Aluminum Corporation of China Limited (2600.HK)

| Previous close | 5.230 |

| Open | 5.200 |

| Bid | 5.270 x 0 |

| Ask | 5.280 x 0 |

| Day's range | 5.160 - 5.300 |

| 52-week range | 3.110 - 5.330 |

| Volume | |

| Avg. volume | 27,390,722 |

| Market cap | 126.789B |

| Beta (5Y monthly) | 2.06 |

| PE ratio (TTM) | 11.73 |

| EPS (TTM) | 0.450 |

| Earnings date | N/A |

| Forward dividend & yield | 0.04 (0.80%) |

| Ex-dividend date | 23 Jun 2023 |

| 1y target est | 5.79 |

Bloomberg

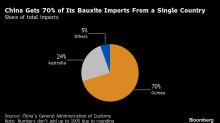

BloombergWorld’s Top Aluminum Producer Sees Raw Material Supply Risk in Guinea

(Bloomberg) -- Aluminum Corp. of China Ltd. said it sees “relatively high” risks to supplies of bauxite from Guinea, highlighting its growing dependence on a single country for the raw material. Most Read from BloombergLondon Insurers Face Baltimore Bridge Payouts Worth BillionsBiden Gains Ground Against Trump in Six Key States, Poll ShowsJapan Amps Up Intervention Threat as Yen Hits Lowest Since 1990Dubai Is Losing Its Allure for Wealthy RussiansChina Property Crisis Is Rippling Through Its Big

Reuters

ReutersRio Tinto shoulders Simandou iron ore bill as Chinese funds delayed - sources

Rio Tinto has been solely funding preparatory work at the blocks it holds at Simandou, one of the world's largest untapped iron ore deposits, as its Chinese partners are yet to make their funds available, two sources close to the matter said. The Anglo-Australian miner owns two of four Simandou mining blocks as part of its Simfer joint venture with China's Chalco Iron Ore Holdings (CIOH) and the government of Guinea, where the mine is located. It has so far spent more than $500 million on developing the project that should have been split with CIOH, due to a delay in the Chinese consortium getting state approval on the financing, the sources said.