Schroders plc (SDR.L)

| Previous close | 377.00 |

| Open | 377.40 |

| Bid | 384.40 x 0 |

| Ask | 384.80 x 0 |

| Day's range | 377.00 - 385.40 |

| 52-week range | 346.20 - 464.20 |

| Volume | |

| Avg. volume | 2,356,325 |

| Market cap | 5.971B |

| Beta (5Y monthly) | 1.21 |

| PE ratio (TTM) | 16.02 |

| EPS (TTM) | 0.24 |

| Earnings date | 01 Aug 2024 |

| Forward dividend & yield | 0.22 (5.59%) |

| Ex-dividend date | 21 Mar 2024 |

| 1y target est | 408.33 |

Bloomberg

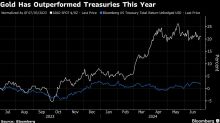

BloombergSchroders, UBS Global Wealth Push Gold as Key Haven This Year

(Bloomberg) -- Excessive government spending in the US and geopolitical uncertainty are underpinning calls from some investor heavyweights to buy gold as a hedge against sovereign debt risks. Most Read from Bloomberg24-Hour Stock Trading Is Booming – and Wall Street Is RattledBlackRock Buys Preqin for $3.2 Billion in Private Data PushTrump as President or Private Citizen: Why Supreme Court’s Immunity Ruling Is a TestFrance’s Market Rally Falters as Investors See Enduring RiskJustice Department t

Barrons.com

Barrons.comElections Don’t Matter When It Comes to Your Portfolio

As a contentious presidential contest heats up, some investors are clinging to cash. But research has shown that presidential elections have a minimal impact on the markets.

Fool.co.uk

Fool.co.uk5 stocks with 5%+ yields I’d love to buy and hold in a Stocks and Shares ISA

Harvey Jones is keen to add these five FTSE 100 high-yielders to his Stocks and Shares ISA, ideally before they recoup their lost value. The post 5 stocks with 5%+ yields I’d love to buy and hold in a Stocks and Shares ISA appeared first on The Motley Fool UK.