NIKKEI 225

38,230.47 +156.49 (+0.41%) HANG SENG

18,859.60 +321.79 (+1.74%) CRUDE OIL

79.78 +0.52 (+0.66%) GOLD FUTURES

2,359.40 +19.10 (+0.82%) DOW

39,387.76 +331.36 (+0.85%) Bitcoin GBP

50,233.94 +958.47 (+1.95%)

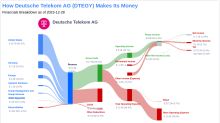

Deutsche Telekom AG (DTE.DE)

| Previous close | 21.64 |

| Open | 21.59 |

| Bid | 21.87 x 910400 |

| Ask | 21.89 x 288200 |

| Day's range | 21.59 - 21.98 |

| 52-week range | 18.50 - 23.40 |

| Volume | |

| Avg. volume | 7,454,512 |

| Market cap | 109.032B |

| Beta (5Y monthly) | 0.59 |

| PE ratio (TTM) | 26.71 |

| EPS (TTM) | 0.82 |

| Earnings date | 16 May 2024 |

| Forward dividend & yield | 0.77 (3.56%) |

| Ex-dividend date | 11 Apr 2024 |

| 1y target est | 26.50 |

Insider Monkey

Insider Monkey20 Richest Billionaires in Telecommunications

In this article, we will look into the 20 richest billionaires in telecommunications. If you want to skip our detailed analysis of the telecommunications market, you can go directly to the 5 Richest Billionaires in Telecommunications. Telecom Industry: Rising Market Trends and Startups The global telecommunication market saw a growing trend of adoption of technologies […]

Simply Wall St.

Simply Wall St.In the wake of Deutsche Telekom AG's (ETR:DTE) latest €4.6b market cap drop, institutional owners may be forced to take severe actions

Key Insights Institutions' substantial holdings in Deutsche Telekom implies that they have significant influence over...

GuruFocus.com

GuruFocus.comDeutsche Telekom AG's Dividend Analysis

Deutsche Telekom AG (DTEGY) recently announced a dividend of $0.84 per share, payable on 2024-04-22, with the ex-dividend date set for 2024-04-12. As investors look forward to this upcoming payment, the spotlight also shines on the company's dividend history, yield, and growth rates. Using the data from GuruFocus, let's look into Deutsche Telekom AG's dividend performance and assess its sustainability.