023,155 |

| Market cap | 67.928B |

| Beta (5Y monthly) | 1.37 |

| PE ratio (TTM) | 10.86 |

| EPS (TTM) | N/A |

| Earnings date | N/A |

| Forward dividend & yield | 0.24 (10.11%) |

| Ex-dividend date | 22 May 2023 |

| 1y target est | N/A |

- GuruFocus.com

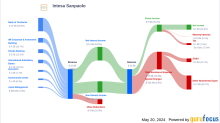

Intesa Sanpaolo's Dividend Analysis

Intesa Sanpaolo (ISNPY) recently announced a dividend of $0.97 per share, payable on an unspecified date, with the ex-dividend date set for 2024-05-20. As investors anticipate this forthcoming payment, it is crucial to delve into the company's dividend history, yield, and growth rates. Utilizing data from GuruFocus, this analysis will scrutinize the performance and sustainability of Intesa Sanpaolo's dividends.

- Reuters

Intesa CEO cautious on share buybacks, upbeat on fees

Intesa Sanpaolo will be cautious in approving any further share buybacks even though it has room to do so, its CEO Carlo Messina said on Friday, sending shares in Italy's biggest bank lower. The bank's shares lost 3.5% after it reported higher than expected net profit in the first quarter, helped by a rebound in net fees which Messina said had continued in April and would result in double-digit growth for fees and commissions this year. Shares extended losses as Messina reiterated his prudent stance on buybacks which have become the form of cashback preferred by bank investors.

- Reuters

Intesa targets new digital-only clients after antitrust blow

Italy's biggest bank Intesa Sanpaolo on Friday said it had acquired some 90,000 new customers through its digital-only arm Isybank, after an antitrust decision effectively halted the migration of existing clients. Italy's competition authority dealt a blow to Intesa's fintech ambitions in November when it ruled the bank had to obtain explicit consent from the around 4 million clients it planned to move to Isybank based on their digital habits. Intesa had informed customers digitally of an opt-out deadline.