NIKKEI 225

38,323.18 -909.62 (-2.32%) HANG SENG

16,279.56 -320.90 (-1.93%) CRUDE OIL

85.87 +0.46 (+0.54%) GOLD FUTURES

2,400.70 +17.70 (+0.74%) DOW

37,735.11 -248.13 (-0.65%) Bitcoin GBP

50,157.00 -2,051.14 (-3.93%)

Macquarie Group Limited (MQG.AX)

| Previous close | 188.23 |

| Open | 186.36 |

| Bid | 185.18 x 39700 |

| Ask | 185.13 x 38900 |

| Day's range | 184.31 - 187.97 |

| 52-week range | 155.30 - 200.25 |

| Volume | |

| Avg. volume | 636,941 |

| Market cap | 71.302B |

| Beta (5Y monthly) | 1.12 |

| PE ratio (TTM) | 16.86 |

| EPS (TTM) | 10.98 |

| Earnings date | 03 May 2024 - 07 May 2024 |

| Forward dividend & yield | 7.05 (3.85%) |

| Ex-dividend date | 13 Nov 2023 |

| 1y target est | 189.11 |

Bloomberg

BloombergMacquarie Targets Over $1.5 Billion for Infrastructure Debt Fund

(Bloomberg) -- Macquarie Group Ltd. is discussing raising a new fund focused on infrastructure debt, according to people familiar with the matter.Most Read from BloombergBeyond the Ivies: Surprise Winners in the List of Colleges With the Highest ROITrump Media’s $5.3 Billion Selloff Deepens as 270% Rally FizzlesIran’s Attack on Israel Sparks Race to Avert a Full-Blown WarS&P 500 Breaks Below 5,100 as Big Tech Sells Off: Markets WrapApple Faces Worst iPhone Slump Since Covid as Rivals RiseThe Aus

Bloomberg

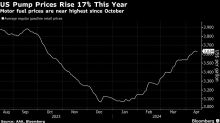

BloombergBiden Likely to Tap Oil Reserve for Summer Demand, Macquarie Says

(Bloomberg) -- The Biden administration will likely need to tap oil from the country’s emergency reserves to counter a spike in gasoline prices and amid inflation fears during the summer driving season. Most Read from BloombergBeyond the Ivies: Surprise Winners in the List of Colleges With the Highest ROITrump Media’s $5.3 Billion Selloff Deepens as 270% Rally FizzlesIran’s Attack on Israel Sparks Race to Avert a Full-Blown WarS&P 500 Breaks Below 5,100 as Big Tech Sells Off: Markets WrapApple F

Bloomberg

BloombergEx-Macquarie Banker’s Activist Hedge Fund Strategy Soars 42%

(Bloomberg) -- One of Australia’s most-prominent activist hedge funds is notching returns nearly double that of the country’s benchmark stock index, as the once-shunned investment style becomes increasingly popular.Most Read from BloombergUS Sees Imminent Missile Strike on Israel by Iran, ProxiesApple Plans to Overhaul Entire Mac Line With AI-Focused M4 ChipsRussian Attacks on Ukraine Stoke Fears Army Near Breaking PointVietnam Tycoon Lan Sentenced to Death Over $12 Billion FraudUS Slams Strikes