NIKKEI 225

38,051.16 +422.68 (+1.12%) HANG SENG

17,592.90 +308.36 (+1.78%) CRUDE OIL

83.80 +0.23 (+0.28%) GOLD FUTURES

2,344.60 +2.10 (+0.09%) DOW

38,085.80 -375.12 (-0.98%) Bitcoin GBP

51,502.15 +52.62 (+0.10%)

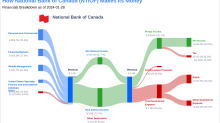

National Bank of Canada (NTIOF)

| Previous close | 81.22 |

| Open | 81.03 |

| Bid | 0.00 x 0 |

| Ask | 0.00 x 0 |

| Day's range | 81.03 - 82.24 |

| 52-week range | 60.71 - 84.81 |

| Volume | |

| Avg. volume | 36,100 |

| Market cap | 27.947B |

| Beta (5Y monthly) | 1.12 |

| PE ratio (TTM) | 11.82 |

| EPS (TTM) | N/A |

| Earnings date | N/A |

| Forward dividend & yield | 3.10 (3.77%) |

| Ex-dividend date | 05 Apr 2024 |

| 1y target est | N/A |

- Bloomberg

National Bank CEO Slams Canada’s Capital Gains Tax Increase

(Bloomberg) -- The chief executive officer of one of Canada’s largest banks is speaking out against the Trudeau government’s plan to raise taxes on capital gains, arguing it won’t spur investment in the country. Most Read from BloombergTraders Are Cashing Out of Markets En MasseMagnificent Seven Earnings Arrive With Stocks at Critical MomentNew York’s Rich Get Creative to Flee State Taxes. Auditors Are On to ThemTikTok Divest-or-Ban Bill Expected to Become US Law in DaysElon Wants His Money Back

- Bloomberg

Canada Opens Mortgage Market to 30-Year Loans for Homebuyers

(Bloomberg) -- Canada will relax the rules on mortgages to allow first-time buyers to take out 30-year loans when they purchase newly built homes. Most Read from BloombergUS Sees Imminent Missile Strike on Israel by Iran, ProxiesVietnam Tycoon Lan Sentenced to Death Over $12 Billion FraudApple Plans to Overhaul Entire Mac Line With AI-Focused M4 ChipsUS Slams Strikes on Russia Oil Refineries as Risk to Oil MarketsRussian Attacks on Ukraine Stoke Fears Army Near Breaking PointThe change to regula

- GuruFocus.com

National Bank of Canada's Dividend Analysis

National Bank of Canada (NTIOF) recently announced a dividend of $1.06 per share, payable on 2024-05-01, with the ex-dividend date set for 2024-03-22. As investors look forward to this upcoming payment, the spotlight also shines on the company's dividend history, yield, and growth rates. Using the data from GuruFocus, let's look into National Bank of Canada's dividend performance and assess its sustainability.