Hollysys Automation Technologies Ltd. (0M58.L)

| Previous close | 26.40 |

| Open | 26.41 |

| Bid | 0.00 x N/A |

| Ask | 0.00 x N/A |

| Day's range | 26.41 - 26.43 |

| 52-week range | 15.45 - 27.23 |

| Volume | |

| Avg. volume | 1,044 |

| Market cap | 1.441B |

| Beta (5Y monthly) | 0.48 |

| PE ratio (TTM) | 0.20 |

| EPS (TTM) | N/A |

| Earnings date | N/A |

| Forward dividend & yield | N/A (N/A) |

| Ex-dividend date | N/A |

| 1y target est | N/A |

- Simply Wall St.

Hollysys Automation Technologies Ltd. (NASDAQ:HOLI) Is Going Strong But Fundamentals Appear To Be Mixed : Is There A Clear Direction For The Stock?

Hollysys Automation Technologies (NASDAQ:HOLI) has had a great run on the share market with its stock up by a...

- GuruFocus.com

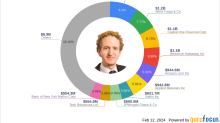

Chris Davis Adjusts Position in Hollysys Automation Technologies Ltd

On December 31, 2023, Davis Advisors, under the leadership of portfolio manager Chris Davis (Trades, Portfolio), made a notable adjustment to its investment in Hollysys Automation Technologies Ltd (NASDAQ:HOLI). Following the trade, Davis Advisors holds a total of 5,248,240 shares in Hollysys, representing an 8.50% ownership stake in the company and accounting for 0.87% of the firm's portfolio. Davis Advisors is a prominent investment management firm overseeing assets worth over $60 billion.

- Reuters

REFILE-UPDATE 1-Hollysys shareholders approve merger with Ascendent Capital affiliates

The U.S. listed Chinese automation control system provider said last year it had agreed that Ascendent Capital, which already owns a 13.7% stake in the company, will acquire the outstanding Hollysys shares at $26.5 each in a deal valued around $1.66 billion. Superior Technologies Mergersub Limited, which is affiliated with Ascendent Capital, will merge into Hollysys, and Hollysys will become a wholly owned unit of Superior Technologies Holding Limited, another Ascendent affiliate, according to a Hollysys statement.