NIKKEI 225

37,552.16 +113.55 (+0.30%) HANG SENG

16,828.93 +317.24 (+1.92%) CRUDE OIL

83.33 +1.43 (+1.75%) GOLD FUTURES

2,340.00 -6.40 (-0.27%) DOW

38,504.94 +264.96 (+0.69%) Bitcoin GBP

53,538.99 +184.16 (+0.35%)

Yelp Inc. (YELP)

| Previous close | 39.53 |

| Open | 39.69 |

| Bid | 40.45 x 800 |

| Ask | 40.50 x 1000 |

| Day's range | 39.75 - 40.54 |

| 52-week range | 26.53 - 48.99 |

| Volume | |

| Avg. volume | 797,088 |

| Market cap | 2.765B |

| Beta (5Y monthly) | 1.48 |

| PE ratio (TTM) | 29.99 |

| EPS (TTM) | 1.35 |

| Earnings date | 02 May 2024 - 06 May 2024 |

| Forward dividend & yield | N/A (N/A) |

| Ex-dividend date | N/A |

| 1y target est | 45.31 |

Simply Wall St.

Simply Wall St.Yelp (NYSE:YELP) shareholders have earned a 31% return over the last year

These days it's easy to simply buy an index fund, and your returns should (roughly) match the market. But if you pick...

Business Wire

Business WireYelp Appoints Dan Jedda to its Board of Directors as George Hu Steps Down

SAN FRANCISCO, March 28, 2024--Yelp Inc. (NYSE: YELP), the company that connects people with great local businesses, today announced the appointment of Dan Jedda, chief financial officer of Roku, Inc., to its Board of Directors, effective March 29, 2024. This appointment coincides with the departure of George Hu, who will be stepping down from the Yelp Board of Directors on the same date after dedicating over five years of service as a director and as a member of the Compensation Committee of th

GuruFocus.com

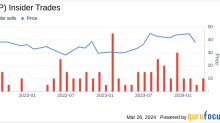

GuruFocus.comYelp Inc (YELP) COO Joseph Nachman Sells 6,000 Shares

Yelp Inc (NYSE:YELP), the company that connects people with great local businesses, has reported an insider sale according to a recent SEC filing.