Banco BPM S.p.A. (BAMI.MI)

| Previous close | 5.83 |

| Open | 5.90 |

| Bid | 5.89 x 0 |

| Ask | 5.92 x 0 |

| Day's range | 5.81 - 6.02 |

| 52-week range | 3.54 - 6.41 |

| Volume | |

| Avg. volume | 17,372,823 |

| Market cap | 8.881B |

| Beta (5Y monthly) | 0.96 |

| PE ratio (TTM) | 7.01 |

| EPS (TTM) | 0.84 |

| Earnings date | 07 May 2024 |

| Forward dividend & yield | 0.56 (9.50%) |

| Ex-dividend date | 22 May 2024 |

| 1y target est | 6.50 |

GuruFocus.com

GuruFocus.comBanco BPM SpA's Dividend Analysis

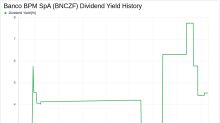

Banco BPM SpA (BNCZF) recently announced a dividend of $0.56 per share, payable on 2024-04-24, with the ex-dividend date set for 2024-04-22. As investors look forward to this upcoming payment, the spotlight also shines on the company's dividend history, yield, and growth rates. Using the data from GuruFocus, let's look into Banco BPM SpA's dividend performance and assess its sustainability.

Reuters

ReutersItaly's Banco BPM in spotlight as dividends, M&A appeal drive volumes

MILAN (Reuters) -A surge in trading of Banco BPM shares is again drawing attention to Italy's third-largest bank, which has long been at the centre of speculation about potential consolidation in the sector. The stock's appeal is a combination of the bank's possible role in expected consolidation in Italy, as well as good cash dividend returns, investors and analyst said. Reporting an 85% rise in full-year profit this month, Banco BPM said it was more than doubling its cash dividend to 56 euro cents a share from 23 euro cents.

Reuters

ReutersItaly's Fondazione CRT lifts stake in Generali to 2%, its chairman says

Italy's Fondazione CRT has increased its stake in insurer Generali to around 2% after selling its entire holding in Italian bank Banco BPM last week, its chairman Fabrizio Palenzona said on Tuesday. "We are and will remain on the 2% threshold," Palenzona said in an interview with daily Il Sole 24 Ore, adding the banking foundation had decided to consolidate its "long-term holding" in Generali to increase the dividend flow to the foundation. CRT previously held a 1.6% stake in Italy's top insurer.