NIKKEI 225

38,329.39 +777.23 (+2.07%) HANG SENG

17,143.01 +314.08 (+1.87%) CRUDE OIL

83.36 0.00 (0.00%) GOLD FUTURES

2,334.70 -7.40 (-0.32%) DOW

38,503.69 +263.71 (+0.69%) Bitcoin GBP

53,467.04 -118.09 (-0.22%)

Allianz SE (ALV.DE)

| Previous close | 266.70 |

| Open | 267.70 |

| Bid | 269.90 x 214900 |

| Ask | 269.90 x 10000 |

| Day's range | 267.10 - 270.50 |

| 52-week range | 198.60 - 280.00 |

| Volume | |

| Avg. volume | 788,314 |

| Market cap | 105.89B |

| Beta (5Y monthly) | 1.09 |

| PE ratio (TTM) | 12.77 |

| EPS (TTM) | 21.18 |

| Earnings date | 15 May 2024 |

| Forward dividend & yield | 13.80 (5.17%) |

| Ex-dividend date | 09 May 2024 |

| 1y target est | 274.30 |

Bloomberg

BloombergAllianz Says Japan Stocks Will Defy Geopolitics, Yen Volatility

(Bloomberg) -- Middle East tensions and currency volatility have caused Japan’s record stock rally to falter, but the weakness looks temporary as solid corporate fundamentals and the long-term artificial intelligence outlook provide support.Most Read from BloombergTrump Has Only $6.8 Million for Legal Fees With Trial UnderwayTikTok to Remove Executive Tasked With Fending Off US ClaimsChina Is Front and Center of Gold’s Record-Breaking RallyTesla Spends Weekend Cutting Prices of Cars and FSD Soft

Simply Wall St.

Simply Wall St.Is Allianz SE's (ETR:ALV) Recent Stock Performance Influenced By Its Financials In Any Way?

Allianz's (ETR:ALV) stock up by 6.0% over the past three months. Given that stock prices are usually aligned with a...

Bloomberg

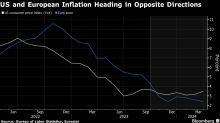

BloombergIt’s Time for the ECB to Diverge From Fed, Stournaras Says

(Bloomberg) -- The European Central Bank shouldn’t be afraid to shift its “overly prudent” stance on interest rates away from that of the Federal Reserve, according to Governing Council member Yannis Stournaras.Most Read from BloombergIsrael Bracing for Unprecedented Direct Iran Attack in DaysApple Plans to Overhaul Entire Mac Line With AI-Focused M4 ChipsRussian Attacks on Ukraine Stoke Fears Army Near Breaking PointUS Sees Imminent Missile Strike on Israel by Iran, ProxiesVietnam Tycoon Lan Se