NIKKEI 225

38,073.98 -128.39 (-0.34%) HANG SENG

18,505.72 +191.86 (+1.05%) CRUDE OIL

79.34 +0.35 (+0.44%) GOLD FUTURES

2,323.40 +1.10 (+0.05%) DOW

39,056.39 +172.13 (+0.44%) Bitcoin GBP

49,361.00 -598.59 (-1.20%)

Banco BPM S.p.A. (0RLA.IL)

| Previous close | 6.34 |

| Open | 0.00 |

| Bid | 0.00 x 0 |

| Ask | 0.00 x 0 |

| Day's range | 0.00 - 0.00 |

| 52-week range | |

| Volume | |

| Avg. volume | 3,774,623 |

| Market cap | 9.367B |

| Beta (5Y monthly) | 1.00 |

| PE ratio (TTM) | 9.70 |

| EPS (TTM) | 0.64 |

| Earnings date | 06 Aug 2024 |

| Forward dividend & yield | 0.23 (4.67%) |

| Ex-dividend date | 24 Apr 2023 |

| 1y target est | N/A |

Reuters

ReutersBanco BPM may lift 2024 EPS forecast after first-quarter profit beat

MILAN (Reuters) -Banco BPM said on Tuesday it may raise its earnings per share guidance for the year after posting a higher than expected first-quarter net profit. Italy's third-largest bank reported a net profit of 370.2 million euros ($398.8 million) for the January-March period, up 40% on a annual basis, as rising revenues and falling loan-loss provisions more than offset an increase in costs. This compared with an analyst consensus estimate of 352 million euros, LSEG data shows.

GuruFocus.com

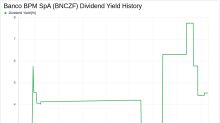

GuruFocus.comBanco BPM SpA's Dividend Analysis

Banco BPM SpA (BNCZF) recently announced a dividend of $0.56 per share, payable on 2024-04-24, with the ex-dividend date set for 2024-04-22. As investors look forward to this upcoming payment, the spotlight also shines on the company's dividend history, yield, and growth rates. Using the data from GuruFocus, let's look into Banco BPM SpA's dividend performance and assess its sustainability.

Reuters

ReutersItaly's Banco BPM in spotlight as dividends, M&A appeal drive volumes

MILAN (Reuters) -A surge in trading of Banco BPM shares is again drawing attention to Italy's third-largest bank, which has long been at the centre of speculation about potential consolidation in the sector. The stock's appeal is a combination of the bank's possible role in expected consolidation in Italy, as well as good cash dividend returns, investors and analyst said. Reporting an 85% rise in full-year profit this month, Banco BPM said it was more than doubling its cash dividend to 56 euro cents a share from 23 euro cents.