NIKKEI 225

38,236.07 -37.98 (-0.10%) HANG SENG

18,207.13 +444.10 (+2.50%) CRUDE OIL

79.06 +0.06 (+0.08%) GOLD FUTURES

2,313.40 +2.40 (+0.10%) DOW

38,225.66 +322.37 (+0.85%) Bitcoin GBP

47,033.41 +927.35 (+2.01%)

ASSA ABLOY AB (publ) (ASSA-B.ST)

| Previous close | 295.00 |

| Open | 292.00 |

| Bid | 293.90 x 0 |

| Ask | 293.90 x 0 |

| Day's range | 290.20 - 294.60 |

| 52-week range | 226.00 - 315.60 |

| Volume | |

| Avg. volume | 1,574,562 |

| Market cap | 327.014B |

| Beta (5Y monthly) | 0.80 |

| PE ratio (TTM) | 22.73 |

| EPS (TTM) | 12.95 |

| Earnings date | 17 Jul 2024 |

| Forward dividend & yield | 5.40 (1.83%) |

| Ex-dividend date | 08 Nov 2024 |

| 1y target est | 324.71 |

GuruFocus.com

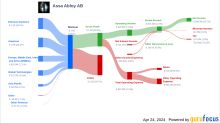

GuruFocus.comAssa Abloy AB's Dividend Analysis

Assa Abloy AB (ASAZY) recently announced a dividend of $0.13 per share, payable on 2024-05-17, with the ex-dividend date set for 2024-04-25. As investors look forward to this upcoming payment, the spotlight also shines on the company's dividend history, yield, and growth rates. Using the data from GuruFocus, let's look into Assa Abloy AB's dividend performance and assess its sustainability.

- Reuters

UPDATE 3-Swedish lockmaker Assa Abloy flags tough conditions in residential market

Sweden's Assa Abloy the world's biggest lockmaker, flagged tough conditions in the residential market on Wednesday after reporting a 5% jump in first-quarter operating profit helped by action on costs and strong pricing. The company, whose products range from security doors to electronic and mechanical locks, said its operating profit, excluding items affecting comparability, rose to 5.43 billion Swedish crowns ($502 million) in the January to March quarter. "If you look at market conditions, we see a continuous, challenging residential market in general as well as in North America, in Europe and in Oceania, our three main markets,” CEO Nico Delvaux told Reuters.