NIKKEI 225

38,405.66 +470.90 (+1.24%) HANG SENG

17,763.03 +16.12 (+0.09%) CRUDE OIL

81.70 -0.93 (-1.13%) GOLD FUTURES

2,304.00 -53.70 (-2.28%) DOW

37,931.28 -454.81 (-1.18%) Bitcoin GBP

48,046.11 -2,139.90 (-4.26%)

NEC Corporation (NEC1.F)

| Previous close | 65.00 |

| Open | 67.98 |

| Bid | 67.80 x 310000 |

| Ask | 68.96 x 300000 |

| Day's range | 67.98 - 67.98 |

| 52-week range | 39.00 - 71.50 |

| Volume | |

| Avg. volume | 127 |

| Market cap | 18.114B |

| Beta (5Y monthly) | 0.35 |

| PE ratio (TTM) | 20.48 |

| EPS (TTM) | N/A |

| Earnings date | N/A |

| Forward dividend & yield | 0.84 (1.30%) |

| Ex-dividend date | 27 Sept 2024 |

| 1y target est | N/A |

- GuruFocus.com

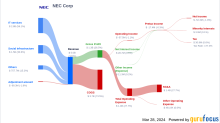

NEC Corp's Dividend Analysis

NEC Corp (NIPNF) recently announced a dividend of $0.60 per share, payable on a date yet to be announced, with the ex-dividend date set for 2024-03-28. As investors look forward to this upcoming payment, the spotlight also shines on the company's dividend history, yield, and growth rates. Using the data from GuruFocus, let's look into NEC Corp's dividend performance and assess its sustainability.

- Reuters

US investor presses Japan Aviation and NEC to cancel buyback, reconsider buyout offers

TOKYO (Reuters) -Chicago-based investor Curi RMB Capital said on Thursday that NEC and its listed unit Japan Aviation Electronics (JAE) should cancel their buyback deal and reconsider alternative buyout offers they have received. The call came after Reuters reported NEC had received multiple buyout offers from global private equity funds for JAE before agreeing to tender much of its 51% stake to the unit at a discount via a tender offer. Curi RMB, with more than $11 billion under management, owns shares in both NEC and JAE, which makes connectors used in smartphones including Apple's iPhones.

- Reuters

Hitachi and NEC seek up to $2.1 billion through Renesas share sale

(Reuters) -Hitachi and NEC Corp are aiming to raise up to $2.1 billion by selling their stakes in chipmaker Renesas Electronics, according to a term sheet seen by Reuters, joining a Japanese restructuring drive that has boosted shares. Investors have welcomed measures to improve capital efficiency at Japanese companies, sending share prices to 34-year highs. Companies have been spurred on by the Tokyo Stock Exchange, which this month published a list of companies that had disclosed plans to improve capital efficiency and is expected to put pressure on them to deliver.