National Australia Bank Limited (NABZY)

| Previous close | 11.13 |

| Open | 11.60 |

| Bid | 0.00 x 0 |

| Ask | 0.00 x 0 |

| Day's range | 11.00 - 11.60 |

| 52-week range | 8.17 - 11.93 |

| Volume | |

| Avg. volume | 56,856 |

| Market cap | 69.185B |

| Beta (5Y monthly) | 0.86 |

| PE ratio (TTM) | 15.32 |

| EPS (TTM) | N/A |

| Earnings date | N/A |

| Forward dividend & yield | 0.55 (4.87%) |

| Ex-dividend date | 10 May 2024 |

| 1y target est | N/A |

- GuruFocus.com

National Australia Bank Ltd's Dividend Analysis

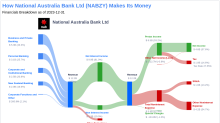

National Australia Bank Ltd (NABZY) recently announced a dividend of $0.27 per share, payable on 2024-07-10, with the ex-dividend date set for 2024-05-10. Using the data from GuruFocus, let's look into National Australia Bank Ltd's dividend performance and assess its sustainability. What Does National Australia Bank Ltd Do?

- Simply Wall St.

National Australia Bank (ASX:NAB) Is Due To Pay A Dividend Of A$0.84

National Australia Bank Limited ( ASX:NAB ) has announced that it will pay a dividend of A$0.84 per share on the 3rd of...

- Reuters

Aussie lender NAB reports lower profit but hints bank margin squeeze is easing

(Reuters) -National Australia Bank posted a double-digit drop in first-half earnings on Thursday but talked up the strength of the economy and said a margin-crunching struggle for the vital home loan market showed signs of easing. The first of Australia's big four banks to front up to investors this reporting season, NAB's results were closely watched for signs that the squeeze on profits from tough mortgage and deposit competition is coming to an end. Cash earnings for the six months ended March 31 fell 13% versus a year earlier to A$3.55 billion ($2.32 billion) as costs for the nation's second-biggest mortgage lender rose and competition tightened margins.