NIKKEI 225

38,617.10 -329.83 (-0.85%) HANG SENG

19,260.05 +39.43 (+0.21%) CRUDE OIL

79.06 -0.20 (-0.25%) GOLD FUTURES

2,419.00 -6.90 (-0.28%) DOW

39,872.99 +66.22 (+0.17%) Bitcoin GBP

54,826.45 -1,026.51 (-1.84%)

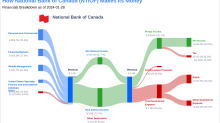

National Bank of Canada (NA-PC.TO)

| Previous close | 25.60 |

| Open | 25.54 |

| Bid | 25.47 x 0 |

| Ask | 25.59 x 0 |

| Day's range | 25.50 - 25.59 |

| 52-week range | 23.51 - 25.80 |

| Volume | |

| Avg. volume | 12,033 |

| Market cap | 25.411B |

| Beta (5Y monthly) | 1.12 |

| PE ratio (TTM) | 2.62 |

| EPS (TTM) | N/A |

| Earnings date | N/A |

| Forward dividend & yield | 1.76 (6.89%) |

| Ex-dividend date | 05 Apr 2024 |

| 1y target est | N/A |

- Simply Wall St.

National Bank of Canada And Two More Dividend Stocks For Reliable Income

Amidst a backdrop of fluctuating inflation trends and cautious monetary policy signals from the U.S. Federal Reserve, the Canadian market remains a point of focus for investors seeking stability through dividend stocks. As global economic dynamics influence market sentiments, dividend-paying stocks in Canada may offer a semblance of predictable income in uncertain times.

- Bloomberg

National Bank of Canada Targets Global Borrowers With Paris Hub

(Bloomberg) -- National Bank of Canada is opening an office in Paris to cater to supranational and government-backed issuers, a segment that’s selling euro-denominated bonds at a record pace this year. Most Read from BloombergTesla Soars on Tentative China Approval for Driving SystemStocks Trade for 390 Minutes a Day. Increasingly, Only 10 MatterYen Sparks Intervention Suspicion After U-Turn From 1990 LowsWhat 60,000 Headlines Say About the Fed’s Next MoveUS Warns ICC Action on Israel Would Hurt

- GuruFocus.com

National Bank of Canada's Dividend Analysis

National Bank of Canada (NTIOF) recently announced a dividend of $1.06 per share, payable on 2024-05-01, with the ex-dividend date set for 2024-03-22. As investors look forward to this upcoming payment, the spotlight also shines on the company's dividend history, yield, and growth rates. Using the data from GuruFocus, let's look into National Bank of Canada's dividend performance and assess its sustainability.