Caesars Entertainment Inc (CZR) Q1 2024 Earnings: Misses Revenue and Net Loss Projections

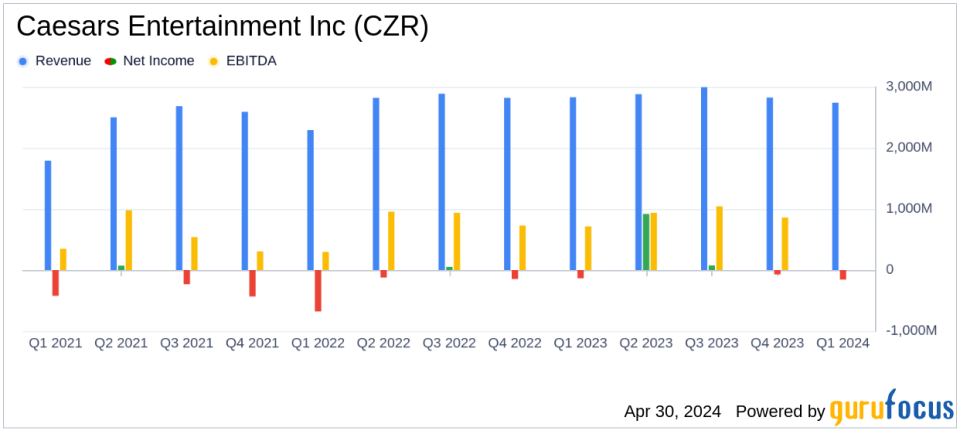

Revenue: Reported at $2.7 billion, falling short of the estimated $2.835 billion.

Net Loss: Increased to $158 million from a net loss of $136 million in the previous year, and was significantly below the estimated net loss of $11.58 million.

EPS: Recorded a loss of $0.73 per share, deeper than the estimated loss of $0.07 per share.

Same-Store Adjusted EBITDA: Declined to $853 million from $947 million year-over-year.

Digital Segment Performance: Caesars Digital Adjusted EBITDA improved to $5 million from a loss of $4 million in the prior year.

Debt and Liquidity: Total debt stood at $12.4 billion with cash and cash equivalents at $726 million as of March 31, 2024.

Future Outlook: Management remains optimistic about improved operating results for the remainder of the year despite first-quarter headwinds.

On April 30, 2024, Caesars Entertainment Inc (NASDAQ:CZR) disclosed its first-quarter financial results via an 8-K filing, revealing a challenging period with a net loss and revenue decline. The company reported GAAP net revenues of $2.7 billion, falling short of the estimated $2.835 billion and marking a decrease from the $2.8 billion recorded in the same period last year. The net loss widened to $158 million from $136 million year-over-year.

Caesars Entertainment, the largest casino-entertainment company in the US, operates about 50 domestic gaming properties across key markets including Las Vegas and various regional segments. The company has expanded significantly since its inception in 1937, now offering a wide range of gaming, entertainment, and hospitality amenities, along with online gaming and sports betting platforms.

Performance and Segment Breakdown

The Las Vegas segment, usually a strong revenue driver, experienced a 4.5% decline in revenue to $1.028 billion. This was primarily due to lower-than-expected hold despite record occupancy influenced by events such as the Super Bowl and Chinese New Year. The regional segment also saw a decrease of 1.7% in revenue, attributed to adverse weather conditions offset slightly by new property openings.

Conversely, Caesars Digital showed a positive trajectory with an 18.5% increase in revenue, reaching $282 million. This growth, however, was tempered by lower-than-expected hold in online sports, impacted by unfavorable outcomes during the Super Bowl and March Madness.

Financial Health and Future Outlook

As of March 31, 2024, Caesars reported $726 million in cash and cash equivalents, down from $1.005 billion at the end of 2023. The total debt stood at $12.4 billion, reflecting the company's significant leverage. Management plans to utilize free cash flows to reduce debt throughout 2024, with an estimated capital expenditure of $800 million excluding joint venture capex.

CEO Tom Reeg expressed optimism about overcoming the first quarter's headwinds and improving operating results for the remainder of the year. This sentiment is supported by strategic investments and operational adjustments aimed at enhancing performance across all segments.

Investor and Analyst Perspectives

Adjusted EBITDA, a critical measure of operational efficiency, declined by 9.9% to $853 million from $947 million, indicating ongoing operational challenges. The earnings report underscores the need for Caesars to bolster its operational efficiency and navigate the competitive and macroeconomic landscape effectively.

Investors and analysts might remain cautious, watching closely how Caesars manages its operational challenges and debt levels in the increasingly competitive casino-entertainment landscape. The company's ability to leverage its broad market presence and digital platforms while optimizing cost structures will be crucial for its financial recovery and growth.

For detailed insights and further information, stakeholders are encouraged to access the full earnings report and join the upcoming investor call scheduled for later today.

Explore the complete 8-K earnings release (here) from Caesars Entertainment Inc for further details.

This article first appeared on GuruFocus.

Yahoo Finance

Yahoo Finance