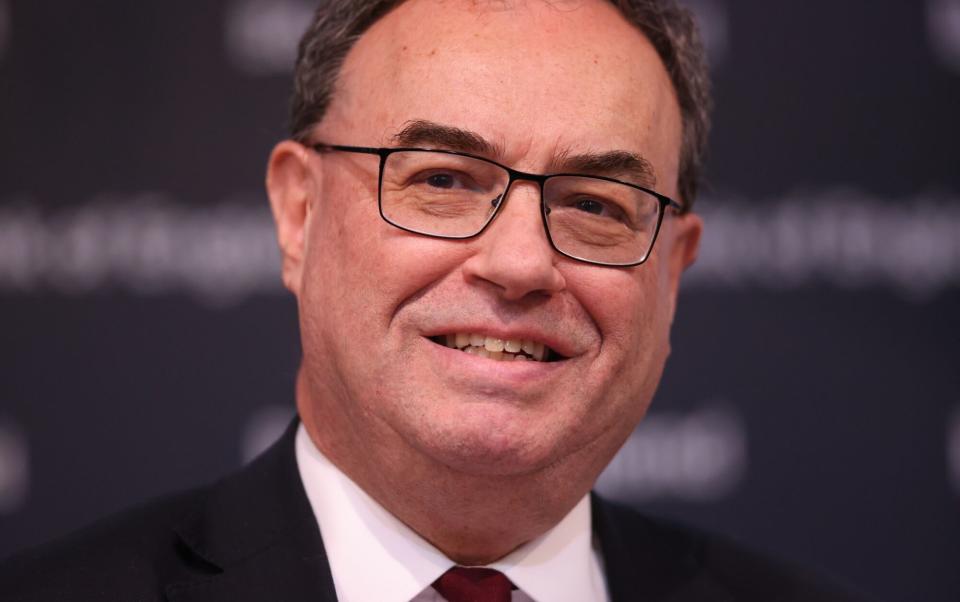

Hunt urges Bailey not to cut interest rates too quickly

Jeremy Hunt has urged the Bank of England not to cut interest rates too quickly after Governor Andrew Bailey opened the door to a steep fall in borrowing costs.

The Chancellor intervened after Mr Bailey suggested rates could come down faster than market expectations.

The Bank held borrowing costs at 5.25pc but suggested the first cut might come as soon as next month.

Asked if he hopes rates would fall before the general election, Mr Hunt said he “would much rather that they waited until they’re absolutely sure inflation is on a downward trajectory than rush into a decision that they had to reverse at a later stage”.

Stressing that the Bank of England takes its decisions independently, he added: “What we want is sustainably low interest rates, and I think what’s encouraging is that the Bank of England Governor, for the first time, has expressed real optimism that we’re on that path.”

Mr Hunt’s warning stems from fears that the Bank could trigger a renewed surge in mortgage costs if they were forced to change course on interest rates.

Around 1.5 million homeowners are expected to reach the end of fixed-rate mortgage deals in 2024.

It came as Huw Pill, the Bank’s chief economist, said that high levels of immigration were fuelling Britain’s housing crisis.

He said there have been “quite large increases in immigration into the UK of late”, which has led to rising levels of demand for housing.

Investors are pricing in two rate cuts by the end of this year but increased their bets on a reduction next month after Mr Bailey said they could fall by more than expected.

A reduction in interest rates would boost Rishi Sunak by easing financial pressures on households.

The Prime Minister, who last year fulfilled his pledge to halve inflation, is battling to close a yawning gap in the polls before an expected autumn election.

Mr Bailey declared he was “optimistic” that the era of higher inflation was at an end, though he stressed rate cuts in June were “neither ruled out nor a fait accompli”.

The Governor said recent falls in inflation had been “encouraging”, adding that the Bank believes inflation may already be at its 2pc target following a drop in the energy price cap.

Inflation stood at 3.2pc in March.

He said: “With the progress we have made, to make sure that inflation stays around the 2pc target - it is likely that we will need to cut Bank Rate over the coming quarters and ... possibly more so than currently priced in market rates.”

He also said the economy had “turned a corner” as it upgraded its growth forecasts over the next three years.

Official figures on Friday are expected to confirm the economy climbed out of recession at the start of this year.

Mr Pill added that policymakers on Threadneedle Street will consider rate cuts in the “next few meetings”, adding that they would be prepared to lower rates before the US Federal Reserve.

However, in a sign that the Monetary Policy Committee (MPC) is becoming increasingly divided, he echoed Mr Hunt’s warning about cutting rates too quickly, adding: “If we give up too early then we will be stuck with inflation away from target for a long time.”

Tensions have previously arisen over Mr Bailey mistakenly claiming last year that interest rates may have peaked at 4pc.

However, stubborn inflation forced rates up higher, causing market chaos.

The Bank also said tax cuts in the Spring Budget would lift economic growth over the next few years and encourage more people back to work.

However, the MPC, which sets interest rates, said stronger growth was partly driven by increases in the population, with higher wages in the public sector being the main driver of upgrades to its wage forecasts this year.

Mr Bailey said the next rates decision will be based on new sets of data relating both to inflation and the health of the jobs market, adding: “That will help us in making that judgement afresh.”

The Bank’s latest health check of the economy showed Britain bounced back from recession at the start of this year, growing by an estimated 0.4pc in the first quarter.

It said inflation had probably fallen back to its 2pc target in April, from 3.2pc in March, adding that food price rises would stabilise at around this level for the rest of the year.

The Bank expects pay rises to average around 5.5pc this year.

However, it warned pay rises for workers in “consumer-facing sectors” were likely to be much higher at 7pc, with a near double-digit increase in the minimum wage “overwhelmingly” cited as the main driver of higher pay.

It added that pay deals in the latter half of the year were set to be “materially lower” than those seen so far in 2024, suggesting average pay growth is likely to cool further.

Threadneedle Street said “fierce competition” from discount supermarkets like Lidl and Aldi was also likely to temper food price rises to between 2pc and 3pc for the rest of the year.

Sir Dave Ramsden, the Bank’s deputy governor, joined calls to cut the cost of borrowing in a 7-2 vote amid signs that inflation was now on a “firm downward trajectory”.

Investors currently expect the Bank to start cutting rates in August, trimming them to 4.75pc by the end of the year.

Read the latest updates below.

06:06 PM BST

Thanks for joining us today

My colleague Chris Price will be back tomorrow morning to cover the opening of the markets in London.

I’ll leave you with some of our latest stories elsewhere at The Telegraph:

‘Hydrogen town’ plan cancelled after protests over forced switch from natural gas

London’s stock market collapse is ‘massively overstated’, says Hunt

Matthew Lynn: These rail strikes are just a taste of life under Labour

05:15 PM BST

Footsie closes up

The FTSE 100 closed up 0.3pc today. The biggest riser was Anglo American, up 3pc, followed by JD Sports, up 2.9pc. The biggest faller was 3i, down 5.2pc, followed by HSBC, down 4.2pc.

Meanwhile, the FTSE 250 rose 0.2pc. The biggest riser was Harbour Energy, up 7.7pc, followed by recruiter Hays, up 4.1pc. The biggest faller was Patria Private Equity Trust, down 5.5pc, followed by alternative investment company Petershill Partners, down 4.8pc.

04:47 PM BST

World shares hit new highs with investors encouraged by interest rate hopes

World stocks have edged higher today, helped by a larger-than-expected rise in US weekly jobless claims that buoyed interest rate cut hopes.

The pan-European STOXX 600 and Britain’s FTSE 100 scaled fresh record highs, last up 0.24pc and 0.36pc respectively after the Bank of England kept rates unchanged. On Wall Street, the Dow Jones Industrial Average rose 0.46pc, the S&P 500 gained 0.35pc and the Nasdaq Composite gained 0.27pc.

But investors cheered indications more policymakers are warming to cutting rates soon.

The Bank of England sent a message that bets on the first cut being in August might be too conservative as it lowered its inflation forecasts for two and three years’ time to 1.9pc and 1.6pc - below its 2[c target - from its February projections of 2.3pc and 1.9pc.

In the United States, initial claims for state unemployment benefits increased 22,000 to a seasonally adjusted 231,000 for the week ended May 4, the Labor Department said.

04:44 PM BST

Bloomberg pays police £100k for extra patrols around its London headquarters

Bloomberg, the financial media giant, is paying £100,000 per year to the City of London Police for officers to patrol the area around its flagship London headquarters. Michael Bow reports:

The news and data company, founded by billionaire Michael Bloomberg, has a private agreement in place with the Square Mile’s local police force to provide extra officers around its £1bn office in central London.

According to a Freedom of Information request by City A.M., Bloomberg paid the force £90,000 per year in both 2020 and 2021 and increased the fee to £100,000 for the year ending March 2023.

The area around Bloomberg’s HQ is often the site of noisy and disruptive climate protests by groups such as Extinction Rebellion and Just Stop Oil.

Protestors from Extinction Rebellion have in the past blocked Mansion House junction, which sits yards from the Bloomberg offices, and attacked sites including the historic Guildhall with graffiti.

Anti fossil-fuel and political marches also regularly pass the Bloomberg building owing to its proximity to the Bank of England.

The City of London Police said Bloomberg’s payments were comparable to funding provided to police other private events like music concerts and football matches.

Rob Atkin, chief superintendent, for the City of London Police, said: “This private agreement has fostered a sense of safety in the surrounding area, enhancing the experience for Bloomberg employees, as well as the millions of commuters and residents who frequent the City each week.”

Bloomberg’s contribution is comparatively small given the force’s £209m annual budget.

04:30 PM BST

WH Smith to open more Toys R Us locations as it boosts revival of brand

WH Smith has unveiled the first 17 locations for the next tranche of Toys R Us concessions to launch within its stores over the summer as the revival of the children’s chain gathers pace.

The high street group, which has already opened nine Toys R Us shop-in-shops as part of its retail partnership with the brand, is to open another 30 of the concessions by the end of August.

The next wave of 17 will be launched nationwide within the next two months as the group looks to bring back a brand “known and loved since the mid-80s”.

Three of the concessions - in Hereford, Herefordshire, Leamington Spa in Warwickshire and Fosse Park in Leicester - will open on May 25.

The firm’s move to open the first concessions last year marked a return for the children’s chain following its collapse more than six years ago.

Toys R Us filed for bankruptcy in 2018, shutting the doors on all its 100 UK shops and resulting in the loss of more than 2,000 jobs.

It announced plans for a relaunch in October 2022, before striking an exclusive deal with WH Smith to run concessions.

04:21 PM BST

Watches of Switzerland buys Italian jewellery brand as it looks to US market

The UK’s top Rolex dealer has bought Italian jewellery brand Roberto Coin in a deal that will help the group expand in America.

Shares in the London-listed Watches of Switzerland rose more than 3pc after it confirmed the deal, worth £104m.

Roberto Coin was founded in Vicenza, Italy, in 1996 and is now the sixth-largest jewellery brand by sales in the US.

Brian Duffy, chief executive of Watches of Switzerland, said: “We have partnered with Roberto Coin for over a decade in the US …

“It will allow us to take one of the fastest growing jewellery brands in the US and use our retail and operational expertise to accelerate growth and further elevate the Roberto Coin proposition in north and central America.”

04:08 PM BST

Oil prices rise

Oil prices rose sharply this morning, before falling back somewhat this afternoon, among anxiety in the markets around tensions in the Middle East.

Brent futures rose 0.4pc to $83.90 a barrel, while US crude gained half a percent to $79.33 a barrel.

03:59 PM BST

TikTok to label AI-generated material amid concerns over fake social media content

TikTok will begin labeling content created using artificial intelligence when it’s uploaded from outside its own platform.

TikTok says its efforts are an attempt to combat misinformation from being spread on its social media platform.

The move is part of an overall effort by those in the technology industry to provide more safeguards for AI usage. In February, Facebook owner Meta announced that it was working with industry partners on technical standards that will make it easier to identify images and eventually video and audio generated by artificial intelligence tools.

The efforts would include Facebook and Instagram users seeing labels on AI-generated images that appear on their social media feeds.

Google said last year that AI labels are coming to YouTube and its other platforms.

TikTok said that it’s teaming with the Coalition for Content Provenance and Authenticity and will use their Content Credentials technology.

The company said that the technology can attach metadata to content, which it can use to instantly recognise and label AI-generated content. TikTok said its use of the capability started todaty on images and videos and will be coming to audio-only content soon.

03:54 PM BST

Bank of England’s careful take on interest rates could boost the Footsie, says analyst

The Bank of England’s cautious management of interest rates could be good for share prices in the long run, a City analyst has claimed.

Kathleen Brooks, research director at XTB, said:

The FTSE 100 and the FTSE 350 both reached fresh intra-day record highs on the back of this report. Stocks are fading slightly as we move towards the end of the European session, potentially because the BOE would not commit to a June cut.

However, we think that this report could be positive for UK stocks in the long term.

The GDP and inflation forecasts included in the report suggest that the disinflation trend in the UK can continue at nearly full employment, and the growth path is set to improve consistently over the next three years.

CPI is expected to fall to the BOE’s target in 2026, a year earlier than what was anticipated in the February report. The BOE is painting a positive economic backdrop for the future of the UK, and that is good news for UK stocks.

03:43 PM BST

Bank of England has been too slow to cut rates, says free-market economist

The Bank of England has been too slow to beging cutting rates, a leading free-market economist has claimed. Julian Jessop, economics fellow at the Institute of Economic Affairs, said:

The Monetary Policy Committee left rates on hold this week, as expected, but there are some clear signals that cuts are coming soon.

For a start, [Monetary Policy Committee member] Dave Ramsden joined Swati Dhingra in voting for an immediate cut. This means that only three of the other seven members need to switch camp.

Moreover, the Bank lowered its medium-term inflation forecasts, with the two-year projection now slightly below the 2pc target. Crucially, this forecast is based on market expectations for the path of interest rates, which assume some quite large cuts.

Finally, the statement included some new language which emphasised the importance of the “forthcoming data releases”. With two sets of price and labour market releases between now and the next meeting in late June, rates could be cut next month, or in August at the latest.

The Bank is still moving too slowly for comfort. But the MPC does at least seem to be paying more attention to developments in broad money and credit, which may now play a bigger part in decision making. Better late than never.

03:36 PM BST

FTSE 100 hits fresh record amid rate cut hopes

The FTSE 100 has risen to a fresh record high after Andrew Bailey signalled that interest rates could be cut faster than markets expect.

The UK’s blue chip index just hit an unprecedented 8,394 - up 0.5pc on the day.

Jessica Shuman, senior investment specialist at Insight Investment said:

No change in rates or voting patterns at today’s Monetary Policy Committee meeting, with two members again voting for rate cuts.

However, in a significant boost for markets the Bank reduced its inflation forecasts across its entire three-year horizon.

In the accompanying statement governor Baily sounded particularly dovish, noting his optimism that things are moving in the right direction but that more evidence was needed that inflation will remain low before the Bank can start to cut rates.

This puts the April CPI number firmly in the spotlight. Markets have become more optimistic after the meeting.

However, barring a spectacular inflation undershoot in April, June still seems a little too early for the Committee to pull the trigger against a backdrop where markets are pushing out expectations for US cuts.

I will sign off at this point, but Alex Singleton will keep you up to speed with the latest developments following the Bank of England’s latest interest rate decision.

03:25 PM BST

Bailey: Bank of England will not be pressured into cuts

Before the Chancellor spoke, Andrew Bailey said in his press conference this afternoon that the Bank of England will not bow to increased pressure from politicians to cut interest rates.

The Governor said:

We are an independent central bank. We have a very clear remit. It’s our duty to exercise our duty at all times.

When we are sitting in a room as the Monetary Policy Committee, we never discuss politics... It isn’t a consideration in that respect.

When pressed on whether an upcoming election could influence how the Bank makes its decisions on rates, Mr Bailey added: “We will take the decisions at each meeting which are consistent with our remit. That’s our job and we will do our job.”

Today the Chancellor said he hoped the Bank of England waited until it is certain that cutting rates would not lead to another spike in inflation. Mr Hunt said:

It is right the Bank takes these decisions independently and they are ultimately very finely balanced judgements.

But what we know is that you should never take risks with inflation and I would much rather that they took their time to make sure that we lower interest rates at a time when we can do so sustainably and for the long term because that is the way that will really benefit people who want to take out mortgages and that will help the housing market and people get pinto the housing ladder.

02:59 PM BST

Hunt: Our decisions are paying off and we need to see them through

Asked if the argument for cutting interest rates was stronger than ever, Chancellor Jeremy Hunt said:

What the Bank of England Governor said today in the report that was published is that the decisions that we have taken in the Budget will increase our GDP and that he is confident that inflation will fall to its target level of 2pc.

Now, compared to 18 months ago when it was over 11pc, it is a dramatic change. Inflation hitting its target a year earlier than many people had predicted.

And what that demonstrates is that the decision that we have taken as a country are paying off and we now need to see them through.

02:55 PM BST

Hunt: Bank of England must be ‘absolutely sure’ before rate cut

Chancellor Jeremy Hunt said the Bank of England’s decision on rates was “finely balanced”.

Asked if he had been hoping rates would be cut ahead of the general election, Mr Hunt said:

I welcome the fact the Bank of England’s obviously thought about this very hard, they take this decision independently.

And I would much rather that they waited until they’re absolutely sure inflation is on a downward trajectory than rush into a decision that they had to reverse at a later stage.

What we want is sustainably low interest rates, and I think what’s encouraging is that the Bank of England governor, for the first time, has expressed real optimism that we’re on that path.

02:46 PM BST

Hunt: I’d rather Bank of England did not rush into rate cuts

Jeremy Hunt has said he wanted “sustainably low interest rates” when asked about the Bank of England’s decision on Thursday to hold rates at 5.25pc.

The Chancellor told reporters:

What we want is sustainably low interest rates.

I would much rather that they waited until they’re absolutely sure inflation is on a downward trajectory than rushed into a decision that they had to reverse at a later stage.

02:34 PM BST

Wall Street mixed after jobs market slowdown

US stock markets were mixed at the opening bell after figures showing the number of claims for unemployment benefits has increased - albeit still from historically low levels.

The Dow Jones Industrial Average has fallen 0.1pc to 30,020.74 while the S&P 500 was flat at 5,188.43.

The tech-heavy Nasdaq Composite rose by 0.1pc to 16,320.38.

02:23 PM BST

Bank of England ‘very close to first rate cut’, say economists

James Smith, ING developed markets economist, said:

The Bank of England is getting very close to its first rate cut.

That much is clear from the latest policy statement which, while keeping rates on hold at 5.25pc, has a distinctly more optimistic flair.

It echoes recent comments from Governor Andrew Bailey, who has been hammering home the message that the UK’s inflation outlook is quite different to the US.

We’re still leaning slightly more towards an August start date for rate cuts, though it’s a close call.

What isn’t in doubt is that the Bank is comfortable with moving ahead of the US Federal Reserve.

02:11 PM BST

Interest rates to hit 3pc next year, say economists

The Bank of England will cut interest rates to 3pc next year, economists predict, as inflation falls further than expected.

Paul Dales, chief UK economist at Capital Economics, said:

While leaving interest rates at 5.25pc today as widely expected, the Bank of England gave the impression that it is close to cutting interest rates and also hinted that rates may need to fall further than investors expect.

This lends some support to our view that the Bank will first cut rates at the next meeting in June and that, due to inflation falling to only 1pc later this year, the Bank will reduce rates to 3pc next year rather than to 3.75pc to 4pc as currently expected by investors.

The Bank seemed a little more open to cutting interest rates at the next policy meeting in June than we had expected.

Admittedly, in the press conference Governor Bailey said “we are not yet at a point we can cut Bank Rate”.

But he also said that two full sets of data (on inflation and the labour market) before the June meeting will help the Bank judge when to ease the restrictiveness of policy, although “a change in Bank Rate in June is neither ruled out nor fait accompli”.

02:02 PM BST

Pound gains after weak US jobs data

After its earlier declines, the pound has now moved higher against the dollar despite the signals from the Bank of England that interest rate cuts are on the way.

Sterling has strengthened against the dollar after figures showing the number of Americans applying for unemployment benefits jumped to its highest level in more than eight months last week in another sign that the jobs market may be softening.

Unemployment claims for the week ending May 4 rose by 22,000 to 231,000, up from 209,000 the week before, the Labor Department reported.

Last week’s claims were the most since the final week of August last year.

However, the figures remain at historically low levels since the pandemic purge of millions of jobs in the spring of 2020.

Weekly unemployment claims are considered a proxy for the number of US layoffs in a given week and a sign of where the job market is headed.

The four-week average of claims, which softens some of the weekly volatility, rose by 4,750 to 215,000.

In total, 1.79m Americans were collecting jobless benefits during the week that ended April 27. That’s up 17,000 from the previous week.

The pound was up 0.1pc against the dollar at $1.25.

2/ Continuing claims drifting down in recent weeks, though of course this will change if initial claims continue to run at 230K. pic.twitter.com/NMeIsrQRIn

— Guy Berger (@EconBerger) May 9, 2024

01:48 PM BST

Bailey refuses to criticise FCA ‘name-and-shame’ plans

Andrew Bailey refused to criticise plans by the Financial Conduct Authority (FCA) to “name and shame” companies that are under investigation.

The Governor of the Bank of England, who is a former chief executive of the FCA, said efforts should be made to resolve the “tension” between the principle of being “innocent until proven guilty” and the potential to mis-sell to consumers.

Companies have privately complained that the plans risk driving away investment and customers. Ministers including Chancellor Jeremy Hunt have voiced concerns that the policy will have a chilling effect on the City.

Mr Bailey said:

What needs to be debated in this and brought to conclusion is a tension.

The tension is this: it is between the principle, which is important obviously, of innocent until proven guilty, but the problem with that is if a regulator - and this could be the PRA - if an investigation is going on and during the course of that investigation - and in the nature of these things they can take time - nothing can be said about that, then the risk is obvious that some misselling to consumers is going on.

I think we need to get back to how we can reconcile those two potentially conflicting principles, rather than say ‘you can’t do this, you can’t do that’.

There is an issue there and we should think about all the ways they can possibly solve that tension.

01:34 PM BST

Bank of England ‘moving too slowly for comfort’, economists warn

Julian Jessop, economics fellow at the Institute of Economic Affairs think tank, said:

The Monetary Policy Committee left rates on hold this week, as expected, but there are some clear signals that cuts are coming soon.

For a start, Dave Ramsden joined Swati Dhingra in voting for an immediate cut. This means that only three of the other seven members need to switch camp.

Moreover, the Bank lowered its medium-term inflation forecasts, with the two-year projection now slightly below the 2pc target. Crucially, this forecast is based on market expectations for the path of interest rates, which assume some quite large cuts.

Finally, the statement included some new language which emphasised the importance of the ‘forthcoming data releases’. With two sets of price and labour market releases between now and the next meeting in late June, rates could be cut next month, or in August at the latest.

The Bank is still moving too slowly for comfort. But the MPC does at least seem to be paying more attention to developments in broad money and credit, which may now play a bigger part in decision making. Better late than never.

01:23 PM BST

Bailey: Minimum wage is talked about a lot by employers

Governor Andrew Bailey said the rise in the minimum wage is “does get talked about a lot” when the Bank of England’s agents visited business leaders across the country.

In response to a question by our economics editor Szu Ping Chan, Mr Bailey said it was important to understand the “headline impact” of the rise in the National Living Wage, which increased from April 1 by £1.02 to £11.44 for workers aged over 21.

However, he added the key thing to find out from businesses was “what is the demand for labour?” and “to what extent are you passing it through into prices?”

He added: “The sense I have been picking up for some months now is greater doubts about passing it on. But we will see.”

01:11 PM BST

Bank of England risks cutting too late, investors warn

Neil Birrell, chief investment officer at Premier Miton Investors, said:

No change to the base rate was not a surprise, but two policy makers voted for a cut, so there is some momentum in that direction as we go through the year.

It’s clear that the path of inflation will be the key driver and it’s possible that the Bank leaves it too late to move, as they are unlikely to risk a renewed upward trend in inflation.

For now, it’s over to the ECB to see if they are the first to blink.

01:06 PM BST

Bank of England is ‘half step’ towards rate cuts, say economists

Rob Wood, chief UK economist at Pantheon Macroeconomics, said the Bank had “moved another half step towards a rate cut”.

He said: “The MPC’s new forecasts - which have inflation below target at the two-year horizon if interest rates follow the path expected by markets ahead of the decision - suggest the MPC needs to start cutting by August.”

But he added:

There is enough in the forecasts and minutes for us to stick to our call for a June rate cut, and reductions at alternative meetings thereafter.

That would leave Bank rate at 4.5pc at the end of 2024 and 3.5pc at the end of 2025.

It probably wouldn’t take much for the MPC to delay the first cut until August, however.

01:01 PM BST

We don’t think inflation will stay at target in coming months, says Bailey

Andrew Bailey has reitereated that he does not think that a widely-expected steep decline in inflation will mean the battle has been won against rising prices.

He said:

We may hit the target in the next two or three months but we don’t think it will stay there.

We have to continually reassess the view: ‘Do we think we’re gonna get there and it’s gonna stay there?’

Inflation is still above our 2% target. Lower oil and gas prices mean that inflation is likely to drop to around 2% in coming months before rising slightly. It should then settle back down again. https://t.co/2lnXthHbMt #MonetaryPolicyReport #inflation pic.twitter.com/yvsYPQa3lC

— Bank of England (@bankofengland) May 9, 2024

12:55 PM BST

Bailey: We have no preconceptions about pace of interest rate cuts

Andrew Bailey said the committee has “no preconceptions” about how far and how fast it can lower interest rates, and it make a judgment based on the economic data it sees before each meeting.

The Governor said it was “not a law” that the US Federal Reserve would change its interest rates first and that other central banks would follow.

It comes as the Fed is expected to delay interest rate cuts until after the summer as its strong economy continues to risk fuelling inflation.

12:44 PM BST

Markets risk underestimating size of rate cuts, Bailey says

Andrew Bailey has said interest rates will need to be cut to help the Bank of England keep inflation at its 2pc target.

He said: “With the progress we’ve made, to make sure that inflation stays around the 2pc target, that inflation will neither be too high nor too low, it is likely that we will need to cut Bank Rate over the coming quarters, and make monetary policy somewhat less restrictive over the forecast period, possibly more so than currently priced into market rates.”

Money markets are pricing in two rate cuts this year, at present.

12:35 PM BST

Bailey: June rate cut ‘neither ruled out nor a fait accompli’

Governor Andrew Bailey said the risks to inflation remain from the Middle East.

He said inflation would “edge up” later this year.

He said a reduction in interest rates in June was “neither ruled out nor a fait accompli.”

12:33 PM BST

Bailey: First quarter ‘a bit stronger’ than expected

The Bank of England press conference has begun after its decision to hold interest rates at 5.25pc.

Governor Andrew Bailey said policymakers will examine upcoming data releases to ensure inflation will fall back to target “and stay there” before cutting rates.

On the economy, he said: “We think the first quarter of this year has been a bit stronger”.

12:30 PM BST

Businesses worried after ‘another month of hesitation’

As the Bank of England held interest rates steady, British Chambers of Commerce’s head of research David Bharier said:

Businesses will be hopeful that tentative signals from the Bank translates into a rate cut later this year.

However, for many SMEs borrowing costs remain very high – and today’s hold means another month of hesitation on investment and growth.

Our research shows that business concern about interest rates is easing, in part due to the period of stability since last August.

Our latest survey showed 35pc of firms worried about the cost of borrowing, down from 39pc at the end of last year. But these remain high levels of concern, compared to pre-pandemic.

Tomorrow’s GDP figures could bring some welcome news, but economic conditions remain tough. Alongside high interest rates, firms are grappling with rising costs, skills shortages and further trade friction with the EU.

Business confidence has been gently ticking up as they see a way out of the inflation and interest rate double whammy, but policymakers need to support this with a clear plan for growth and stability.

12:26 PM BST

FTSE 100 hits fresh record high amid rate cut optimism

The FTSE 100 spiked to a fresh record high amid optimism that the Bank of England will begin cutting interest rates this summer.

The UK’s blue-chip stock index jumped as much as 0.5pc to 8,394.01 as Governor Andrew Bailey said he is “optimistic” about the outlook for the economy.

Mr Bailey said there had been “encouraging news” on inflation which the Bank expects to come close to its 2% target between April and June.

12:20 PM BST

Pound falls as traders favour June rate cut

The pound has fallen amid increasing bets that the Bank of England will cut interest rates in June.

Sterling was down 0.3pc against the dollar at $1.246 and slumped 0.2pc against the euro, which is worth 86p.

Money markets imply there is a 55pc chance that the Bank of England will cut interest rates by a quarter of a percentage point at its next meeting in June.

12:18 PM BST

Bank of England raises growth outlook

The Bank of England said it expects the UK economy to grow by 0.5pc this year and 1pc in 2025, slightly higher than previous predictions.

12:13 PM BST

Bank of England expects deeper decline in inflation

Inflation is expected to fall more than previously thought over the coming years, the Bank of England has projected, dropping below its 2pc target to 1.5pc in 2026.

The consumer prices index (CPI) inflation is expected to fall below the Bank’s 2pc target between April and June, but rise again to 2.6pc in the second half of this year as the impact of recent drops in energy prices fades.

In the longer term, the Bank dropped its projections for CPI inflation to 2.25pc for 2025 and 1.5pc in 2026, down 0.25 and 0.5 percentage points respectively on February estimates.

The projection came in the Bank’s May Monetary Policy Committee (MPC) report, which signalled optimism from recent falls in retail inflation.

The report said persistently high interest rates had helped push headline inflation down, as the MPC voted again to maintain rates at 5.25pc.

12:11 PM BST

Traders favour June for first interest rate cut

Investors think it is increasingly likely that the Bank of England will cut interest rates in June.

Money markets imply there is a more than 50pc chance of that policymakers will reduce borrowing costs next month for the first time since beginning its rate rising campaign at the end of 2021.

If it does not happen then, traders have priced in that the first cut will have happened by the next meeting in August.

12:06 PM BST

Bailey ‘optimistic that things are moving in the right direction’

Andrew Bailey, Governor of the Bank of England said:

We’ve had encouraging news on inflation and we think it will fall close to our 2pc target in the next couple of months.

We need to see more evidence that inflation will stay low before we can cut interest rates.

I’m optimistic that things are moving in the right direction.

12:05 PM BST

Committee split 7-2 as it holds rates

The Monetary Policy Committee which sets interest rates was split 7-2 as it voted in favour of holding interest rates at 5.25pc.

Deputy Governor Sir Dave Ramsden joined Swati Dhingra in voting for a cut to borrowing costs to 5pc.

12:00 PM BST

Bank of England holds interest rates at 5.25pc

The Bank of England has held interest rates at 5.25pc for the sixth consecutive meeting despite sharp falls in inflation.

The Monetary Policy Committee voted to leave borrowing costs unchanged, prolonging the squeeze on households that began when interest rates started rising at the end of 2021.

It comes despite the latest official figures showing that inflation fell to 3.2pc in March, as it edges closer to the Bank’s 2pc target.

11:56 AM BST

Pound lower ahead of interest rates decision

The pound has edged lower ahead of the Bank of England’s imminent interest rate decision.

Sterling was last down 0.1pc on the day against the dollar at $1.249.

The yield on the benchmark 10-year gilt was up slightly to 4.16pc.

11:41 AM BST

Bank of England expected to hold rates steady

The Bank of England is widely expected to keep interest rates on hold when it announces its next decision at midday.

The decision will be accompanied by the Monetary Policy Committee’s latest forecasts for the economy.

Fiona Cincotta, senior financial market analyst at City Index, said:

The market will be watching to see whether the Bank of England lowers its inflation forecasts, adopts more dovish forward guidance, or considers potentially cutting rates.

In the March Bank of England meeting, the vote split was 8 to 1. This vote split could become more dovish in this meeting.

Several policymakers, including Sir David Ramsden, have suggested in recent speeches that they could be moving towards a position where they’re comfortable cutting rates.

A more dovish rate vote split of two or more waiting for a cart could point to a sooner rate cut from the central bank.

11:20 AM BST

Wall Street poised to fall ahead of jobs data

US stock indexes slipped in premarket trading ahead of jobless claims data that could provide a clearer picture of the Federal Reserve’s interest rate agenda for the year.

The S&P 500 ended flat on Wednesday after four sessions of gains and the Nasdaq slipped for a second day.

The Dow Jones Industrial Average, however, stretched its winning streak to a sixth straight session and closed above 39,000 points for the first time in five weeks.

With the latest jobs data out later, money market traders are pricing in US rate cuts of 43 basis points (bps) by the end of 2024, according to LSEG’s rate probabilities app.

Ahead of the opening bell, the S&P 500 was down 0.2pc and the Nasdaq 100 had fallen 0.3pc. The Dow Jones Industrial Average was down 0.2pc.

10:59 AM BST

Watches of Switzerland buys Italian jeweller for £104m

The UK’s top Rolex dealer has snapped up Italian jewellery brand Roberto Coin in a deal worth $130m (£104m).

Shares in Watches of Switzerland rose by 0.6pc after it confirmed the deal, which comes amid a strategy to grow the luxury branded jewellery operation.

The London-listed retailer, which also owns the Goldsmiths and Mayors jewellery chains, said it will “leverage its operational and retailing expertise” to drive growth at the acquired business.

Watches of Switzerland will finance the deal with a new $115m (£92.2m) loan facility.

Roberto Coin was founded in Vicenza, Italy, in 1996 and is now the sixth largest jewellery brand by sales in the US.

It reported annual revenue of $146.2m (£117.2m) and a pre-tax profit of $30.1m (£24.1m) in 2022.

Brian Duffy, chief executive of Watches of Switzerland, said:

We have partnered with Roberto Coin for over a decade in the US, retailing its elegant jewellery in a number of our Mayors showrooms.

We believe there is significant opportunity to leverage our proven retail expertise in luxury branded jewellery.

10:38 AM BST

Mortgage arrears rise as homeowners struggle with rising borrowing costs

The number of UK mortgages falling into arrears has risen, latest figures show, as the Bank of England prepares to announce its latest decision on interest rates.

There were 96,580 homeowner mortgages in arrears in the first three months of the year, according to UK Finance, an increase of 3pc on the previous quarter.

The figure was 26pc higher than the same time last year, as increased borrowing costs take their toll on households.

The Bank of England is widely expected to keep interest rates on hold at their 16-year highs of 5.25pc when the latest decision of its Monetary Policy Committee is announced today.

Mortgage rates have risen since the start of the year lenders adjust to shifting bets by traders on money markets, who have drastically reduced their predictions for rate cuts this year from as many as five in January to two now.

Charles Roe, director of mortgages at UK Finance, said:

The number of mortgages in arrears, while still low, continues to rise as households remain under pressure from the cost of living and higher interest rates.

Lenders offer a range of support to anyone worried about their finances, with teams of trained experts ready to help.

10:20 AM BST

TSB owner faces hostile takeover bid

Spain’s second-largest bank BBVA has announced a hostile takeover bid for TSB owner Banco Sabadell in a move that would create a European giant .

BBVA’s new bid, which was swiftly condemned by the government, came three days after Sabadell’s board of directors rejected a merger proposal, saying it was “not in the best interest” of the bank.

The takeover proposal values Sabadell, Spain’s fourth-largest banking group in terms of capitalisation, at nearly €11.5bn (£9.9bn).

BBVA said in a statement: “The operation will create one of the best banks in Europe.”

The takeover would be carried out under same conditions as the initial approach - an exchange of one new BBVA share for every 4.83 Sabadell shares, a 30pc premium over the April 29 closing price of both banks.

“We are presenting to Banco Sabadell’s shareholders an extraordinarily attractive offer to create a bank with greater scale in one of our most important markets,” BBVA Chair Carlos Torres Vila said in the statement.

A takeover would create a banking powerhouse capable of competing with Santander - Spain’s leading bank - as well as with European giants such as HSBC and BNP Paribas.

However, Spanish Prime Minister Pedro Sanchez’s leftist government swiftly came out against the takeover attempt, as did the regional government of Catalonia where Sabadell was born and where it has a strong presence.

10:07 AM BST

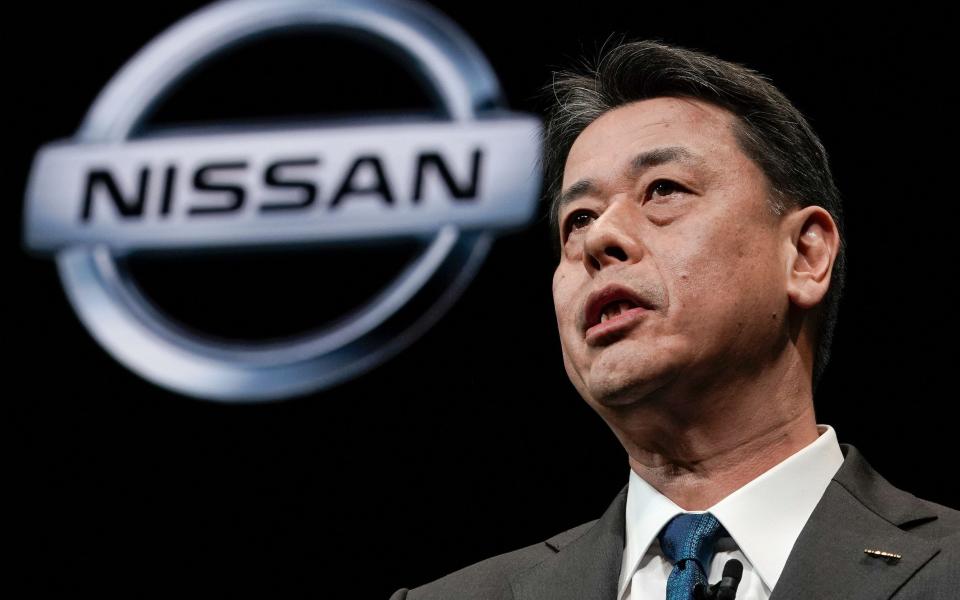

Nissan nearly doubles profit amid weakening yen

Nissan nearly doubled its full-year net profit over the last year but forecast a dip in earnings as a boost from a weakening yen fades.

The Japanese carmaker said demand was rising at home as well as in North America, Europe and China, where it has struggled to compete with fast-growing electric vehicle firms backed by Beijing.

Profit totalled 426.6 billion yen (£2.2bn), up 92.3pc, but Nissan expects that to fall by about 10pc to 380 billion yen (£2bn) in 2024-25.

Operating income rose more than 50pc, the company said, citing “an increase in sales volume, improved net sales per unit, and disciplined management of fixed costs”.

The weak yen also provided a “short term” boost to profits, chief executive Makoto Uchida said.

He warned: “But in the mid and long term, whether it’s a strong or weak yen... volatility in forex markets is not very beneficial. It will be a challenge.”

Thursday’s results struck a different tone to an announcement last month when Nissan trimmed its sales and profit outlook for 2023-24, predicting a more modest net profit of 390 billion yen.

Mr Uchida said this year that Nissan had struggled with sales in the Chinese market, where capacity is “excessive” despite improvement in recent months.

09:48 AM BST

Defence giant’s shares hit record high after Sunak’s spending pledge

BAE Systems shares hit a record high today as it said it expects “positive momentum” following Rishi Sunak’s pledge to increase defence spending.

The defence giant has risen as much as 0.9pc today to 1,394p ahead of its AGM today, as it left its guidance for the year unchanged and said trading had been in line with expectations so far in 2024.

The stock has risen 40pc over the last 12 months.

The Prime Minister last month pledged to increase spending to 2.5pc of GDP by the end of the decade, pointing to an increasingly dangerous world and seeking to ease concerns about spending on the armed forces.

BAE said in its update to shareholders: “Defence spending is high across our sectors and key markets.”

09:35 AM BST

Recruiters place fewer candidates to permanent jobs

The jobs market will be a key focal point for the Bank of England’s policymakers as they deliberate on when to cut interest rates this year.

Rate setters may gain some comfort from the latest figures showing recruitment consultants in Britain placed fewer candidates to permanent jobs last month.

KPMG and REC reported there was heightened caution amongst clients, with firms reportedly holding back on recruitment.

KPMG senior partner Jon Holt said:

UK CEOs continue to grapple with the Bank’s hawkish stance on interest rates, and will no doubt hope April’s survey data is another marker in the sand on the journey towards a summer cut.

While there are still complexities, like pay rates improving due in part to last month’s 9.8pc rise in the National Living Wage, overall pressure is easing on the labour market.

Ongoing weak demand is driving the steady decline in permanent staff appointments month on month, and we’ve seen a sharp uptick in candidate availability.

Business leaders see this cooling, combined with weakening inflationary pressure, as indicators for the Bank to hopefully shift to a more dovish position. Companies would then have the confidence and certainty to press go on their investment strategies.

09:18 AM BST

Bank of England could show wider split on rate cuts, say economists

At the last meeting of the Monetary Policy Committee in March, just one member, Swati Dhingra, voted for rates to be cut by 0.25 percentage points.

The remaining eight members voted for no change, although this was seen as a tilt towards rate cuts as two of them had voted for rate rises at the previous meeting.

Philip Shaw, chief economist at Investec, said:

This broad direction illustrates that collectively the committee is moving gradually towards a rate cut.

It seems unlikely though to be ready to bite the bullet just yet and the Bank rate looks set to remain on hold at 5.25pc for the sixth consecutive meeting.

He added that it is possible that a second member of the MPC will switch to the “easing camp” and vote for a cut on Thursday.

Laith Khalaf, head of investment analysis at AJ Bell, said: “It is almost certainly too early for the Bank of England to pull the trigger on a rate cut right now, especially against the backdrop of a more hawkish US central bank.”

08:57 AM BST

FTSE 100 wavers as investors await Bank of England rate decision

UK stocks wavered as investors turned cautious ahead of the Bank of England’s interest rate decision.

The blue-chip FTSE 100 was flat, hovering below its record high of 8,365.28 points set on Wednesday. The mid-cap FTSE 250 edged lower by 0.1pc.

The pound slipped against the US dollar and the UK’s benchmark 10-year gilt yield rose to 4.17pc ahead of the decision.

Investors avoided big bets ahead of the interest rate decision due at midday, where the central bank is widely expected to keep borrowing costs steady.

The focus will be on whether policymakers deliver any hints for the timing of loosening policy. Markets are currently pricing in a 50-50 chance of a June rate cut, and have priced in a cut by August.

Meanwhile, IMI jumped as much as 1.1pc after the specialised engineering firm confirmed its full-year guidance.

BAE Systems gained 0.6pc after the defence firm said it was on track to meet guidance for higher earnings and forecast a “further positive momentum”.

3i Group fell 4.1pc after posting full-year results, which showed that total returns were lower than expected.

08:35 AM BST

Concord will not increase bid for Hipgnosis

US-based Concord Music has said it will not increase its $1.5bn offer for troubled music rights firm Hipgnosis, likely bringing a bidding war for the company to a close.

The fund said it would up its offer of $1.25 per share after Hipgnosis accepted a $1.6bn takeover offer from private equity group Blackstone worth $1.30 per share.

The two sides had become embroiled in a bidding war for Hipgnosis, which owns the rights to songs by artists including Shakira and Neil Young.

08:27 AM BST

Pound falls as traders await guidance on interest rate cuts

The pound has edged lower ahead of the Bank of England’s monetary policy meeting, where it is expected to hold rates steady but flag when it intends to lower the cost of borrowing.

According to LSEG data, money markets are pricing in an almost 95pc chance that the BoE will hold its benchmark interest rate at 5.25pc - the highest since 2008.

However, investors will be watching for signs of when the first interest rate cut in four years will come as inflation falls.

Markets now see a 56pc chance of such move in June - when the European Central Bank has already signalled it will reduce borrowing costs, and a greater chance of 72pc of a rate cut in August.

Jim Reid, strategist at Deutsche Bank, said:

It’s widely anticipated they’ll leave rates unchanged at 5.25pc, where they’ve been since August.

So the focus will instead be on the vote split, their new forecasts, and what their forward guidance signals about potential cuts in the future.

Sterling fell 0.1pc to $1.248, moving away from a three-week high of $1.271 touched on Friday.

Against the euro, the pound was down 0.1pc at €1.161, trading close to a two-week low touched against the single currency on Wednesday.

08:16 AM BST

China exports grow as Beijing battles to boost economy

Chinese exports returned to growth last month while imports smashed expectations, providing a much-needed boost to the country’s leadership as it tries to steer the economy out of a long-running slump.

Overseas shipments expanded 1.5pc in the year to April, slightly beating forecasts and a strong turnaround after a shock 7.5pc plunge in March.

Meanwhile, imports surged 8.4pc, far better than the 4.7pc estimated by economists, providing hopes that demand in the world’s number two economy could be improving.

The figures from Beijing’s General Administration of Customs (GAC) come as authorities struggle to spur an economic recovery that has sputtered since the country emerged from stringent Covid control measures in late 2022.

China continues to fight a crisis in its debt-ridden property market, with home prices sliding in recent months, while retail sales have been hit by poor domestic demand. A global slowdown is also weakening demand for the country’s products overseas.

Zhiwei Zhang, chief economist at Pinpoint Asset Management said “weak domestic demand led to deflationary pressure, which boosts China’s export competitiveness”.

It comes as the United States overtook China as Germany’s most important trading partner in the first quarter of this year, according to Reuters’ calculations based on official data from the German statistics office.

Germany’s trade with the United States - exports and imports combined - totalled €63bn ($68 billion) from January to March, while the figure for China was just under €60bn, the data showed.

08:04 AM BST

UK markets subdued ahead of interest rate decision

The FTSE 100’s record breaking run slowed down as trading began ahead of the Bank of England’s next decision on interest rates.

The UK’s flagship stock index edged up 0.1pc to 8,360.85 while the midcap FTSE 250 was flat at 20,487.37.

07:59 AM BST

Balfour Beatty expects profits to grow as construction confidence returns

Construction company Balfour Beatty said it expects profits to increase this year as confidence returns to the building sector.

In a trading update before its AGM today, the company said trading since the start of the year has been in line with expectations.

It comes after data on Wednesday showed Britain’s construction sector grew in April at its fastest pace for 14 months as companies increased their spending on renovations.

Data from S&P said that there had been “solid rates of expansion” in the commercial and civil engineering activity, although there had been a setback for house building as high interest rates continued to have an effect.

07:48 AM BST

ITV hit by US writers’ and actors’ strike

ITV has revealed a 16pc plunge in revenues from its production arm after taking a hit from last year’s US writers’ and actors’ strike.

The broadcasting giant behind hit TV shows such as I’m A Celebrity... Get Me Out Of Here! and Love Island said ITV Studios’ revenues tumbled to £382m in the three months to March 31 from £457m a year earlier.

ITV said it also expects to see Studios’ revenues fall again over the second quarter after the strike action - one of the longest in the industry’s history - brought productions to a halt in 2023, sending shockwaves across Hollywood and globally.

The division is also being impacted by “weaker demand from free-to-air broadcasters in Europe who have been holding back spend until they see more certainty in the advertising market”, according to ITV.

ITV had previously warned the strikes would delay around £80m of revenues from 2024 into 2025, but it said in its latest update that it expects ITV Studios’ revenues to be “broadly flat” overall in 2024.

The group saw total advertising revenues rise 3pc in the first quarter and said it is expecting an 8pc jump in the half-year to June 30, with the upcoming Euros football tournament expecting to drive ad demand.

07:35 AM BST

BAE Systems boosted by ‘high’ defence spending

The boss of BAE Systems said it has seen a “strong” operational performance and is on track to meet its targets for the year.

The defence manufacturer also highlighted that the recent US military aid deal for Ukraine and UK Government defence spending commitments “should build further positive momentum”.

Highlighting its selection to build new nuclear submarines under the Aukus pact between the UK, US and Australia, the company said: “Defence spending is high across our sectors and key markets.”

Chief executive Charles Woodburn said:

Trading so far this year has been in line with expectations.

Operational performance continues to be strong and our backlog and programme incumbencies underscore our confidence in our long-term value-creating model.

Our global presence and diverse portfolio of products and services provide high visibility for top-line growth, margin expansion and cash generation in the coming years.

07:28 AM BST

Buyer inquiries for new homes falls in April

New home buyer inquiries fell back in April following three months of increases in a row, according to surveyors.

The Royal Institution of Chartered Surveyors (Rics) said its latest survey of property professionals suggests that a recent recovery in buyer demand has mellowed slightly, with the market seeming to have been impacted by mortgage rates edging up over the past few weeks.

A net balance of 1pc of property professionals reported new buyer inquiries falling rather than rising in April, following a balance of 6pc reporting inquiries rising in March.

The regional feedback on buyer demand is mixed, with a notable loss of momentum mainly seen in London and southern parts of England, Rics said.

07:20 AM BST

Wood reveals falling revenues after rejecting takeover bid

Engineering group Wood has revealed declining revenues a day after rejecting a takeover offer that valued the company at £1.4bn.

The Scottish consultancy said revenues fell by 7.3pc in the first three months of the year to $1.4bn (£1.1bn) but said its order book had risen 9pc in March compared to the same time last year.

The North Sea oilfield services and engineering business rejected a 205p per share offer from the Sidara Group on Wednesday, saying the bid undervalues both the company and its future prospects.

Chief executive Ken Gilmartin said:

We are now in the second year of our growth strategy and are making good progress, with ebitda growth, margin expansion and an order book 9pc higher than a year ago.

We continue to win exciting and complex work across energy and materials, with sustainable solutions representing 40pc of our pipeline.

The Aberdeen-based company is a global leader in oil, gas, renewable energies and in the production of minerals like lithium, which are essential for the energy transition.

It employs around 35,000 people in 60 countries and is widely seen as a key company for the UK’s hopes of reaching net zero.

07:08 AM BST

Tax rises inevitable regardless of who wins election, economists warn

Tax rises are inevitable regardless of who wins the next general election, top economists have warned, as the Government is set to break its borrowing rules by racking up too much debt.

Income tax could have to rise by as much as 3p in the pound if the next Chancellor is to hit his or her borrowing targets.

Both Labour and the Conservatives have promised to stick to the fiscal rules, and analysts at the National Institute of Economic and Social Research (Niesr) warn this means the only way to feasibly meet the promises is to increase taxes.

Niesr said: “Anaemic UK GDP trend growth at about 1pc together with inflation coming back to target means that the winner of the next general election will have to raise taxes to maintain the existing provision of public services.

“There is essentially no fiscal headroom for any further tax cuts, given that the Government’s spending plans do not meet their self-imposed fiscal rules.”

The economists predict the Government will fail to meet its goal to get annual borrowing below 3pc of GDP in five years’ time, and will also not manage to get debt falling as a share of GDP.

Stephen Millard, deputy director at Niesr, said the most obvious way to raise more revenue is through higher income taxes.

He said: “If you want to hit the fiscal target, you need to raise taxes. The most efficient way of doing that is to slap a penny, or two or three, on the rate of income tax.”

He said it would be better to abandon the borrowing rules, replacing the set of targets with something more sensible.

Mr Millard said: “They should change the fiscal framework. It is the targets that are creating the problem, it is the targets that are forcing the Government to put brakes on the economy.”

Niesr expects the Bank of England to wait until August or later before it starts to cut interest rates from 5.25pc, as inflation, particularly in the price of services, has proven stubborn.

The analysts expect two rate cuts this year and two next year, with cautious progress over the next five years eventually taking the base rate to 3.25pc in 2028.

The Bank of England is expected to maintain interest rates at a 16-year high of 5.25pc today, although a cut is more possible than it has been for several tears after sharp falls in inflation.

06:49 AM BST

Good morning

Thanks for joining us. The Bank of England will announce its next decision on interest rates at noon.

We will have live coverage of the build-up, the decision and what it means for you.

We start with a look at income tax, which a leading think tank believes could rise by 3p regardless of who wins the next election.

The National Institute of Economic and Social Research (Niesr) said the promise to stick to the fiscal rules - which says debt will be falling within five years - means that the only wait to meet the pledge is to increase taxes.

5 things to start your day

1) Apple’s ‘destructive’ new iPad ad sparks backlash from artists and authors | Musical instruments and art supplies were squashed in Apple’s latest advert

2) Treasure hunter backed by Sir Paul Marshall loses legal battle over World War Two silver | Argentum fails to recoup costs of recovering 2,000 silver bars from 1942 shipwreck

3) P&O Ferries chief forced to ‘clarify’ evidence to MPs as he admits crew get just one day off a month | Peter Hebblethwaite said he was seeking to clarify the situation after giving evidence in person

4) HS2 tunnel held up by question marks over £1bn of funding | Bosses take drill delivery despite uncertainty over 4.5-mile route through London

5) I was debanked like Nigel Farage, says ex-Bank of England economist Haldane | City regulation had gone too far, the economist argued

What happened overnight

Asian shares were mixed after Wall Street’s lull stretched into a second day, with Chinese benchmarks rising after China reported better than expected trade figures for April.

In Tokyo, the Nikkei 225 index was up 0.5pc at 38,392.10.

Carmaker Mitsubishi’s shares dropped 4.7pc in early trading after the company forecasted a 7pc lower net profit in the fiscal year that will end in March 2025.

Toyota Motor edged 0.1pc higher after it reported Wednesday that it doubled its net profit in the fiscal year that ended in March.

The US dollar rose to 155.59 Japanese yen from 155.52 yen, as reports in Tokyo speculated on the likelihood of further intervention by the Finance Ministry to curb the yen’s slide.

The Hang Seng in Hong Kong added 1.2pc to 18,538.57 and the Shanghai Composite index gained 0.9pc to 3,156.96.

China reported that its exports rose 1.5pc in April from a year earlier, while imports jumped 8.4pc. The renewed growth suggests a stronger recovery in demand than earlier data had suggested.

In South Korea, the Kospi lost 0.6pc, to 2,729.64. Australia’s S&P/ASX 200 shed 0.9pc to 7,735.20.

In America, the S&P 500 finished virtually unchanged yesterday at 5,187.67. The Dow Jones Industrial Average rose 0.4pc, to 39,056.39, and the Nasdaq Composite index slipped 0.2pc, to 16,302.76.

The yield on benchmark 10-year US Treasury bonds rose to 4.49pc from 4.46pc late on Tuesday.

Asian shares were subdued on Thursday as investors awaited China trade data to gauge the health of the Chinese economy.

MSCI’s broadest index of Asia-Pacific shares outside Japan rose 0.1pc, hovering not far from a 15-month high hit earlier in the week.

Chinese bluechips climbed 0.6pc and Hong Kong’s Hang Seng index gained 0.7pc thanks to a 2pc bounce in technology shares and a recovery in Chinese property developers.

Yahoo Finance

Yahoo Finance