UK markets closed

NIKKEI 225

37,628.48 -831.60 (-2.16%) HANG SENG

17,284.54 +83.27 (+0.48%) CRUDE OIL

83.80 +0.99 (+1.20%) GOLD FUTURES

2,344.10 +5.70 (+0.24%) DOW

38,085.80 -375.12 (-0.98%) Bitcoin GBP

51,724.72 +606.86 (+1.19%)

Kerry Group plc (KYGA.L)

LSE - LSE Delayed price. Currency in EUR

Add to watchlist

At close: 06:10PM BST

| Previous close | 82.10 |

| Open | 79.25 |

| Bid | 78.40 x 0 |

| Ask | 79.20 x 0 |

| Day's range | 78.35 - 79.40 |

| 52-week range | 71.05 - 98.95 |

| Volume | |

| Avg. volume | 169,079 |

| Market cap | 136.316M |

| Beta (5Y monthly) | 0.51 |

| PE ratio (TTM) | 0.19 |

| EPS (TTM) | 4.10 |

| Earnings date | N/A |

| Forward dividend & yield | 1.15 (1.41%) |

| Ex-dividend date | 11 Apr 2024 |

| 1y target est | N/A |

GuruFocus.com

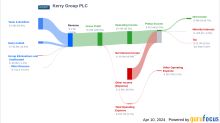

GuruFocus.comKerry Group PLC's Dividend Analysis

Kerry Group PLC (KRYAY) recently announced a dividend of $0.88 per share, payable on 2024-05-20, with the ex-dividend date set for 2024-04-11. As investors look forward to this upcoming payment, the spotlight also shines on the company's dividend history, yield, and growth rates. Using the data from GuruFocus, let's look into Kerry Group PLC's dividend performance and assess its sustainability.

PR Newswire

PR NewswireALTIVIA Appoints Scott Barnum as Director of Manufacturing and Dean Hale as Corporate Engineering Manager

ALTIVIA today announced that it has named Scott Barnum as Director of Manufacturing and Dean Hale as Corporate Engineering Manager.

Zacks

ZacksASBFY or KRYAY: Which Is the Better Value Stock Right Now?

ASBFY vs. KRYAY: Which Stock Is the Better Value Option?