Rakuten, Inc. (RKUNF)

| Previous close | 4.8178 |

| Open | 5.0500 |

| Bid | 0.0000 x 0 |

| Ask | 0.0000 x 0 |

| Day's range | 4.9080 - 5.0500 |

| 52-week range | 3.3100 - 5.9000 |

| Volume | |

| Avg. volume | 688 |

| Market cap | 10.543B |

| Beta (5Y monthly) | 0.79 |

| PE ratio (TTM) | N/A |

| EPS (TTM) | -1.1500 |

| Earnings date | N/A |

| Forward dividend & yield | 0.07 (1.51%) |

| Ex-dividend date | 30 Dec 2022 |

| 1y target est | N/A |

Bloomberg

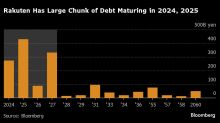

BloombergRakuten’s Costly Junk Bonds Signal Challenge for Japanese Billionaire Mikitani

(Bloomberg) -- After five straight years of losses, billionaire Hiroshi Mikitani’s Rakuten Group Inc. is trying to bounce back from a move into mobile that cost it billions of dollars. Doing so is proving expensive.Most Read from BloombergUS Sees Imminent Missile Strike on Israel by Iran, ProxiesUS Slams Strikes on Russia Oil Refineries as Risk to Oil MarketsVietnam Tycoon Lan Sentenced to Death Over $12 Billion FraudChinese Cement Maker Halted After 99% Crash in 15 MinutesUS Inflation Refuses t

Zacks

ZacksRadcom (RDCM) Renews Collaboration With Rakuten Mobile

Radcom (RDCM) expands its partnership with Rakuten Mobile to include AI-powered comprehensive network analytics along with existing solutions.

Bloomberg

BloombergRakuten Boosts Junk Bond Sale to $2 Billion With Juicy Yield

(Bloomberg) -- Rakuten Group Inc. boosted a junk bond sale to $2 billion as the debt-laden Japanese company attracted investors with a yield that’s significantly higher than similarly rated debt.Most Read from BloombergApple Explores Home Robotics as Potential ‘Next Big Thing’ After Car FizzlesKim Jong Un Faces Annihilation in Most Korea War ScenariosTexas Toll Road Takeover to Cost Taxpayers at Least $1.7 BillionTSMC Facilities to Resume Production Overnight After QuakeA Million Simulations, On