Akzo Nobel N.V. (AKZA.AS)

| Previous close | 61.92 |

| Open | 62.10 |

| Bid | 0.00 x 0 |

| Ask | 0.00 x 0 |

| Day's range | 61.92 - 62.66 |

| 52-week range | 60.06 - 79.32 |

| Volume | |

| Avg. volume | 413,354 |

| Market cap | 10.675B |

| Beta (5Y monthly) | N/A |

| PE ratio (TTM) | 20.12 |

| EPS (TTM) | 3.11 |

| Earnings date | 23 Jul 2024 |

| Forward dividend & yield | 1.98 (3.20%) |

| Ex-dividend date | 29 Apr 2024 |

| 1y target est | 79.10 |

Simply Wall St.

Simply Wall St.Akzo Nobel N.V. (AMS:AKZA) Will Pay A €1.54 Dividend In Three Days

Akzo Nobel N.V. ( AMS:AKZA ) stock is about to trade ex-dividend in three days. The ex-dividend date is usually set to...

Reuters

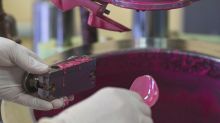

ReutersDulux paint maker AkzoNobel Q1 beats expectations, outlook underwhelms

(Reuters) -AkzoNobel reported a 19% rise in first-quarter core profit on Tuesday, beating analysts' expectations, as higher volumes and prices as well as lower restructuring costs helped the Dulux paint maker bolster margins. Shares in the company fell more than 5% to their lowest since November though, as some investors had hoped management would raise its full-year outlook and after the company said it faced a lawsuit in Australia which could result in potential damages.

Zacks

ZacksIs AkzoNobel (AKZOY) Stock Undervalued Right Now?

Here at Zacks, our focus is on the proven Zacks Rank system, which emphasizes earnings estimates and estimate revisions to find great stocks. Nevertheless, we are always paying attention to the latest value, growth, and momentum trends to underscore strong picks.